Thailand: Steady economy amid political risks

Prime Minister Prayut Chan-o-cha is likely to remain in power at the general elections next month, though the transition to the new government under him may not be smooth. Absent a significant political shock, the economy will be on a steady 3-4% growth path and the currency will continue to be an Asian outperformer in the medium-term

2018 wasn’t all that bad with firmer growth

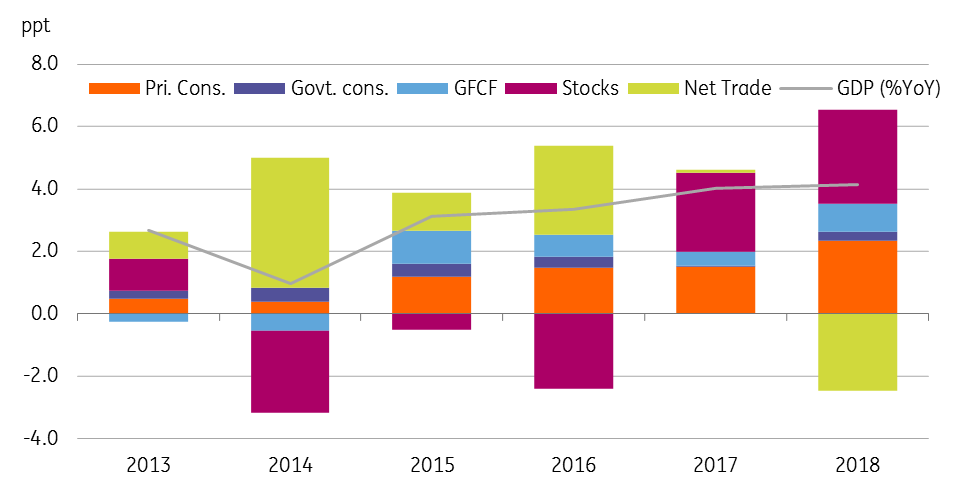

Thailand’s economy grew by 4.1% in 2018, the best performance in the last six years. However, it was not much of an improvement from the 4% growth rate recorded in the previous year and underlying drivers of growth weren’t very impressive either. As in 2017, a large contribution to growth came from inventory re-stocking, which isn’t a healthy sign as the potential inventory overhang is likely to keep future output growth subdued. There was some improvement in domestic demand but the all-important investment demand continued to be anaemic and lacked a material boost from public investment. Meanwhile, narrowing external trade surpluses held headline GDP growth down.

Sources of GDP growth

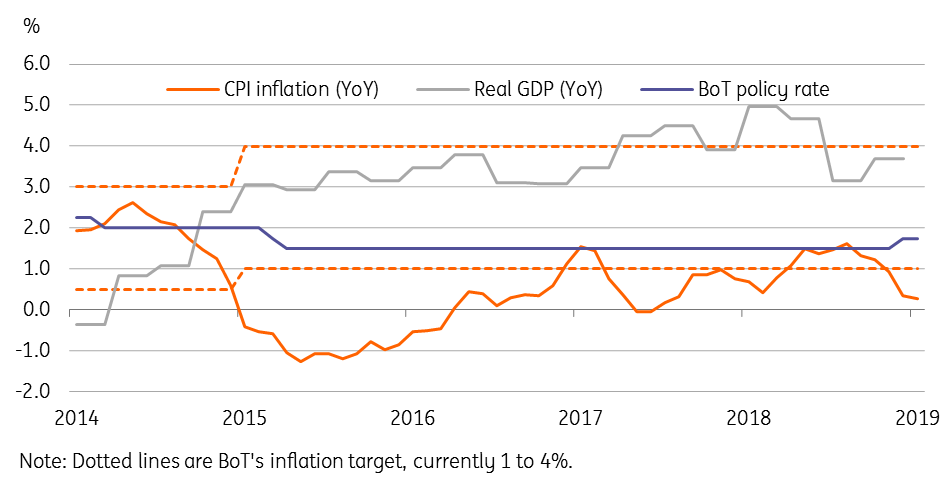

The strong currency and lack of demand-side pressure have kept consumer prices subdued. The Bank of Thailand’s (BoT) 1-4% policy inflation target has barely been achieved on a sustained basis in recent years. Last year was no different. Even though average CPI inflation of 1.1% in 2018 was the most in four years, after a brief return to the target level, inflation slid closer to zero toward the year-end. Apart from the pass-through of higher global oil prices to domestic fuel prices, which kept the CPI transport component elevated, and higher "sin taxes" on alcohol and tobacco products, there was no inflation in most other CPI components, not even in food prices, which have been the main driver historically, due to their 36% CPI weight.

