The Fed’s pre-emptive strike

The Federal Reserve has cut the fed funds target range by 25bp. We characterise this as an early pre-emptive move to help ensure the longest US economic expansion on record continues. It will likely ease again, but not by as much as the market is pricing

A 25bp rate cut

As widely expected, the Federal Reserve has lowered the target range for the federal funds rate by 25bp to 2.00-2.25% and left the door open to more easing. It has also decided to conclude its balance sheet run down in August - two months earlier than previously announced. Today’s decision to cut interest rates, for the first time since December 2008, was not unanimous though with Esther George and Eric Rosengren preferring to see policy left unchanged.

Fed funds target rate (upper bound) 1995-2019

They never cut just once...

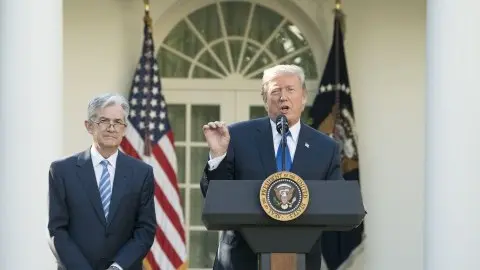

The Fed has been building up to this move over a number of weeks. Officials have frequently cited the weaker global backdrop and uncertainty over trade as factors that could act as a brake on US growth. Fed Chair Jerome Powell had already suggested they have contributed to business investment growth slowing “notably” and they were watching for signs of weakness elsewhere in the economy. Given the benign inflation backdrop, the Fed had room to loosen policy early and chose to take it.

An early, pre-emptive move

We characterise today’s move as a precautionary, pre-emptive policy change to ensure that the US economic expansion – already the longest since the National Bureau for Economic Research’s database began in 1854 – continues for a good while longer. However, the Fed never cuts rates just once and we doubt it will this cycle.

The language in the Fed statement is fairly vague and offers room for flexibility over coming months. It keeps in play what futures markets are pricing - at least another three rate cuts before the end of 2020. But, if anything, the statement (and vote outcome) offers more support to our more cautious outlook of only one further rate cut, most likely coming in September.

The labour market was still described as “strong” and activity is still expanding at a “moderate” rate. Moreover, the Fed’s base case remains that “sustained” growth, a “strong” labour market and inflation “near” the 2% target “are the most likely outcomes”.

We see no reason for this situation to change in the near term. After all, domestic demand is strong, asset prices are high, the labour market is robust and even the manufacturing sector has shown renewed signs of life thanks to the US-China trade truce. Indeed, the strength of the consumer sector can certainly offset some of the headwinds from lingering global growth worries.

Consumers have the confidence and the cashflow to spend

Trade to determine the policy outlook

Nonetheless, the Fed continues to highlight the “uncertainties” and it is the trade story that remains critical to the outlook for policy. This is very firmly in President Trump’s hands. Should tensions escalate once again, tariffs are hiked, markets sell-off and economic weakness spreads then the Federal Reserve will respond with more stimulus given the benign inflation backdrop.

However, we remain open to the view that the fear of economic weakness for both sides will lead to China and the US finalising a deal later this year, even if it doesn’t necessarily achieve all of President Trump’s initial demands. President Trump wants to go into next year’s election with the economy in the best shape possible. A positive boost to sentiment from a trade deal would be a shot in the arm for the economy and help his re-election chances. It would also clearly reduce the need for additional Fed policy easing.

Download

Download article

6 August 2019

What’s happening in Australia and around the world? This bundle contains 7 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more