South Africa: Key takeaways from the 2023 budget

South Africa’s budget announcement yesterday should offer at least some near-term comfort to investors. The backdrop of a worsening energy crisis for the nation has increased scrutiny from investors on the need for a more comprehensive solution to state utility Eskom’s operating issues and debt troubles

South Africa’s 2023 budget has come into sharp focus for EM (Emerging Market) investors in recent months, given the backdrop of a worsening energy crisis for the nation. Rolling power cuts have increased in intensity, which has brought the need for a more comprehensive solution to state utility Eskom’s operating issues and debt troubles to the forefront. Despite multiple injections of support from the government and ongoing reform efforts, the outlook for the company, and consequently South Africa’s economic growth prospects, has deteriorated in recent years, leaving investor sentiment towards South African assets fairly negative heading into this year’s budget announcement.

In this context, the budget announcement yesterday should offer at least some near-term comfort to investors. Significant front-loaded support for Eskom will increase government debt and debt-servicing costs, but offers optimism in reducing the company’s debt load, allowing it to focus on vital investments in order to ease the energy crisis. The outlook for economic growth remains downbeat and government debt levels remain high (and likely increasing in the coming three years at least), but the trend towards fiscal consolidation should continue, with a gradual increase in the government’s main budget primary surplus forecast after years of persistent deficits.

Here are our key points to note from the budget announcement:

A strong signal of support for Eskom

The government announced a significant debt relief programme for Eskom, amounting to ZAR254bn ($13.9bn, 3.8% of GDP) in total over the next three years. This will cover the entire debt servicing requirement for the company over this time horizon (ZAR168bn of capital and ZAR86bn in interest payments).

The nature of this support will be in the form of interest-free subordinated loans and will be provided by tranches of ZAR78bn, ZAR66bn and ZAR40bn in financial years of 2024, 2025 and 2026 (FY26, ending 31 March). Provided loans will then be settled in Eskom shares rather than cash, subject to pre-announced conditions related to the use of debt relief proceeds, along with limitations on capital expenditure and a ban on new borrowing. The government will then also directly take on ZAR70bn of Eskom’s debt in the financial year of 2026.

The net result should be an improvement in Eskom’s credit profile, with a reduction in debt stock, including government-guaranteed debt. This should free up capacity for Eskom to undertake the investment and maintenance needed to support the security of electricity supply of the country.

Government debt and financing needs to increase

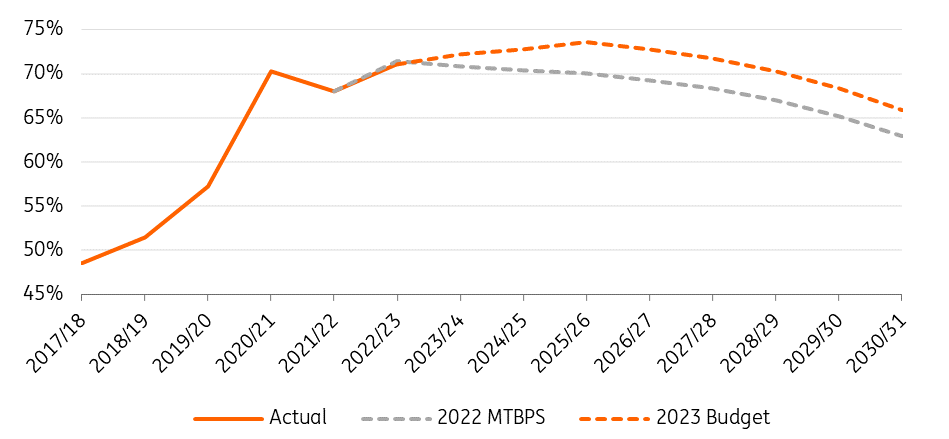

While Eskom’s balance sheet should improve on the back of the support package announced, the natural counterweight is that the South African government’s debt profile should weaken as it takes on the additional debt to its own balance sheet. This is highlighted by the change in the National Treasury’s forecast for the trajectory of government debt to GDP since last October’s update (2022 Medium-Term Budget Policy Statement – MTBPS). Instead of a steady downtrend from this year, the government now projects gross debt to increase from 71.1% of GDP this year to a peak of 73.6% in FY26, before trending down in the longer term. These projections remain somewhat more optimistic than the broad market consensus, as well as those of the credit ratings agencies.