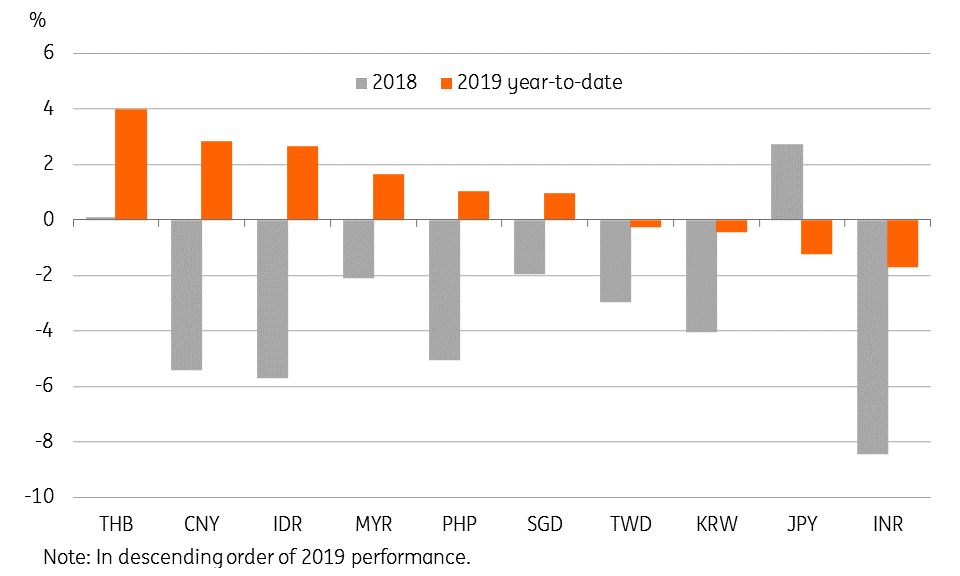

On the external side, the current account surplus equivalent to 7.5% of GDP in 2018 represented a sharp narrowing from 11% recorded in the previous two years. Yet this remained the main source of currency (THB) strength. The Thai baht was unscathed and retained its top spot among Asian currencies during bouts of emerging market volatility owing to the trade war and contagion from the crisis in Argentina and Turkey.

Indeed, persistently low inflation was an argument against the Bank of Thailand following the US Federal Reserve in tightening. Even so, the BoT stepped up its hawkish rhetoric and moved policy with a 25 basis point interest rate hike in December. The first BoT rate hike in seven years was aimed at gaining policy space for the future. Meanwhile, fiscal policy remained expansionary with close to a 3% of GDP budget deficit.

Growth, inflation, and central bank policy

Could 2019 be ugly as politics overtakes the economy?

After frequent rescheduling, general elections are (hopefully finally) set to take place on 24 March 2019. Hopes rest on this ending the long-standing political uncertainty about establishing a civilian government after the military grabbed power in May 2014. That coup overthrew the last elected government of Yingluck Shinawatra (2011-14), the sister of the former Prime Minister Thaksin Shinawatra (2001-06). General Prayut Chan-o-cha initially promised elections within a year of the coup but has pushed out the timing until this latest rescheduling.

Will the transition from military to publicly-elected government be smooth, without any political turmoil? Maybe not, judging by Thailand’s political history which has been marred by frequent unrest, military interventions, and short-lived governments. A glimpse of this came earlier this month when a Thaksin-linked Thai Raksha Chart Party announced Princess Ubolratana Rajakanya, the elder sister of King Maha Vrjiralongkorn, as its prime ministerial candidate for upcoming elections. A spike in political risk ensued with a public outcry against the move deemed unconstitutional and disrespectful to the royal family. The sell-off in local financial markets was associated with the steepest single-day depreciation of the THB since last October.

The King denounced the Thai Raksha Chart’s move as unconstitutional, and the party now faces dissolution by the constitutional court on the grounds of violating election laws. This nipped in the bud Thaksin’s bid to reacquire his grip on Thai politics via a royal family member and also bolstered the odds of Prayut holding on to power.

