The emerging market pioneers in green and sustainable bonds

Environmental, social, and corporate governance issuance in emerging markets has become a thing in recent years. The draw has been diversification and larger order books. The greenium is of lesser influence. It is there though, varying from 1bp to 5bp, but can also flip negative

Central European pioneers in green and sustainable issuance

In Central Europe, Poland has been the pioneer, launching its first green bonds in 2019, followed by Hungary in 2020 and Serbia in 2021. In every case, they are EUR-denominated bonds. All of them share the positives of having heavily oversubscribed books at issuance, and all can claim a material greenium in terms of where they trade on the secondary market.

Slovenia also issued a EUR-denominated sustainable bond in 2021, which trades with a definite greenium, at some 5bp through the grey curve. Hungary also launched local currency green bonds, one in 2022 and a second one earlier this year. They trade tight to the grey curve, with an ad hoc moderate greenium.

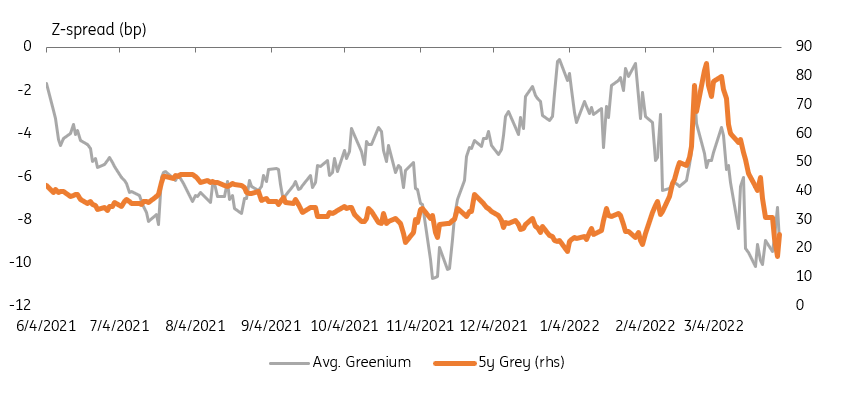

The greenium does jump around a bit. We saw that as spreads came under widening pressure recently, the greenium fell away, and the subsequent re-tightening helped reassert the greenium. However, we've also seen the reverse correlation. At times it can be determined by the types of players driving the market. We also don't read it as a lack of liquidity in environmental, social, and corporate governance (ESG) bonds. Rather, sometimes the easier to sell product can be sold first, resulting in a perceived underperformance.

Example of emerging market sovereign issuer average greenium vs grey spread movement (bp)

The rationale here for green issuance is threefold. First, ESG issuance still comes with a novelty value that helps secure a strong book at issuance. Second, and in a parallel fashion, ESG issuance has a captive audience that will show up at issuance. And third, ESG issuance is seen to place the issuer in a positive light. Stakeholders – from investors to citizens to international observers – take note with a positive gloss.

Apart from the various hurdles that need to be overcome in terms of documentation, project identification and subsequent monitoring, issuers come away with an overall glow of positive kudos for going down that route in the first place. So-much-so that it in a way places pressure on other comparable issuers to step up and do the same.

Selected ESG issuers in emerging markets

Looking forward, Turkey, for example, is well advanced in structuring its sustainable framework and will use this to look at opportunities for green, social or sustainability bonds in the future. Other issuers in the Central and Eastern Europe space are also looking at options in ESG issuance, but in many cases it is a bit of a slow process.

Key Latin American players: Chile is a huge player in the ESG space

One of the more interesting players in the emerging markets sovereign ESG space is Chile. Issuance of Chilean green, sustainable, sustainable-linked and social has seen its CHILE hard currency ticker on Bloomberg littered with ESG issuance options in the USD space. In fact, there are more ESG lines (11) than there are grey lines (4). Similar proportions are in evidence for EUR-denominated Chilean bonds.

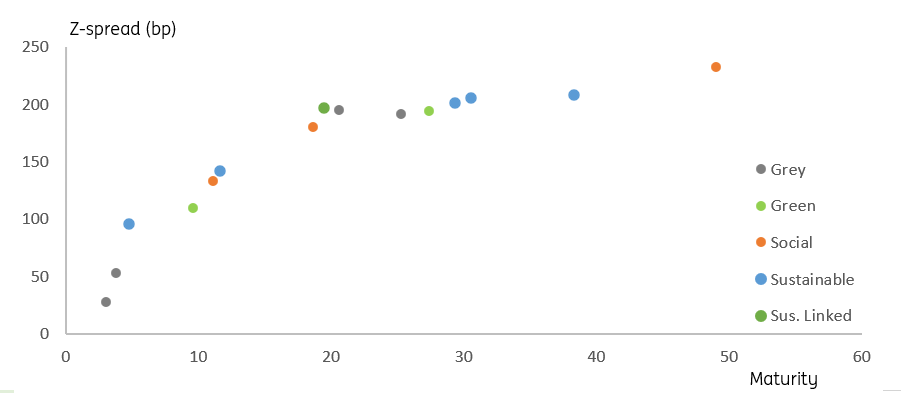

Chile issues along the whole spectrum of ESG bonds

Interestingly, in this case, there is more of an ESG bond discount in evidence than a greenium. Certainly the ESG lines in the belly of the curve trade at a discount to and extrapolation between grey bonds, and for longer maturities, ESG lines tend to trade flat to or at a higher yield versus grey lines. We calculate a generic ESG bond discount of some 10bp for Chile USD paper; no greenium there.

But this is an interesting case in point. Of its last 12 USD lines issued since 2019, 11 of them are ESG bonds. And four of those have been issued in 2022 year-to-date, despite the existence of an ESG discount. This is a clear example of an issuer that has flipped towards ESG. All new lines issued in 2021 were also ESG bonds.

This is an example of an issuer that is not in ESG issuance for the greenium. Rather Chile sees itself in the pioneering space for sovereign issuance, and followed that through by being the first sovereign to issue a sustainability-linked bond in March 2022. The positives don’t have to be in the price; that sustainability-linked bond was eight times oversubscribed, although it is also the cheapest bond on the Chile curve.

Other interesting issuers

- Peru has also dipped into the space with two USD-denominated sustainable bonds launched in 2021, and one EUR-denominated social bond. The EUR bond does seem to exhibit a moderate greenium versus an extrapolated grey curve, while the longer-dated USD bond trades at an ESG discount to the interpolated grey curve.

- Mexico has issued two EUR-denominated sustainable bonds, one in 2020 and the second in 2021. Both trade about flat to the grey curve, maybe a tad through at times for a very moderate greenium.

- In Asia, there are some examples of ESG issuance to note. Indonesia issued its first sustainable bond in 2021, which traded flat to a moderate pickup versus the grey curve. So no material greenium here.

Download

Download article

7 April 2022

Green finance: how greenium is evolving This bundle contains 5 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more