Oil market set to continue tightening over 2021

While there is still plenty of uncertainty over 2021 due to Covid-19, the roll out of vaccines and continued supply cuts from OPEC+ mean that the market should continue to tighten over the course of the year, which suggests further upside for oil prices

OPEC+ to continue with cuts

2020 was a year which saw OPEC+ having to take extraordinary action in order to try stabilising the oil market. The unprecedented fall in oil demand last year, and in particular over 2Q20, left the market drowning in supply. Covid-19 meant that OPEC+ members had to put aside their differences in April, and agree on historic record production cuts. The group agreed to cut by 9.7MMbbls/d over May and June, and this was eased as we moved through the year. Under the original deal the group was set to ease further starting in January 2021, reducing the level of cuts to 5.8MMbbls/d, which would then be in place until April 2022. However, with the demand recovery this year taking longer than initially expected, coupled with a surge in Libyan supply, the group has been forced to revisit this plan, given the risk that easing too much at the beginning of 2021 could push the market back into surplus.

Instead, OPEC+ will ease output less than originally planned. For January 2021, the group eased cuts by 500Mbbls/d, leaving the level of cuts at 7.2MMbbls/d. From there, OPEC+ will assess the market on a monthly basis and decide whether to ease further. Under the revised deal, the group will ease by a maximum of 500Mbbls/d per month.

This approach does create more uncertainty around what OPEC+ may decide every month, and so the potential for increased volatility in the first few months of 2021. We have already witnessed this during the first week, with Saudi Arabia announcing that it would make additional voluntary cuts of 1MMbbls/d over February and March, following the last OPEC+ meeting.

We believe that the changes the group made to the deal will be enough to ensure that the market does not return to surplus in 1Q21 while for the remainder of the year, we would expect the market to continue drawing down stocks. Clearly, much will depend on how Covid-19 develops over the course of this year.

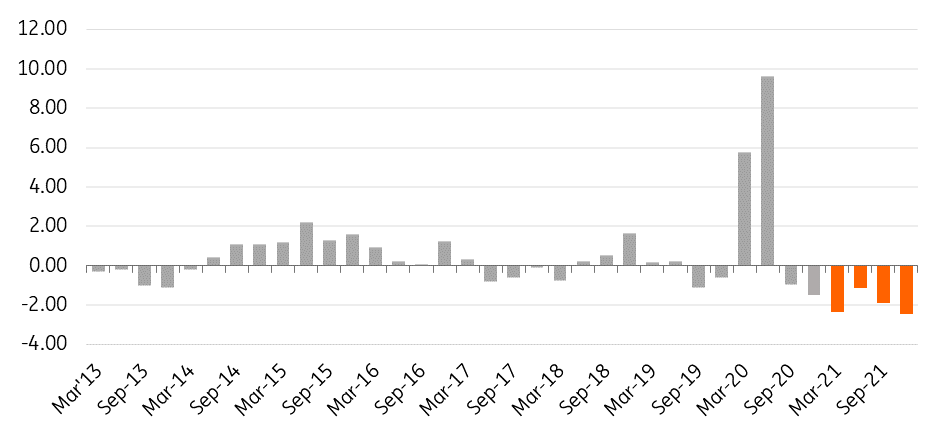

Quarterly oil balance (MMbbls/d)

Limited non-OPEC supply growth

OPEC+ was not the only one to respond to the weaker price environment that we saw in 2020. Non-OPEC+ producers were also quick to shut in production in 1H20 due to the build up in stock, and the weak price environment. At its peak over May, we saw somewhere in the region of 2.7MMbbls/d of non-OPEC+ production shut, with the US standing out, having shut in a little over 1MMbbls/d of production in May.

However, what has been even more surprising is that with the fairly quick recovery in oil prices from the April lows, producers have been quick to bring back this shut-in production. The US has basically brought back all shut-in production, while Norway seems to be the only meaningful producer to have still shut-in production, although that is due to mandated production cuts put in place earlier in 2020.

We saw a large decline in non-OPEC supply over 2020 and this year growth is expected to be limited, with less than a 500Mbbls/d increase year-on-year, which still leaves non-OPEC supply in 2021 well below 2019 levels.

In the US, while we have seen a pick-up in rig activity in recent months, it is still well below pre-Covid-19 levels, with the number of active rigs in the US standing at 267, down around 61% since mid-March. Therefore, it is difficult to see the US returning to growth anytime soon. We would need to see a further pick up in prices before producers are willing to increase spending, and as a result, a significant pick up in drilling activity. Producers will likely rely on drilled but uncompleted wells (DUCs) in order to try to sustain production levels, although these DUCs have only been declining at a fairly modest pace in recent months. For 2021, US production is expected to fall by a further 300Mbbls/d YoY to leave output averaging 11.1MMbbls/d. This compares to an estimated 850Mbbls/d YoY decline in 2020.

Demand uncertainty

The biggest uncertainty and risk for the market remains the demand outlook. While recent vaccine developments are positive for the demand outlook in the medium term, there are still plenty of uncertainties over demand in the short term, with it likely to take some time before a vaccine becomes widely available, allowing us to all return to a more normal life. Before that comes, there are risks of further Covid-19 waves and lockdowns, and international air travel is likely to remain very limited until governments feel comfortable easing border restrictions and quarantine requirements. Assuming that we see an effective vaccine becoming widely available from spring into summer, we believe that we will see a robust demand recovery over the second part of 2021.

However, we are still unlikely to return to pre-Covid-19 levels in 2021. We are currently assuming that demand will grow by around 6.7MMbbls/d this year, after having fallen by around 10MMbbls/d in 2020. It appears we will have to wait until at least 2022 to reach pre-Covid-19 demand levels once again.

Iranian supply risk

While demand is a big uncertainty for the market, another key downside risk for the market is Iran. Following the outcome of the US election, it is looking more likely that the US will return to the Iranian nuclear deal, and with that the potential for the removal of sanctions. Such action could bring anywhere between 1.5-2MMbbls/d of supply back onto the market. However, the big unknown is around timing, as it's not clear how high Iran is on Biden’s priority list. If we were to see a fairly quick return of Iranian supply over 1H21, this could put some pressure on the market, with the market likely finding it difficult to absorb additional barrels. However, if we only see Iranian supply starting to come back in the latter part of next year, the market should be able to digest this oil more easily, given expectations of demand continuing to recover as we move through the year.

Stronger prices through the year

We expect that the oil market will draw down inventories throughout 2021, as demand continues to make a recovery. The key risk was around 1Q21, but OPEC+ have addressed this with its recently revised deal. We forecast that ICE Brent will average US$55/bbl over 2021 and likely end 2021 in the region of US$60/bbl. This view is dependent on a vaccine allowing demand to continue to recover, along with the OPEC+ deal holding through the whole of 2021.

ING oil forecasts

This article is part of our Energy Outlook 2021. You can read the full report here.

Download

Download article

15 January 2021

More power, flower This bundle contains 10 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more