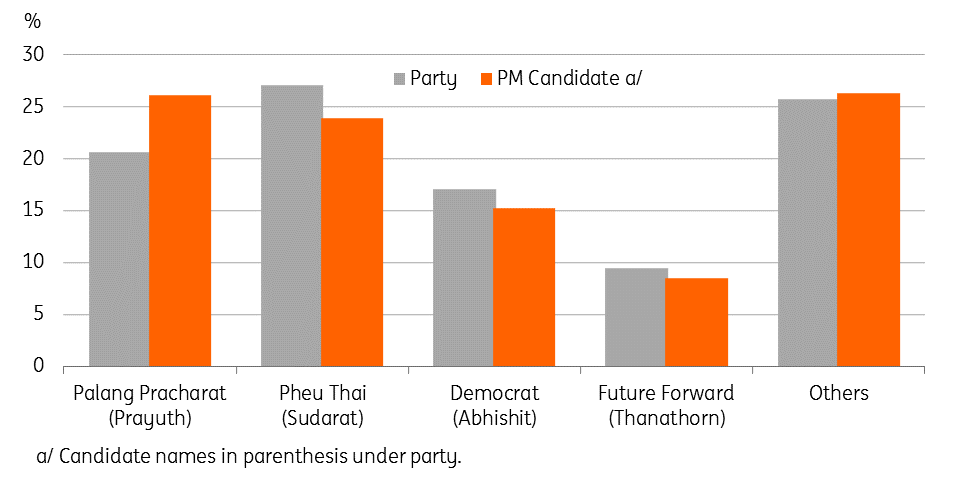

There are 68 prime ministerial candidates in the ring, including Prayut contesting from the military-backed Phalang Pracharat Party and former Prime Minister Abhisit Vejjajiva (2008-11) from the Democrat Party. Thaksin’s Pheu Thai Party is also fielding three prime ministerial candidates, while the fourth major party in the fray is the newly-formed Future Forward Party led by Thanathorn Juangroongruangkit.

Moreover, the new constitution adopted in 2017 allows the military to retain its decisive role in future governments. The upcoming elections will be for the 500-seat lower house of parliament, but the 250-seat upper house, or Senate, is the non-partisan body of appointees from the Royal Thai Military. As such, the balance of power remains tilted toward Prayut. Yet, the passage to the new government may not be without any political gridlock or public unrest.

What pre-election opinion polls point to?

Average results of various opinion polls held since December 2018.

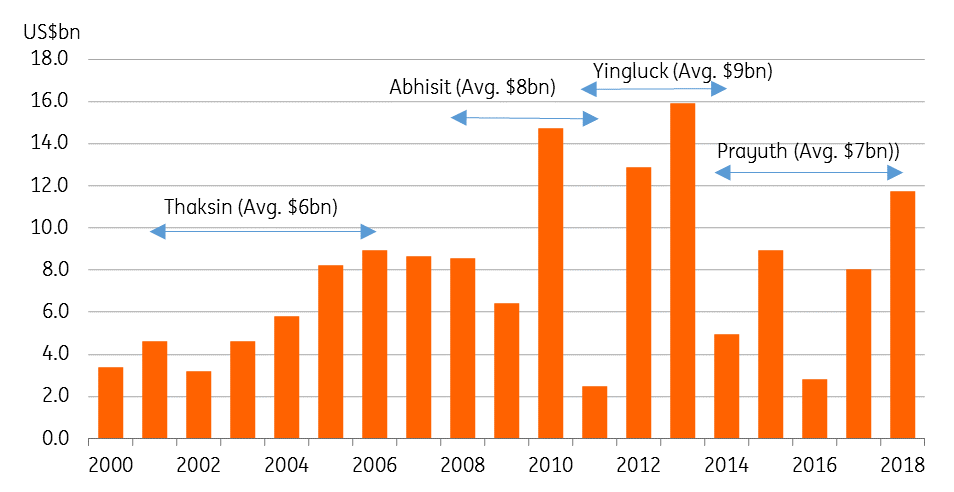

Economic case for Prayut’s re-election

Let’s take a look at Thailand’s economic performance under the current and previous regimes to assess Prayut’s chances of continuing as prime minister.

Growth improved from a low of 1% in 2014 (the year of the military coup) to about 4% in the last two years, though the 3% average over these years was hardly an improvement over previous administrations. The economy enjoyed lower inflation under Prayut than previous regimes though this is more a result of weak demand and lower commodity prices.

How did the economy fared under recent governments?

External situation - great, but thanks to weak demand

Of course, the external payments position had never been as strong as it was under Prayut, supported by a lumpy current account surplus and swelling foreign exchange reserves. However, a large current account surplus also reflects a gross economic imbalance, which has failed to correct despite expansionary macroeconomic policies. Having slashed policy rates by 200 basis points to 1.5% from late 2011 to early 2015, the BoT held policy stable until the latest hike in December 2018. The fiscal deficit averaged about 3% of GDP in the years from 2014, more than the previous administrations.

