US: Heading for recession?

The US bond market is seemingly worried about a slowdown. While not our base case, a prolonged inversion of the yield curve runs the risk of becoming a self-fulfilling prophecy through constraining credit

Markets are spooked

We have regularly written about the headwinds facing the US economy this year, namely the lagged effects of higher interest rates and the stronger dollar, the fading support from the fiscal stimulus, signs of weakness in Europe and Asia and the uncertainty generated by ongoing trade tensions with the rest of the world. Nonetheless, we feel there are still positives that can keep the economy expanding at a decent pace both this year and next.

Longer-dated yields have fallen too with the yield curve having inverted – 3M interest rates are now higher than 10-year bond yields

However, an increasingly dovish sounding Federal Reserve, which last week dropped the two rate hikes its officials had been pencilling in for this year, has contributed to a growing belief their next move will be an interest rate cut. The perception that inflation is not a threat and that a slowdown is coming has prompted futures markets to price more than an 80% chance of a 25 basis point rate cut before the end of 2019 with two full cuts priced by the end of 2020. Longer-dated yields have fallen too with the yield curve having inverted – 3-month interest rates are now higher than 10-year bond yields. As such, the market appears to be signalling deep concern about the economic outlook.

10Y-3M inversion, but 10-2Y still positive

How worried should we be?

An inverted yield curve has preceded all last nine recessions, so such an event is typically cited as an indicator of impending doom. Indeed, the New York Federal Reserve has a recession indicator based on the 3M-10Y spread, and even before the current inversion the probability of recession was pegged at 24.6%. However, it's important to remember that it has given false signals before and we have to acknowledge the distorting influence of the Federal Reserve’s large QE driven balance sheet, which has helped to keep longer-dated Treasury yields low.

There has been some concern about activity in 1Q caused by disruption relating to the government shutdown and trade tensions, but the Atlanta Fed NowGDP model is currently running at 1.2% for 1Q GDP growth versus just 0.2% a couple of weeks ago. As more data comes in, we look for a 1.5-2% outcome for 1Q GDP annualised growth, which wouldn’t be too bad given the tendency in recent years for 1Q GDP to disappoint.

We continue to look for US GDP growth more than 2% this year with 2020 growth currently pegged at 1.8%. Such outcomes are likely to be consistent with a re-steepening of the yield curve.

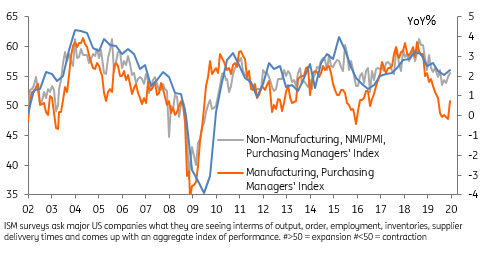

Indeed the current US economic position looks fairly decent. The strong jobs market is resulting in rising worker pay and means consumer confidence is back close to cycle highs. There have also been better retail sales and durable goods orders numbers of late while the ISM reports continue to point to healthy growth rates. Meanwhile, a 60 basis point plunge in the interest rate on a 30-year fixed rate mortgage offers support to the real estate market.

If progress can be made on US-China and US-EU trade talks that can lift some of the gloom surrounding the global economy, we may see markets gradually re-appraise the growth outlook and prospects for inflation. We continue to look for US GDP growth more than 2% this year with 2020 growth currently pegged at 1.8%, broadly in line with the consensus forecast. Such outcomes would likely be consistent with a re-steepening of the yield curve.

ISM indices still point to growth

But beware of the self-fulfilling prophecy…

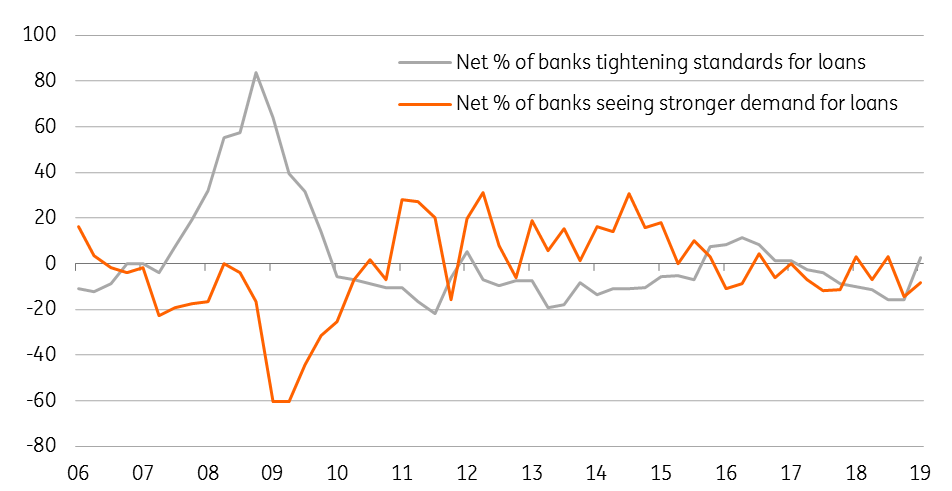

That said, we have to be wary that an inverted yield curve driven by recession fears can potentially be self-fulfilling. Banks typically borrow short term and lend longer term so when the yield curve is inverted, the interest rate received on assets is typically going to be lower than what they pay on their liabilities.

A scenario of much tighter credit conditions would clearly add to the headwinds facing the US economy and heighten the chances of a downturn. It's difficult to see the Fed not eventually bowing to the markets' will and cutting rates in such an environment

This will likely hit profitability and could decrease risk tolerance, which implies tighter lending standards. Indeed, when asking banks about this for the Federal Reserve's Senior Loan Officers report, the write up concluded an inverted yield curve would be interpreted as 'signalling a less favourable or more uncertain economic outlook and likely to be followed by a deterioration in the quality of existing loan portfolio.'

So far there is little evidence that the flattening and subsequent inversion of the yield curve is feeding through into reduced credit availability, but that could change if the inversion persists, and this still isn’t our base case given underlying healthy economic fundamentals. A scenario of much tighter credit conditions would clearly add to the headwinds facing the US economy and heighten the chances of a downturn. It's difficult to see the Fed not eventually bowing to the markets' will and cutting rates in such an environment.

Senior Loan Officers survey still suggest widespread credit availability

Download

Download opinion

29 March 2019

In case you missed it: Self-fulfilling prophecy? This bundle contains 8 articles

James Knightley

James Knightley is the Chief International Economist in New York. He joined the firm in 1998 in London and has been covering G7 and Western European economies. He studied economics at Durham University, UK.

James Knightley

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more