Government debt-to-GDP forecasts over time

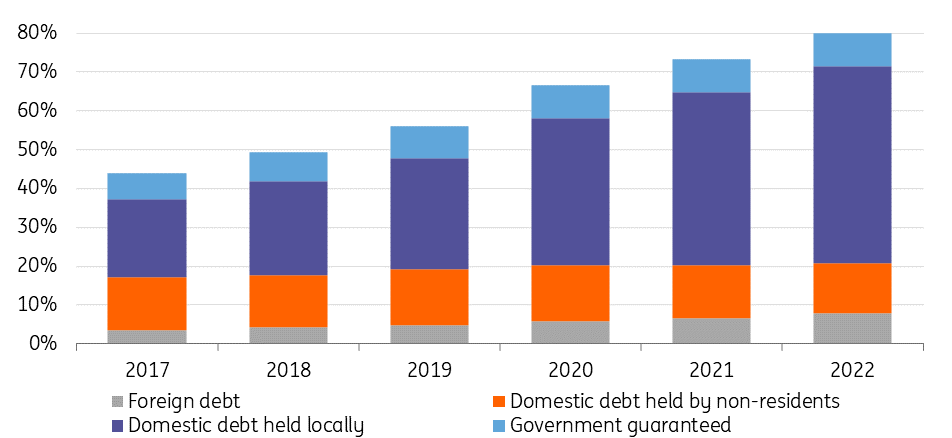

However, to mitigate some of the risks from South Africa’s high and rising government debt levels, there are some structural positives. The nation’s debt is largely denominated in local currency, and even the share of this domestic debt held by foreign investors has fallen significantly since peaking in 2018, meaning more reliance on a steadier domestic investor base. Investors in South Africa’s external bonds can take comfort that this situation is likely to persist, with the increased borrowing requirement to fund Eskom support (ZAR118bn over the next 3 years, adding to the ZAR66bn already provisioned in 2019’s medium-term expenditure framework) set to be financed domestically, meaning less risk of a significant uptick in international bond supply.

Government & guaranteed debt stock, % of GDP

Additionally, the impact on the consolidated public sector balance sheet in the coming years should be less significant, given the sizable amount of government-guaranteed debt (mostly for Eskom) at 8.6% of GDP that has largely been already considered a part of government debt by the credit rating agencies in particular. Shifting this guaranteed debt directly to the government’s balance sheet as it matures should therefore be viewed less negatively by both investors and ratings agencies in comparison to debt increases driven purely by regular government expenditure.

