US: Recession or rebound?

An inverted US yield curve signals a clear fear of recession with financial markets fully pricing Federal Reserve interest rate cuts. Are things really that bad?

Last month the Federal Reserve confirmed its increasingly dovish tone by dropping the two interest rate hikes officials had been pencilling in for this year. While the members of the Federal Open Market Committee (FOMC) continue to have one rate hike in their forecast for 2020 and talk positively about the economic outlook, financial markets appear increasingly concerned about prospects.

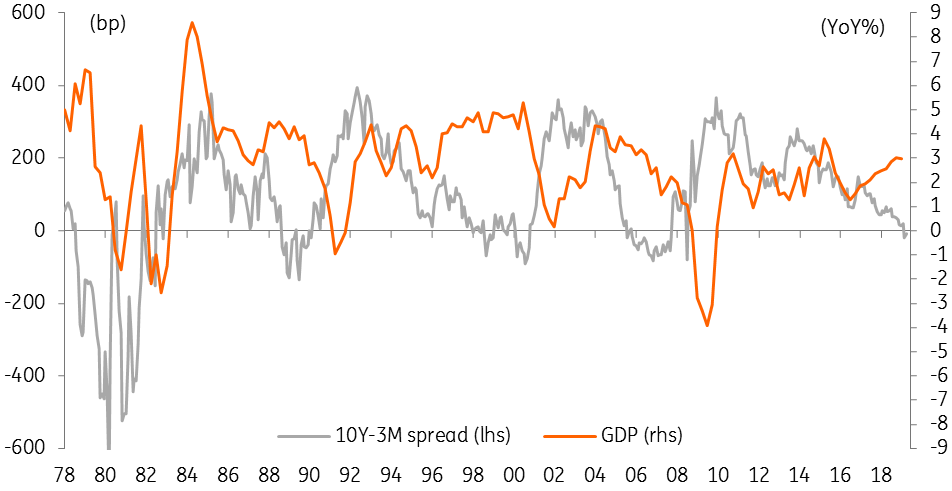

Weak European and Asian figures coupled with mixed domestic data and the Fed’s change of stance has led to a growing sense that an economic slowdown is on its way. Inflation is not perceived to be a threat, so financial markets now believe the Fed’s next move will be to cut rates, potentially later this year. Longer-dated yields have fallen too with the yield curve having inverted – 3M interest rates are now higher than 10-year bond yields. The worry is that an inverted yield curve has preceded each of the last nine recessions, so such an event is typically cited as a clear indicator of impending doom.

US yield curve hints at recession risk

We have regularly written about the headwinds facing the US economy this year, namely the lagged effects of higher interest rates and the stronger dollar, the fading support from the fiscal stimulus, signs of weakness in Europe and Asia and the uncertainty generated by ongoing trade tensions with the rest of the world.

As such we certainly recognise there are threats to growth and accept there is a valid concern about disruption relating to the government shutdown from late December to late January. Data has been volatile in recent months and the uncertainty that this creates fully justifies the Federal Reserve’s “patient” stance regarding monetary policy.

However, it's important to remember that an inverted yield has given false signals before and that the 2-10Y and 10-30Y part of the curve remains positively sloping. We also have to acknowledge the distorting influence of the Federal Reserve’s large quantitative easing purchases and remember that negative yields in Europe have been driving a “search for yield” which is contributing to strong demand for US treasuries. These technical issues help support the argument that things are “different this time” and the yield curves usefulness as a guide for recession may be weaker.

There are technical factors that mean the yield curve's prediction of recession may be false this time