Foreigners have been pouring funds into local stocks and bond markets in recent years, thanks to the comfort of healthy external payments boosting the currency. And direct investment inflows also gained traction in the last two years. But real investment growth continued to be depressed under military rule (there is also a structural aspect to this as discussed in the next section).

Net foreign direct investment inflows

Structural trends – plenty of slack in the economy

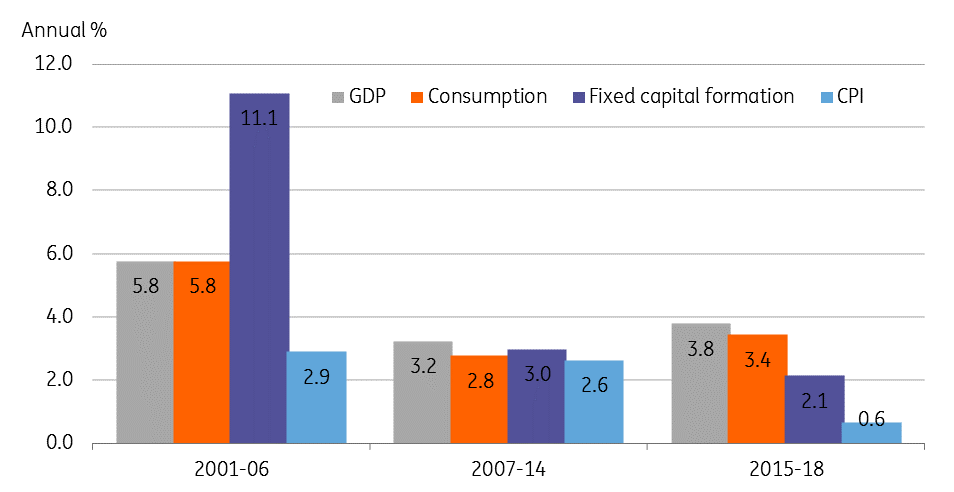

The post-Thaksin era was marked by a significant surge in political uncertainty taking a toll on the economy. This is evident from the almost permanent shock to growth via weak investment demand. Once an Asian tiger, Thailand’s economy has struggled to grow in recent years with a steady slowdown from an annual average rate of 5.8% in 2000-06 (Thaksin era) to 3.2% in 2007-14 (years of heightened political turmoil). A slight improvement in recent years (military government) can be characterised as lopsided – persistent weak domestic demand – without stoking any inflation.

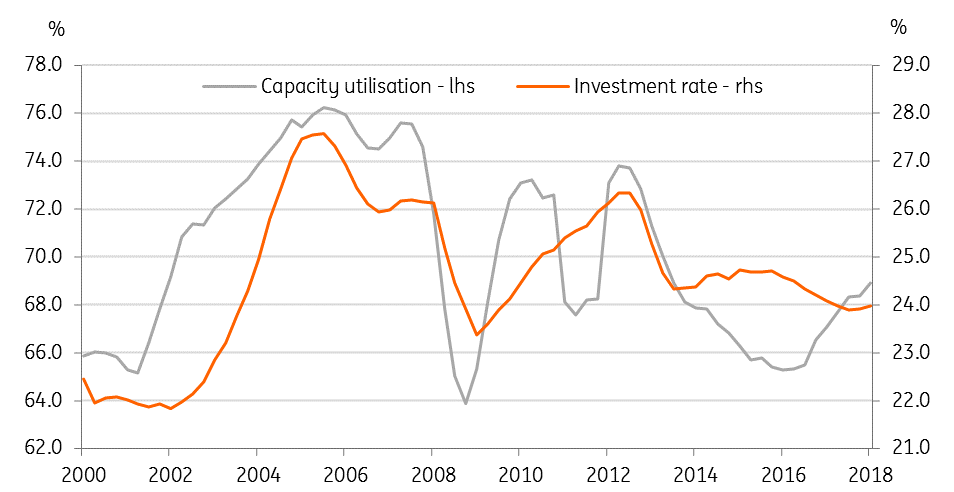

There is plenty of slack in the Thai economy as underscored by factories running at about two-thirds of their capacity. The elevated manufacturing inventory-to-shipment ratio points to the same feature. And this has dampened the investment rate (ratio of fixed capital formation to GDP), which has failed to reach the Thaksin-era highs, while politics has been a constant overhang on investor sentiment.