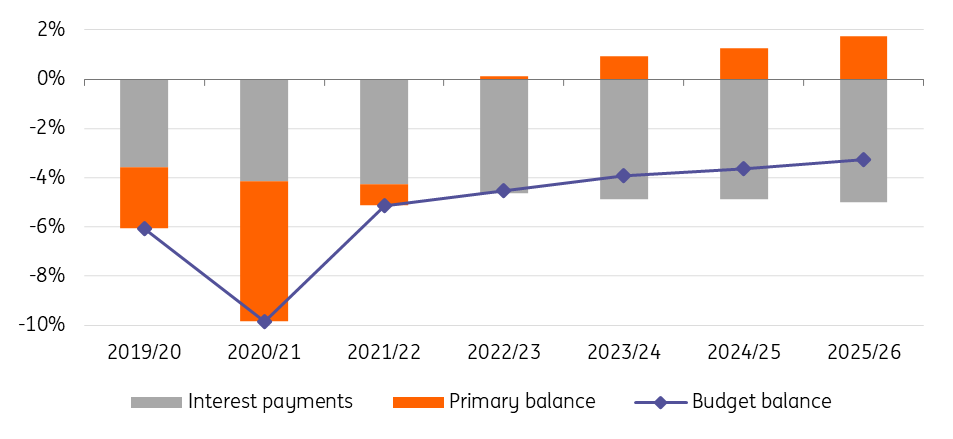

Gradual fiscal consolidation to continue

At the headline level, the fiscal flow picture has slightly improved, with the main primary balance forecast to improve relative to last October, reaching a slight surplus in FY23. The consolidated deficit is projected to narrow from 4.6% of GDP in FY22 to 3.2% of GDP in FY26, with revisions in part driven by accounting changes in terms of support for Eskom now being shifted directly to the government’s borrowing requirement, rather than being classified as expenditure.

Fiscal balance to GDP

The general trend points toward gradual fiscal consolidation for South Africa continuing, with the main budget primary surplus forecast to increase from 0.1% of GDP this year, to 1.7% in FY26. However, risks will likely remain around the key issue of public sector wages, along with the potential for more support for Eskom and other struggling state-owned enterprises.

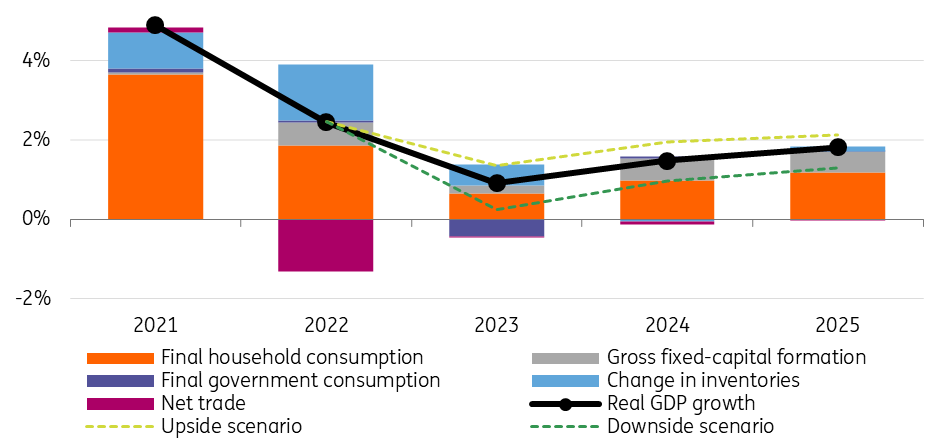

Growth outlook remains subdued

South Africa’s economy was estimated to have grown by an upwardly revised 2.5% in 2022, slowing from 2021’s post-Covid rebound of 4.9%. The slight uptick in 2022 relative to October’s forecast was driven by better-than-expected performance of the agriculture and services sector. But more broadly the macro-outlook is fairly downbeat. Real GDP growth is forecast at 0.9% in 2023 (slightly more optimistic than 0.3% from the central bank), while growth is now projected to average just 1.4% from 2023 to 2025, compared with 1.6% in October, largely driven by structural constraints, especially the ongoing power cuts, and a less supportive global environment. The 2023 forecast is also weighed down by a negative fiscal thrust.

National treasury real GDP growth forecasts and contributions (YoY%)

Within these forecasts, the government also laid out some alternative scenarios. Even in an upside scenario that sees a swift resolution of the power crisis this year, GDP growth is only seen as reaching 2.1% in 2025, while a downside scenario of more persistent power cuts could see growth average just 0.8% in the next three years.

On this front, to address the key issue of power cuts, planned investments are intended to add 6,484 MW to the grid over the next 24 months. Priorities include:

- Improving Eskom’s plant performance, procuring power from existing independent power producers.

- An Energy Security Bill, which removes regulatory impediments for independent power producers.

- Supporting the rollout of rooftop solar for households with a tax incentive to encourage electricity generation (tax relief in the budget totalling ZAR13bn to support energy generation).

- Implementing grid capacity rules to provide certainty to private producers investing in energy projects.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more