EUR bond supply and spreads

Fundamentals look weaker emerging from multiple crises, and the supply of government bonds will remain elevated when also taking into account ECB quantitative tightening. Eventually, accelerated EU investments and structural reforms could improve the trajectory, especially if paired with the prospect of ECB easing and a recovering macro backdrop

Less favourable fundamentals following multiple crises and less certain ECB support

The prospect of stagnating growth, likely still high interest rates and ongoing elevated funding needs is not an ideal backdrop for sovereign bond spreads to materially tighten from here.

On the positive side, there is still the prospect of more spending via the NextGenerationEU to support the growth outlook and eventually, spreads. This could be the case for Italy, in particular, as the implementation of the programme has fallen behind target this year and Italy is the biggest beneficiary. But progress will be closely scrutinised, not just by markets but also by rating agencies with lingering concerns over rating downgrades.

The European Central Bank (ECB) will cut rates eventually, but it is not a fully-fledged easing cycle, rather a return of monetary policy towards a more neutral setting. Crucially, it is more likely that the ECB’s balance sheet decline will continue or even accelerate. This downward trajectory means that longer rates could struggle to materially rally alongside rate cuts – direction as a driver of tighter spreads of higher beta credit could underwhelm.

The ECB’s first line of defence for sovereign spreads, which is currently provided via the ECB’s ability to flexibly reinvest Pandemic Emergency Purchase Programme (PEPP) maturities, could also weaken – we think reinvestments could slow around mid-year before eventually stopping by the end of 2024. There is still the ECB’s Transmission Protection Mechanism, but the hurdle to activate this backstop looks rather high and markets may be unsure as to whether Italy would even qualify given the outlined conditionality of this tool.

That said, the ECB will have some discretion around weighing strict conditionality against the danger of wider systemic risks. The ECB has already proven it can act pragmatically in the past; the question is more what its pain tolerance is before getting there. In the end, the ECB may also find a way to keep its first line of defence depending on the outcome of its operational framework review. Even ECB hawks have expressed the view that it may be desirable to retain some of the flexibility that is currently provided by the PEPP reinvestment policy.

Budget deficits remain elevated in many cases

10Y Italy-Germany yield spread could stay in a 150-200bp range

The key yield spread between 10y Italian government bonds and their German counterparts has recently narrowed to 165bp (interpolated) after Moody’s raised the outlook of Italy’s rating to stable. Sitting at the lowest possible investment grade level, the stable outlook removed the immediate threat of non-investment grade status. Near-term, the yield spread may tighten even further as issuance slows into the end of the year.

However, issuance will pick up again and in 2024, Italy will likely face even higher gross and net bond supply compared to this year, especially when taking into account the ECB potentially also slowing PEPP reinvestments. A rewidening of spreads in the first part of next year looks possible when resuming issuance, a hawkish ECB and weak growth come together. Overall, we would look for the 10Y spread to remain in the 150-200bp area with tightening toward the latter part of next year amid policy easing and a more benign macro backdrop.

10Y Italian bonds are likely to remain in a wider range

Eurozone net government bond issuance should moderate...

In aggregate, eurozone countries are expected to see modest deficit reductions as fiscal support is further pared back following the pandemic and energy crisis. Yet overall net lending requirements are still seen at relatively high levels in 2024 with the European Commission, for instance, having pencilled in only a reduction by €35bn to €424bn versus 2023 across the 19 eurozone nations.

What this means for eventual gross bond supply will depend on the debt that has to be rolled on top of the new borrowing and also on the choice of funding instrument by the issuers. One will not only have to consider the split between money market funding and bond funding, but also the increased reliance on retail bond issuance as seen in the case of Italy and Belgium.

Very few issuers have provided concrete issuance plans as of yet, and in the case of Germany, we are even confronted with uncertainty about overall funding needs after the constitutional court declared the retroactive repurposing of €60bn in unused pandemic emergency funds (in reality unused borrowing capacity) towards funding climate action as unconstitutional. German issuance needs have been dominated in recent years by the off-budget funding for numerous special funds rather than the government’s main budget.

