Taiwan trade data shows resilience in early 2025

Export growth has beat expectations so far in 2025, with demand for semiconductor and other electronics remaining strong. Taiwan's trade growth could see another solid year as it looks likely to avoid the worst of tariff headwinds.

| 16.8% |

Taiwan's Jan-Feb export growth (YoY) |

| Higher than expected | |

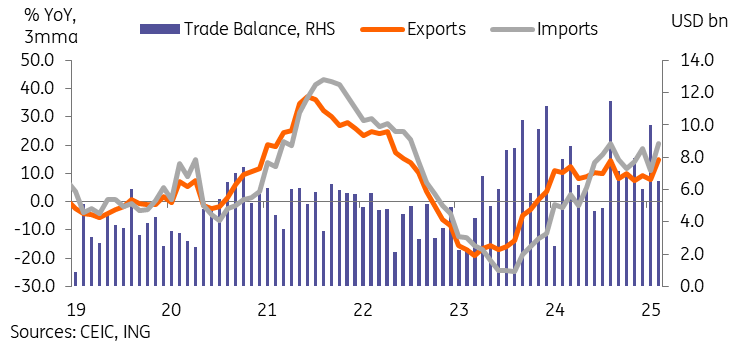

Export momentum still impressive as demand for tech exports remains high

February's export growth surged from a modest 4.4% YoY growth in January to a robust 31.5% YoY in February, far exceeding forecasts for a 18.4% YoY uptick. With that said, the Lunar New Year always creates significant volatility in the first two months of data, and so it is more helpful to look at the first two months in aggregate. By this gauge, exports still saw a very respectable growth rate of 16.8% YoY year-to-date, which equates to USD11.5bn.

The strong export growth to start the year is unsurprisingly tied to Taiwan's core industries. The broader machinery and electrical equipment category, which contributed over three quarters of total exports, grew by 25.2% YoY ytd. With in this category, semiconductor exports were up 13.7% YoY ytd, with DRAM chip exports up 34.3% YoY ytd. Computer and accessory exports surged 73.9% YoY ytd, while computer parts (13.8%) as well as switches and routers (34.2%) all performed solidly on the year.

By export destination, export growth to the US remained a bright spot, rising 30.5% YoY ytd. Exports to ASEAN (19.4%), Japan (12.8%), and Korea (13.8%) were all quite strong in the first two months of the year as well. Exports to mainland China and Hong Kong saw relatively modest 5.3% YoY ytd growth, but considering China's sharp decline of imports, this performance was not as weak as it may seem at first glance. Exports to the EU slumped to -12.1% YoY ytd.

Taiwan's exports and imports both beat forecasts in the first two months of the year

Surge in imports resulted in a smaller-than-expected trade surplus

On the other side of the equation, Taiwan's import growth surged to a robust 47.8% YoY in February, bringing the year-to-date growth rate to 9.3%. While this is still softer than export growth, it nonetheless has come in above expectations so far, and as a result we've seen a smaller trade balance of just USD58.8bn in the first two months of the year.

The import picture continues to paint a mixed picture. We saw strong import growth for machinery and electrical equipment (38.9%) and optical & precision instruments (53.1%), as well as base metals (14.2%). Many other categories remained weak in early 2025, with year-on-year contractions for textiles, mineral products, petroleum, and agricultural products.

Taiwan's trade surplus with the US has surged in recent years

Could Taiwan avoid the worst of the tariff storm?

Given Taiwan's rising trade surplus with the US, there was and still is a risk of tariffs hitting. Taiwan's trade surplus with the US has more than septupled since 2017, rising from USD8.4bn to USD64.9bn in 2024. The surge of exports to the US sent Taiwan to ninth place in the ranking of US import partners. Taiwan's average tariff rate for most favored nations is 6.5%, which, while not the highest in Asia, is higher than the US and thus does risk reciprocal tariff action. Given how Taiwan's export growth has been largely driven by exports to the US, the potential for tariffs is a significant wildcard for this year's trade and growth story.

At first glance, these developments would appear to put Taiwan in the crosshairs for the next stages of Trump's tariff actions. However, this week's announcement that TSMC would be investing USD100bn into building chip fabrication plants in Arizona could help delay, if not avert, some of the tariff pain, a development which has been touted by the Trump administration. While there are certainly some questions on the long-term impact of such a large investment into the US, it is likely a positive for this year in terms of avoiding damaging tariffs coming into effect.

It also doesn't hurt that there is no shortage of demand for Taiwan's semiconductors and tech products as the AI race continues - tariffs on products with no suitable replacement would likely see costs borne by US importers.

With that said, predicting tariff action or lack thereof is certainly no easy task, and there's certainly no guarantee that Taiwan will avoid measures. We'll see the extent to which Taiwan is included once there is more detail on the reciprocal tariff plan in April. Until then, Taiwan's trade data looks off to a healthy start again in 2025 after a solid 2024.

Download

Download snap