Rates: Swing low

Rates have to stay low. They could get there the hard way, from a multi-quarter shutdown - unlikely, fortunately. But even in the dream scenario of a quick return to 'normal', rates need to be kept low. Our base view is in between - the US 2yr hits zero and the 10yr goes below 50 basis points. Any hint of a supply-driven rise in rates will be hammered down by the Fed

Flight to safety got us here

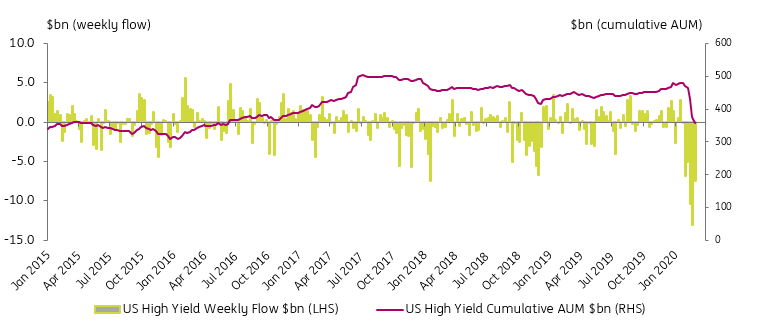

A mad dash from risky assets explains the bulk of the fall in core market rates seen in the past month. The chart below illustrates the remarkable outflow from high yield, and similar outflows can be gleaned from emerging markets, investment grade credit and equities. No surprise against this backdrop that core market rates literally collapsed, and especially US rates, which had more room to fall.

Capitulation outflows from High Yield corporates

Risky assets have stabilised of late, but we continue to see a lower rates bias as a dominating outcome in the coming weeks, and perhaps months. Part of the rationale centres on the likelihood that risky assets wobble in the period ahead, and during such periods there will be an appetite for the safety of government bonds as a cash parking alternative.

Big QE plus small CPI equals low rates

Add to that the considerable weight of central bank buying through quantitative easing (QE) programmes and there is an irresistible force in play that keeps core rates under wraps. This QE episode is unique in the sense that it is not just massive, but is simultaneous and seemingly as open-ended as it needs to be. It also spans developed and many emerging markets.

On top of that, the lockdown measures in place mean significant demand reduction, and in consequence is seen as a deflationary impulse. We see this in market inflation break-evens too, e.g. the current market discount for US inflation is 0.5% per annum for the next five years, and the eurozone market discount is between zero to 0.25% per annum. These are remarkably benign market discounts for inflation.

We eye the 2yr US yield hitting zero and we see the 10yr peppering 50bp, and likely dipping below.

There are some counter arguments. For starters, real rates are negative along the curve out to 10 years, and deeply negative in the eurozone. Deep negative real rates suggest that nominal market rates are too low. They probably are, but the weight of central bank demand together with massive central bank holdings are acting to keep rates hammered down.

The net outcome is for low and even lower rates to obtain in the coming period. We eye the 2yr US yield hitting zero (now 25bp) and we see the 10yr peppering 50bp (now 65bp) and likely dipping below. At the same time, the German curve can dip back down to the -100bp to -50bp area along the 2yr to 10yr segment. Yes, these are crisis levels. But, well justified as we are still in mid crisis mode.

Curvewise, the narrative for much of the second quarter is one of curves shifting lower and flatter, with the US curve seeing a floor at zero in the 2yr.

But some eye-popping supply is coming

Once we get to a re-opening process, expect to see market rates come under a different dark influence: high bond supply. With the US deficit set to rocket to over 15% of GDP in the near term, the size of the bond issuance required to finance this will be substantial.

The most likely prognosis is for a supply-driven re-steepening of the curve to dominate through the third quarter, with the 10yr Treasury yield targeting a break back up to 1+% by the turn of the year. Even though a decent rump of the extra issuance will be concentrated in bills, the bigger directional pressure would be felt in longer dates, especially if this coincides with re-building inflation expectations.

Whether the curve re-flattens from the front end in the fourth quarter will depend on the degree of market credibility attached to a rate hike process in 2021. Certainly, the Federal Reserve would be keen to reverse as much of the emergency measures as possible, and in particular to move the funds rate off zero. That would be enough to see the curve re-flatten from the front end by 4Q 2020, with the 2yr heading back above 0.5% in anticipation.