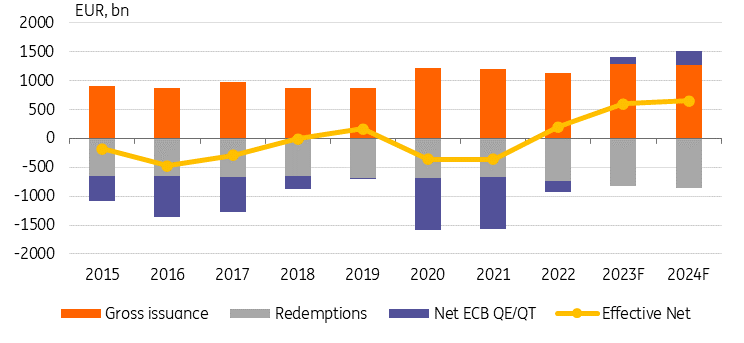

Taking it all together, our initial estimate for 2024 gross bond issuance stands at €1.27tr vs an estimated €1.29tr for 2023. Higher bond redemptions next year imply a somewhat larger drop in net issuance, from €470bn down towards €415bn. These are rough indications that we will refine as debt agencies present their final issuance plans over the coming months.

The ECB impact is likley to offset any moderation in issuance

… but the ECB’s portfolio roll-off could speed up

The issuance that the market will effectively have to absorb will also depend on the net impact of the ECB bond portfolios. We think that the shrinking of the ECB’s balance sheet could more than offset the aforementioned decline in net issuance. 2023 had seen the ECB start with the roll-off of the Asset Purchase Programme (APP) portfolio, and 2024 could see the ECB begin to reduce its PEPP portfolio as well. In 2023, public sector holdings will have declined by €166bn, and over 2024 that volume could increase toward €300bn including slowing PEPP reinvestments. The volume impact on government bonds requires some assumptions with regard to the split of the ECB’s public sector holdings, which also include Supra, agency and regional bonds.

The Bund ASW has tightened as collateral fears abate

The past couple of months has seen a notable underperformance of Bunds versus swaps, which has narrowed the gap between the two to below 50bp and thus the tightest levels since February 2022.

Traditionally, hedging demand and risk sentiment have been key drivers of the spread. With the market turning to rate cuts, the widening pressure from structural demand to hedge interest rate risk via paying fixed rates has gone. At the same, time risk sentiment has also started to ease as markets have digested the ECB's initial tightening shock therapy. Sovereign spreads over Bunds have receded and implied volatility measures have also backed down from last year’s high. Looking at a longer history, these measures still sit at somewhat elevated levels though.

More recently, however, the availability of high-quality paper has also become an important factor in driving the spread of Bunds versus swaps. This factor is more difficult to grasp and has not just been driven by pure net bond supply expectations (including the ECB’s portfolio impact), but also by the central bank's tweaking of other parameters, for instance surrounding the remuneration of government deposits on its balance sheet, and also prospects around the more general decline in excess reserves.

10Y Bund ASW spread to find balance at structurally tighter levels

Our issuance outlook foresees a considerable drop in Bund net supply from just above €100bn in 2023 to €64bn next year. However, taking into account the ECB impact, we estimate that the net amount that markets will have to absorb will drop only moderately from around €135bn to around €115bn. This historically high level in effective net supply confirms the notion that collateral availability will play a less dominating role and argues for structurally tighter spreads alongside some moderate improvements in the dynamics of the other aforementioned factors.

At the same time, the longer-term issuance outlook for Germany could be somewhat less generous than previously anticipated in the wake of the German constitutional court decision regarding the government's use of special funds to effectively circumvent the constitutional debt brake. And crucially, the central bank’s footprint in bond markets still remains large in absolute terms. Overall, we think the 10Y spread of Bunds to swaps (vs 6m Euribor) should start to find an equilibrium around 45bp.

Download

Download article

24 November 2023

Rates Outlook 2024: Fair winds and following seas This bundle contains 8 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more