Bank Pulse: all too familiar rifts opening up again in Eurozone bank lending

While the European Central Bank Bank Lending Survey at first glance shows resilience, some less positive signs lurk beneath the surface. Moreover, North vs South differences are becoming apparent once again

The ECB’s Bank Lending Survey, held in March, reported a modest increase in demand for loans by eurozone businesses. That’s not necessarily good news, however. The main drivers for the increase are increasing inventory financing demand (which can be linked to e.g. supply chain disruptions) and a lower availability of alternative means of finance. Meanwhile, demand for investment finance weakened somewhat. Banks expect loan demand to moderately weaken further in 2Q. Looking at the five largest eurozone economies, banks see, and expect, most resilient demand in the Netherlands, France and Germany, while most weakness is observed and foreseen in Spain and Italy. Particularly worrying is the weakening of investment financing demand in Italy, contrasting with more resilience in the other four main Eurozone economies.

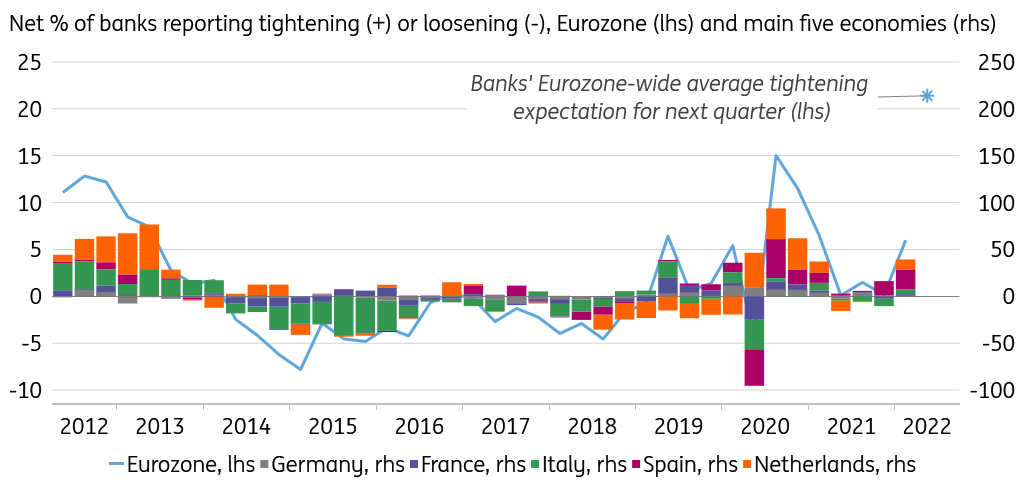

Business credit standards (loan approval criteria) were unsurprisingly up in 1Q, with banks citing increasing risks and high uncertainty. Banks expect considerable further tightening in 2Q, comparable in magnitude to the tightening in 2Q 2020 when corona arrived on the continent (see chart). Bank cost of funding and other constraints did not induce banks to tighten credit standards yet, though that may change as monetary policy turns less accommodative. The strongest tightening in 1Q was reported in Spain.

Bank business loan standards

Banks slightly tightened business loan terms and conditions, in particular by increasing their interest margin on riskier loans. Italian banks led the way here.

Eurozone household mortgage demand strengthened somewhat in 1Q, mostly driven by the favourable rate environment, while it still lasts. The exception is Italy, where demand did lose steam. Banks on average expect mortgage demand to weaken somewhat in 2Q, with Spanish and French banks being most pessimistic about demand prospects.

Like with business loans, increased bank risk perceptions have led to a modest tightening of mortgage standards, and further tightening is expected – though still a far cry from the tightening reported two years ago. Banks did report a moderate tightening of terms and conditions, mainly by using stricter Loan-to-Value ratio criteria. Again, Italian banks are leading the way. At the same time, banks allowed their interest margins to shrink somewhat – meaning that increasing market rates are not yet fully passed through to mortgage borrowers. As asset purchases are concluded and the ECB starts to hike rates, such pass-through is bound to increase in the course of this year.

At first sight, the ECB March Bank Lending Survey shows resilience in the face of high uncertainty. But scratch beneath the surface and a more cloudy picture emerges. Banks expect to tighten their lending standards considerably for businesses, and more moderately for mortgages as well. Moreover, old rifts are showing their ugly face again. Weakness and pessimism tend to be concentrated in Spanish and Italian survey responses, while loan demand and expectations appear most resilient in Germany and the Netherlands. As so often, France is somewhere in between. These all-too-familiar North-South differences are not the best starting point for the eurozone and its banks to face the economic and financial challenges ahead. If this fragmentation persists and worsens, it could well complicate the ECB’s path towards normalisation. The ECB though does not come unprepared, and has indicated that reinvestments of its Pandemic Emergency Purchase Programme could be used in response.

Download

Download snap