China’s trade data points to weak start to 2025

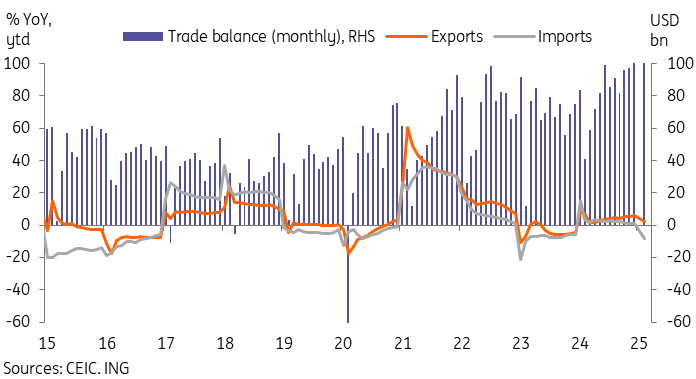

China’s economy got off to a weak start in 2025 as exports grew just 2.3% in the first two months of the year. A sharp slump in imports, meanwhile, resulted in a bigger-than-expected trade surplus

| USD 170.5bn |

China's Jan-Feb net exports |

| Higher than expected | |

Exports have slow start to the year

Exports grew just 2.3% year on year in the first two months of 2025 to USD 539.9bn. Though well below market forecasts for a 5.9% YoY increase, it was a bit stronger than our more cautious forecasts.

Today's data from the Customs Administration offered our first real look at China's early 2025 trade performance. For one thing, the January-February data present a picture less skewed by Lunar New Year effects than many expected. And some of last year's winning categories continued to perform strongly.

Semiconductor exports led the way with 11.9% YoY year-to-date growth, while automatic data processing equipment saw a strong 10.5% reading. Exports of ships, one of last year's top growth categories at 57.3% YoY, saw growth slow to just 2.2% YoY in the January-February period. It will be worth monitoring how the attempts to curb China's dominance in shipping affect this category going forward.

Many other categories remained soft: furniture (-15.5%), toys (-11.1%), shoes (-18.3%) and apparel (-6.9%) all started the year well in contraction territory.

The export destination data shows an interesting picture. The big question mark heading into today's release was the potential impact of US tariffs. Would we see a larger impact from export frontloading, or would the effects from February tariffs start to show up in the data? The numbers suggest that, at least for now, the former dynamic is still playing the larger role.

Exports to the US rose by 2.3% YoY ytd, which does not seem particularly strong relative to the headline growth. It also contrasted with lower export growth to the EU (0.6%), Japan (0.7%), Korea (-2.6%), and Russia (-10.9%). Unsurprisingly, exports to ASEAN continue to be the main source of strength, rising 5.7% YoY ytd. While we don't read too much into a few months of data, the breakdown does pose questions about how export trends might look once tariffs start to drag on the US, too.

With tariffs coming into effect in February and March, it's likely that the impact will be seen gradually in the coming months. That is, unless a deal is reached to avoid or delay tariffs.

Sharp slump in imports brought growth to lowest level since February 2023

While exports disappointed, imports came in even softer than expectations. Inbound shipments turned negative in the first two months of the year, falling to -8.4% YoY ytd, for a total of USD 369.4bn.

By category, much of the same trend from 2024 carried over. We still saw strong imports in tech-related imports, with a 54.4% YoY ytd surge in automatic data processing equipment imports. And an overall 6.4% YoY ytd growth in hi-tech product imports. However, most other categories came in weak.

Commodities imports generally contracted over the first two months of the year, with crude oil (-10.5%), natural gas (-13.8%), and steel (-7.9%) all still soft. We’re already seeing a slump in soybean imports, which fell by -14.8% YoY ytd. This was even before the impacts of China's retaliatory tariffs on US agricultural products. Our commodities research noted that China has been rebalancing imports of soybeans away from the US -- and that imports could be pivoting toward Brazil as a result.

Imports from the US were a relative strong point, with 2.7% YoY ytd growth. We saw imports from the EU (-5.6%), ASEAN (-1.3%), Japan (-4.9%), and Korea (-0.1%) all contract in the first two months of the year. It's possible that Chinese importers were also frontloading from the US.

Imports will likely remain soft this year unless we see a stronger-than-anticipated rebound in consumption and private investment. While stimulus policy should help on these fronts, it remains to be seen how much of this will translate to import demand.

Trade surplus beat forecasts as slump in imports outweighed sluggish exports

On net, we saw China's trade surplus rise to USD 170.5bn in the first two months of the year. This was considerably higher than the USD 124.6bn in the same period last year, and well above market forecasts as well.

It highlights the difficulties in gauging the ultimate impact of tariffs on growth. While total trade value slumped -2.4% YoY in the first two months, the sharper slowdown of imports implies we could see a larger-than-expected contribution from net exports in the first quarter of 2025.

Much remains in flux, though. It’s possible, but not guaranteed, that we will finally get US-China trade talks. The tariff scenario has been highly unstable with new developments almost weekly – veering from implementation to backtracking. Yet it’s likely that after driving growth in 2024, the external environment will be less supportive this year. This puts more pressure on policymakers to improve domestic demand and achieve this year's 5% growth target set at the Two Sessions.

Despite soft trade growth, trade surplus actually picked up in first two months of the year

Download

Download snap