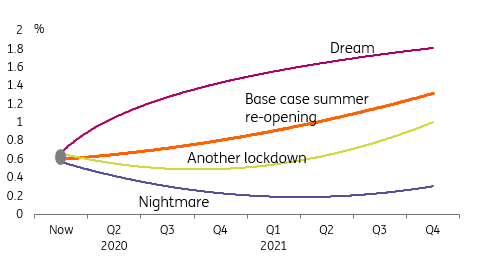

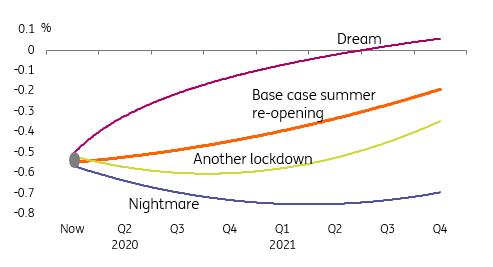

From nightmare to dream with the likely base for yields in between

A range of routes for the US 10yr yield are illustrated below. The best case "dream" scenario is also the least likely, so focus on the other three for a good guide. Our base case is in orange.

Potential path for the US 10yr yield in the coming quarters

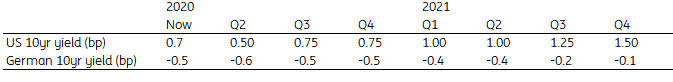

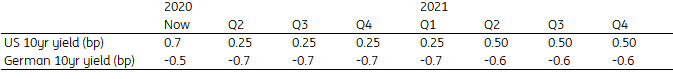

The point estimates for our US base case scenario are summaried below, adding projections for the 10yr German yield. Here, we have a re-opening in the summer, and we return to a new 'normal'. As you can see, that new normal does not see yields getting much above 1.5% in 2021.

Most likely scenario - The shutdown comes to an end by summer

Here, the 10yr Bund yield peppers the -50bp area for most of 2020, bearing in mind that even on a re-opening there is ongoing macro angst to withstand.

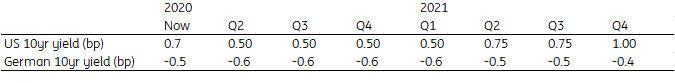

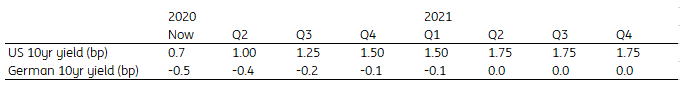

A less likely (but not improbable) counter scenario is one where we see another lockdown as we face the 2020/21 flu season. The main outcome of this is for the US 10yr yield to remain at 50bp or lower through much of 2020, and does not make its way back up to 1% until 4Q 2021. Here the 10yr Bund yield deepens to the -60bp area, and does not make it above -50bp until end 2021.

Worse than the base case - Another lock down in the fall/winter

By the same token, should we see the other extreme where the lockdown remains in place on a multi-quarter profile, then the 10yr has a 25bp tendency for the second half of 2020, and only edging back up to 50bp in 2021 (by which time, a virus solution is found). For the eurozone, this translates to the -70bp area as a theme through 2020/21.

Nightmare scenario - Multi-quarter shutdown till vaccination found

If there were a quicker return to normal than implied in the base case, then the 10yr would head to 1.5% by the fourth quarter 2020. It would still be held down by the collateral damage done by the lockdown, implying that a break back above 2% would not be likely. Here, we see the 10yr Bund yield edging back towards zero as a theme for 2021.

Dream scenario - Quick return to "normal"

Below is a summary of the aforementioned scenarios, with a focus this time on the path for German yields in the quarters ahead.

Potential path for the German 10yr yield in the coming quarters

Why rates need to stay low for 2020

One of the striking aspects of these rates views is they are bounded by extremes of zero to 2% for the US 10yr, and so whichever way we go, we see maintenance of low core market rates as a natural outcome. And the German 10yr is bounded by -1% and zero. But in a sense this is also a desired outcome in order to secure recovery. In that vein, should the US 10yr rate break back above 2%, we’d suggest that the Federal Reserve would manage them back down, assuming that such a break above 2% was detrimental to the recovery.

And that’s why rates need to be kept under wraps, whether by design or 'default'

In our base view, market interest rate management, if required, is not an improbable development. Anything to soften the default risk that is bound to evolve as we progress through 3Q and into 4Q. This default risk would extend from the personal sector and into the corporate sector. A classic deep recession would see high yield defaults in the 5% to 10% area. This one will be at the upper end of that zone. The two deeper negative scenarios entertained here would take it comfortably into double digits.

And that’s why rates need to be kept under wraps, whether by design or 'default'.

Download

Download article

2 April 2020

Covid-19: The scenarios, the lockdown, the reaction, the recovery This bundle contains 18 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more