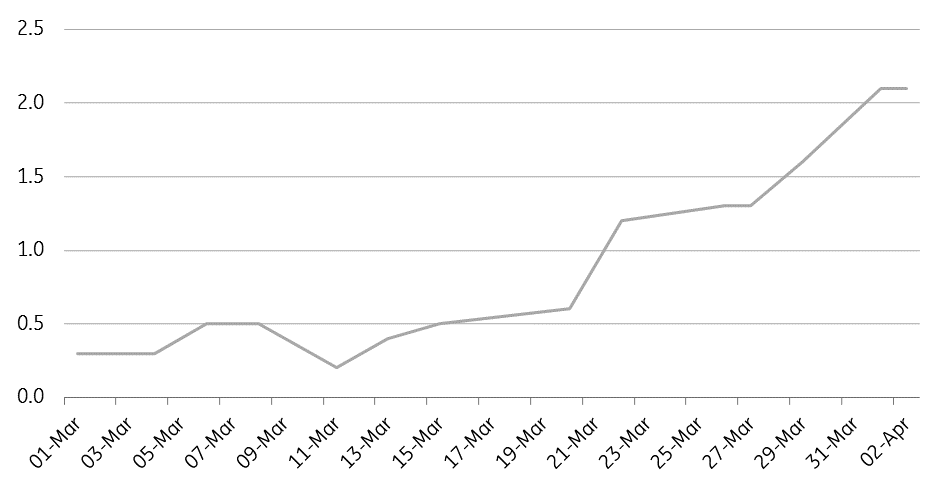

Moreover, we feel there are positives that can keep the economy expanding at a decent pace both this year and next, which will help core inflation continue to move higher. After a poor start, things are looking up for 1Q GDP. The Atlanta Fed GDPNow model provides an estimate of what GDP growth will be based on the economic data released so far. It has been shooting higher in recent weeks and is currently pointing to 2.1% growth for Q1, which is very respectable given the recent tendency for GDP readings in the first quarter to disappoint.

Evolution of Atlanta Fed NowGDP prediction for 1Q GDP annualised growth

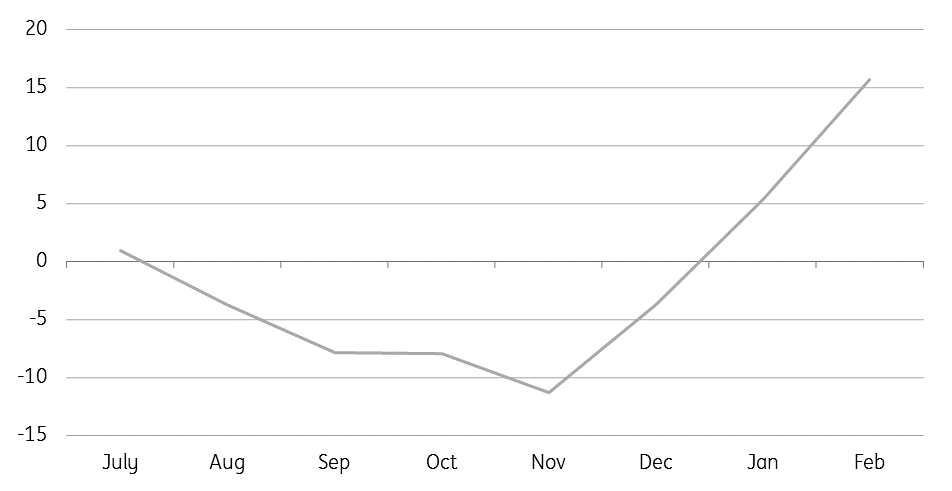

The ISM manufacturing index has been a positive signal while there have been some improvements in consumer spending. Construction spending has also been a major boost with 3M annualised growth currently running more than 15%. Moreover, the housing market looks set to contribute more broadly with plunging mortgage rates prompting a notable increase in mortgage applications for home purchases. Looking longer term, the strong jobs market is leading to rising worker pay and should help to underpin confidence and spending. None of this appears consistent with an imminent threat of recession.

3M annualised growth in US construction spending

However, a positive outcome on trade talks is critical for maintaining the long term economic outlook. Protectionism threatens supply chains, risking higher costs for businesses and consumers while sapping confidence. If an agreement can be reached with China, this would be a major boost for the global economic environment. Officials suggest the talks are going well, but an actual signed deal may be weeks away and markets will remain cautious until they see something concrete.

Our assumption remains that there will be a deal given President Trump will want to take a trade “victory” into the 2020 election campaign. This implies some scope for compromise, and if progress can be made, we should see markets gradually re-appraise the growth outlook and the prospects for inflation. However, a trade conflict with Europe is another threat that could materialise with President Trump yet to decide on whether to implement auto tariffs.

A positive resolution to the ongoing trade talks can remove a huge amount of uncertainty and give business the confidence to put more money to work

Overall, our position remains that while the economy does face more threats this year, there are reasons for optimism, most notably the strong household fundamentals. If we can also get a positive resolution to the ongoing trade talks, this can remove a huge amount of uncertainty and give business the confidence to put more money to work. Consequently, we look for US GDP growth of 2.3% this year with 2020 growth currently pegged at 1.8. In such an environment we expect the Federal Reserve to keep monetary policy unchanged this year and next, likely prompting a modest re-steepening of the yield curve lasting through the summer.

Download

Download article

5 April 2019

April Economic Update: Cheer up! The gloom is mostly set to fade This bundle contains 8 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more