Thai inflation returns to sub 1% territory

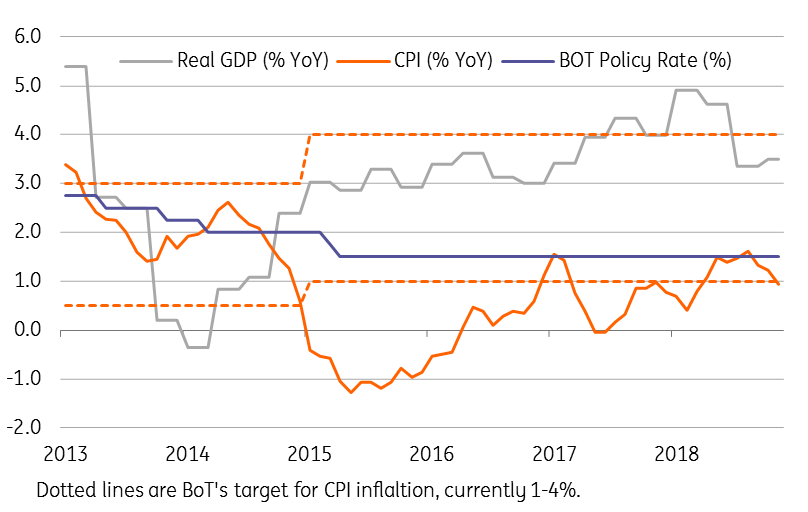

Lower inflation coupled with slowing GDP growth provide more reasons for the Bank of Thailand to leave the monetary policy on hold in December. But expect food to be displacing transport as the key driver of inflation in 2019

| 0.9% |

CPI inflation in November |

| Lower than expected | |

Lower oil price have kicked in

Breaking the brief 1% plus trend, the consumer price inflation dipped to 0.9% year on year in November from 1.2% in October while core inflation eased by half a percentage point to 0.7%. We anticipated no change in both measures from their October levels.

What stood out the most was a sharp slowdown in the transport component to 1.6% in November from 3.9% in October as the recent plunge in global crude oil prices works its way through to domestic fuel prices. Lower transport inflation more than offset higher food inflation of 1.0% than 0.3% in October, while inflation in other components remained mostly unchanged over the course of two months.

We maintain our forecast of 1.1% inflation for 2018.

Paving way for more being inflation outlook

We see food displacing transport as the key driver of inflation in 2019. The low base effect is at work in the food component and could push the annual increases to as high as 3% by mid-2019.

On the transport side, the 30% plunge in global oil prices over the last two months doesn’t look to be completely reversible as slower global growth weighs down demand.

As such, the risk to our 2019 inflation forecast of 1.3% remains on the downside.

Why the central bank needs to tighten the policy?

In the recent past, inflation hasn't been a policy concern and is unlikely to become one shortly either. And GDP growth has dipped below what appears to be the government's 4% comfort level in the third quarter, which is where it likely to remain for most of next year. Yet, the noise about the central bank hiking at its next meeting is on the rise.

Balance of economic risks tilted toward growth

We believe the balance of economic risk is tilted towards growth, not inflation and that expectations of central bank tightening in December are misplaced. The Bank of Thailand has already signalled downside risk to its 4.4% growth forecast for the current year. Its growth and inflation projections for 2019 are 4.2% and 1.1% respectively.

We maintain our contrarian view that there will be no change to the 1.50% policy rate in December and are pencilling in a 25bp rate hike in 2Q19, which we will be looking to push out in time if growth continues to be under 4% in coming quarters.

Download

Download article

4 December 2018

Good MornING Asia - 4 December 2018 This bundle contains 4 articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).