The UK’s summer rate cut hinges on April’s inflation data

Delays to the first Federal Reserve rate cut, coupled with potential strength in April’s inflation data as service-sector prices are subjected to annual increases, suggest an August rate cut is still slightly more likely than June for the Bank of England

Markets have taken notice of recent BoE comments

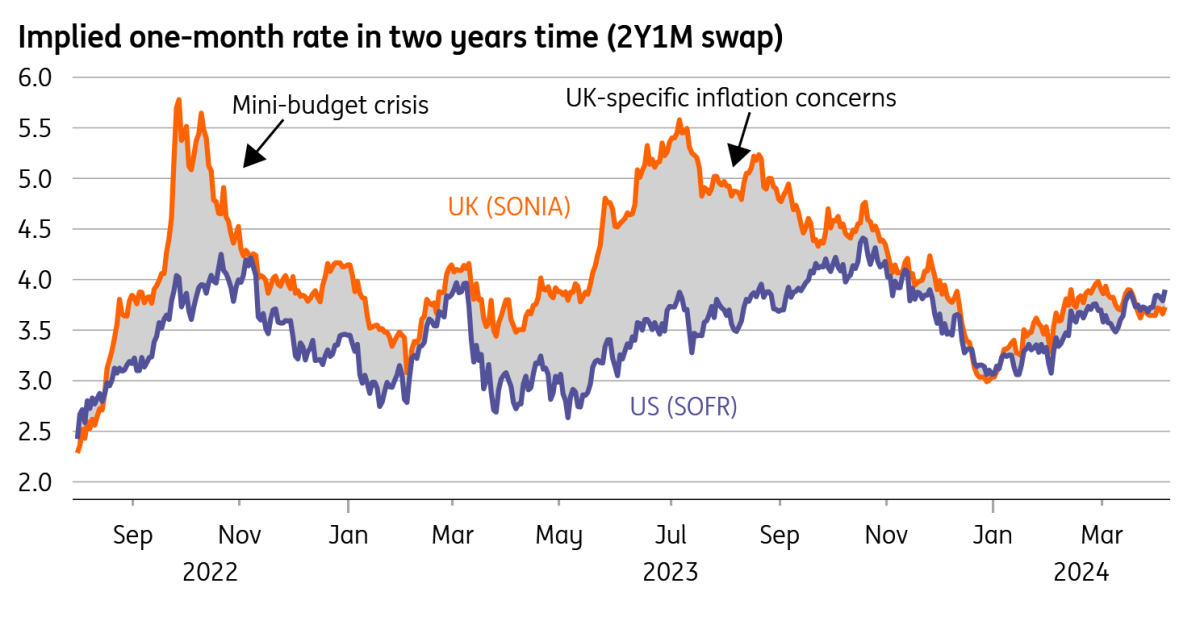

Ever since the mini-budget crisis of summer 2022, investors have generally felt that the Bank of England would be more hawkish than the Federal Reserve and that rates would need to stay higher for longer relative to the US.

But after some surprisingly candid comments from Governor Andrew Bailey which appeared to open the door to an imminent rate cut, markets are taking notice. Markets are now pricing US rates higher than the UK equivalent in two years’ time, which hasn’t been true for the majority of the last two years. And while the latest strong US payrolls and inflation data pushed back the date of the first expected US rate cut, the same hasn't happened to the same extent in the UK. Markets think there’s a 40% chance of a June rate cut from the Bank of England and 80% for August.

We think that's fair and we’re sticking with our long-held base case that the first rate cut will come in August. That’s true not just because the Fed is now less likely to cut in June, but also because we think the near-term data on services inflation – a critical ingredient for the BoE – may not fall as quickly as hoped.

Markets now expect lower UK rates in two years' time than in the US

August is our base case for the first BoE rate cut

Much hinges on the April CPI data due later in May, which is when we’ll see the results of the annual contract-linked price rises that typically take place at the start of the year. Our rough estimates suggest 40% of the services inflation basket is affected by these annual price hikes to some degree, and last year’s data release was much stronger than expected, prompting the single biggest daily increase in two-year swap rates in 2023 as a whole. There’s a risk that something similar – albeit less dramatic – happens this year, and recent US inflation data is a cautionary tale. Wage data will be crucial here too.

Until we’ve seen that data – and unless the BoE comes out strongly in favour of a June rate cut at its early-May meeting – we’re narrowly favouring an August start. But to some extent, we’re splitting hairs, and the more important point is that the totality of the rate cutting cycle is likely to be a little larger than markets are currently pricing. We think 3% or slightly above is a sensible estimate of the terminal rate, on the assumption that underlying inflation remains higher over this decade than the last. Markets are pricing rates at 3.55% in two year’s time, so there’s some limited scope for further repricing of the Bank’s rate cycle.

Download

Download article

11 April 2024

ING Monthly: Hello, hello, hello, how low? This bundle contains 14 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more