Spanish headline inflation spike is no cause for concern

Spanish headline inflation jumped to 2.4% in November, largely due to base effects. Core inflation, excluding food and energy, edged down to 2.4% from 2.5%, supporting the notion that underlying inflationary pressures in the economy are continuing to ease. Consequently, we expect inflation to trend downwards in the coming months

Base effects drive November's headline inflation increase

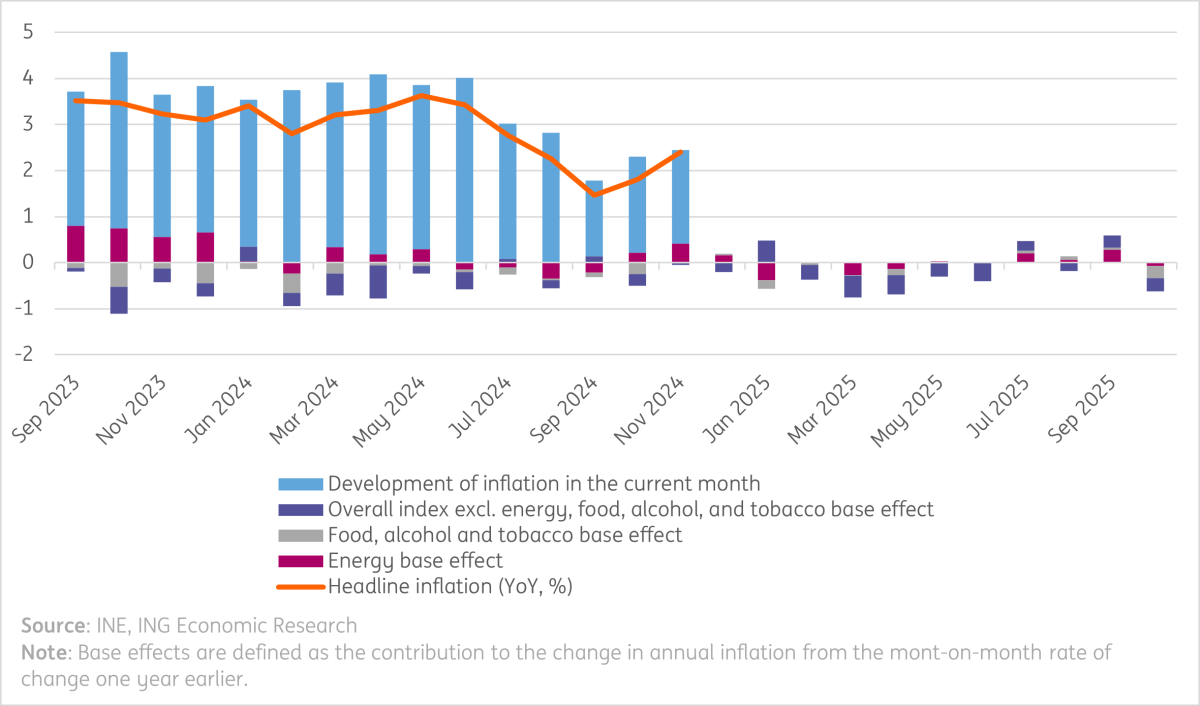

The final inflation number published this morning by Spain's Statistics Service came in at 2.4% for November, matching the earlier flash estimate and in line with expectations. This marks a significant increase from October's 1.8% inflation, despite a decrease in monthly inflation to 0.2% from 0.6%. This apparent contradiction can be explained by the base effect, where the inflation rate from the same period last year drops out of the year-over-year comparison. In November 2023, a sharp decline in energy prices (-0.4% contribution to inflation) was not matched by this November's 0.2% energy contribution to inflation, making the base effects a major factor in this month's inflation figure (See chart below).

Additionally, considering that last month's base effect impacted the inflation number adversely, it becomes clear that inflation is trending in the right direction—downward—despite the headline figure suggesting otherwise. Core inflation, which excludes food and energy, edged lower to 2.4% from 2.5%, supporting the notion that underlying inflationary pressures in the economy are continuing to ease.

Decomposition of headline inflation: base effects and monthly inflation developments

Service inflation evolves positively

Zooming in on the drivers of this month’s inflation, we see that upward pressure mainly came from goods prices, which increased to 1.7% year-on-year (YoY) from 0.6% in October. Base effects played a role, but clothing and footwear also contributed significantly with a 4.2% month-on-month (MoM) increase. Service inflation remained steady at 3.3% YoY, showing a favourable downward trend in recent months. With the peak tourist season over, prices in the recreation and culture sectors, as well as in hotels, cafes, and restaurants, have been decreasing. The three-month-over-three-month (3Mo3M) inflation rate in the service sector stands at -1.1%.

Inflation outlook

The upward contribution of base effects to headline inflation, driven by last year’s energy price declines, is nearly exhausted. This sets the stage for more subdued inflation numbers moving forward. Notably, base effects are expected to predominantly exert a negative influence on inflation in 2025, with particularly strong negative contributions anticipated between February and April (see also Figure above). Our projection for harmonised inflation remains at 2.9% for 2024, while we expect headline inflation to decrease and stabilise around 2.2% over the next year.

Upward risks are increasing energy prices and the potential inflationary impacts of US economic policy under the new Trump administration. This is likely to affect Spain to a lesser extent, however, given Spain’s lower exposure to the US compared to the EU. Spain exported goods equivalent to 1.26% of its GDP to the US in 2023 and imported goods equal to 1.64% of its GDP, whereas the overall EU exposure was 2.9% of GDP for exports and 2% of GDP for imports.