Plant-based milk IPO puts dairy alternatives in the spotlight

Sales of plant-based drinks have been growing at double-digit rates both in the US and Europe in recent years. For dairy companies, this means the pressure to enter the plant-based alternatives market and the need to further improve the sustainability of their products is expected to increase

Potential Oatly IPO puts dairy alternatives in the spotlight

Press reports about a vegan milk maker's potential IPO shows you that you don’t necessarily need dairy milk to become big and strong.

The move itself shouldn't really come as a surprise as plant-based food has been the talk of the town in the food industry for some years now. Vegan burger maker, Beyond Meat's IPO in 2019 showed investors, that plant-based alternatives can also walk the talk.

Although retail sales of plant-based dairy alternatives are bigger than those of meat alternatives, the alternative dairy space somewhat lacked a flagship company. But following strong sales growth, Oatly seems to be moving into that position. For traditional dairy companies, it means the pressure to enter the plant-based market has increased while it also heightens the importance to ramp up their efforts to improve the sustainability of their dairy products.

Market for plant-based drinks bigger than plant-based meat

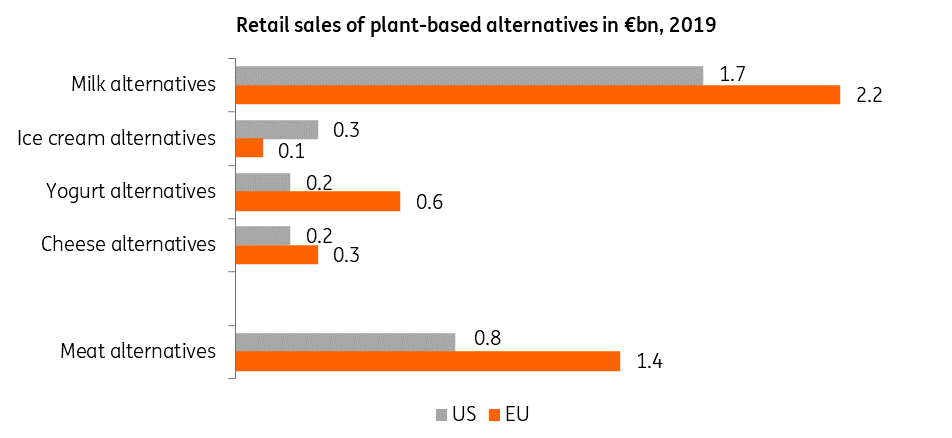

In recent years, sales of plant-based drinks have been growing at double-digit rates in both the US and Europe. Within the plant-based segment, milk alternatives stand out because they already represent a sizeable part of the overall milk market. The total share in retail value is estimated at 14% in the US and at 10% in the EU.

In comparison, meat substitutes and other dairy alternatives only have a market share of 1% or less. In the US, almond drinks are the most popular plant-based drinks while in the EU soy is the most popular. But oat-based drinks have gained ground rapidly too and have for example overtaken soy as the second most popular dairy alternative in the US.

Milk alternatives are the biggest plant-based category in US and the EU

Dairy alternatives can become five billion market in EU in 2025

We have shown earlier the growth potential of plant-based dairy and meat products. Still, the main challenge for plant-based producers is to bring down the price gap compared to meat and dairy products, improve aspects like taste and texture and increase availability.

The main challenge for plant-based producers is to bring down the price gap in comparison to meat and dairy products, improve aspects like taste and texture and increase availability

Many consumers in the US and the EU haven’t purchased a plant-based beverage before. Household penetration for plant-based drinks in key markets in the EU ranges from 30 to 50%, which is still much lower than for milk, which is greater than 90%.

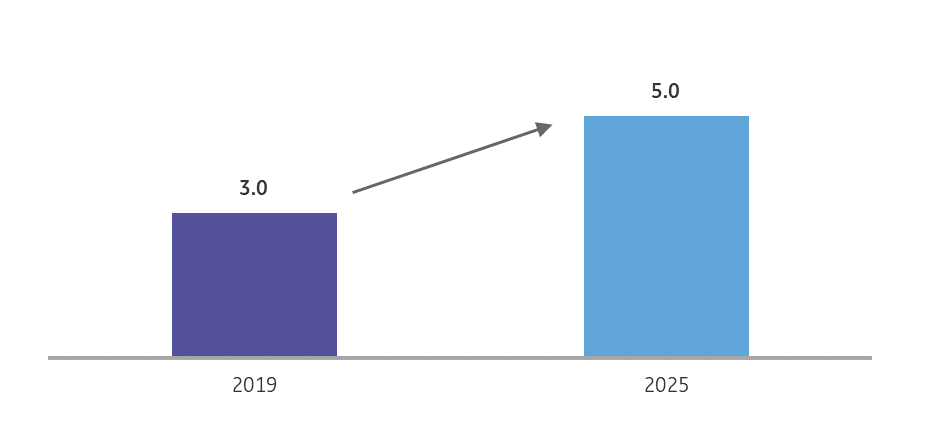

If these companies succeed, we expect the European market for dairy alternatives to develop from a 3 billion EUR market in 2019 into a 5 billion market in 2025. Both an increase in household penetration of plant-based drinks and the possibility to branch out to adjacent categories like spreads, yoghurt and ice cream are expected to support his growth.

Sales of dairy alternatives in EU + UK forecasted to rise to 5 billion in 2025

(value of retail sales in EU and UK, in €bn)

Many dairy companies haven’t embraced plant-based alternatives.. yet

While start-ups like Oatly and fast-moving consumer goods companies like the French dairy giant Danone were building the dairy alternatives category, many dairy companies followed a wait-and-see approach. Although milk consumption in the US and EU is declining, they still experience growth in dairy products like cheese and yoghurt and exports to developing markets.

Many dairy companies in Europe have only begun trialling plant-based products over the last two years and only in some of their markets. Still if they were to enter the plant-based space on a more structural basis they do have the opportunity to build on existing knowledge of consumer preferences and can benefit from existing supply chains and contracts with retailers.

Plant-based pressure is additional incentive for sustainability efforts in dairy sector

The decrease in milk consumption and the growth of plant-based milk alternatives show that the era of milk as an undisputed staple food lies behind us, at least in Western markets.

On many occasions, plant-based competitors position themselves as a more sustainable alternative given the lower CO2 emissions per glass. The impact from these plant-based competitors also goes beyond their own operations as they provide dairy companies with an extra incentive to increase their efforts to improve the sustainability aspects of their products.

Download

Download article

26 February 2021

Advanced warning of the bond sell-off spooking investors This bundle contains 7 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more