Years of political uncertainty has shocked growth lower

Unused capacity weighs down investment

Steady as it goes into the medium term ...

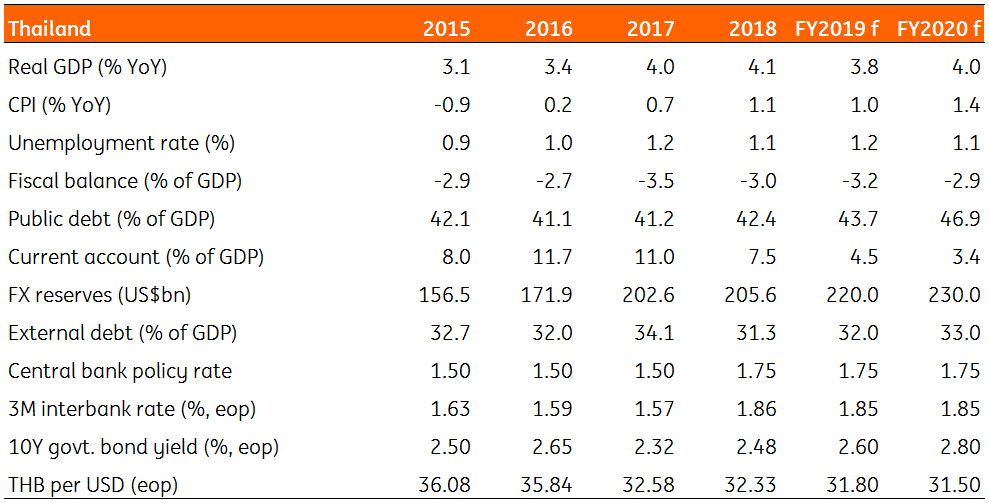

We expect the broad economic trends described above to remain in place in the medium term. Absent significant political risk, we see no reason for Thailand’s GDP growth to break out of the 3-4% range that it’s seen in recent years. The National Economic and Social Development Council (NESDC) projects 3.5-4.5% growth in 2019, as election spending is likely to provide upside to consumer spending. But with the prevailing external risks from the global trade war, GDP growth will likely be closer to the low end of the NESDC’s forecast range.

Investment will persist as a weak spot. Hope rests on the continuation of the Eastern Economic Corridor Plan undertaken by the current administration under the new government. This is a long-term plan to develop three coastal regions into a special economic zone with airports, deep sea ports, and high-speed rail, and spanning a multitude of industries. Thailand is also seen among the destinations for potential supply chain relocation resulting from the US-China trade dispute, but is still not as attractive a destination as Cambodia, Vietnam, Myanmar or Laos – all up-and-coming countries with relatively cheap labour.

We see external trade imbalances narrowing gradually. A significant negative swing in the trade balance in January to a deficit of $4 billion from a surplus of $1.1 billion in the previous month heralds this trend. We forecast that the current surplus will shrink further to 4.5% in 2019, providing continued strong support for the currency's appreciation.

Key economic indicators and ING's forecasts

... thanks to continued policy accommodation

We aren’t anticipating a near-term departure of monetary or fiscal policy from the current accommodative stances. Despite the sustained hawkish tone, the BoT has flagged policy to be data-dependent and yet likely maintaining an ‘accommodative’ bias for this year. We don’t see anything significant in the data to cause another rate hike this year, nor do we expect any easing. This view of policy status quo hinges on our forecasts of growth slipping below 4% and inflation hovering around 1% in the current year.

Fiscal policy will remain accommodative, too. The state budget for the current financial year ending September 2019 is set to produce a deficit equivalent to about 2.6% of GDP, a consolidation from 3% in FY2018. But slower GDP growth will likely depress revenue, and together with the surge in election spending, this will see a wider budget gap than projected. However, we don’t see anything here threatening the country’s investment-grade sovereign credit rating underpinned by still sound external payments.

Still, there are more reasons for the authorities to be worried about the ongoing currency strength, which is detrimental to exports in the current environment of rising global trade protectionism. The BoT views recent THB appreciation as consistent with broader emerging currency trends supported by a dovish turn in US Fed policy and softer US dollar. Moreover, we think the reason for the currency’s 4% year-to-date appreciation probably lies in investor confidence about the military Junta maintaining its grip on the government, and thus ensuring political as well as economic stability. Although we aren’t ruling out some weakness in the run-up to March elections, the THB will remain investors' darling for the rest of the year.

THB remains top-performing Asian currency

Download

Download article

5 April 2019

What’s happening in Asia ? This bundle contains 9 articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).