Now walk the talk: Monitoring the ECB’s purchase programme

A concerted effort by the European Central Bank to talk rates down is clear. As this has had little impact on financial conditions, the focus now turns to action. Markets are watching ECB purchase volumes, but in the end, only the result will count and we'll see just how far the ECB is willing to go. Italian bonds could be the canary in the bond market coal mine

If talking doesn't help, action is needed

Thursday's speech by ECB chief economist Philip Lane cast aside any doubts that there is a concerted effort by the governing council to lean against the move higher in EUR rates. Keeping “favourable financing conditions” is the ECB’s main compass. Higher risk-free rates (overnight indexed swap rates) and sovereign yields, now also feeding into wider bond spreads, risk putting the ECB off course.

There is limited evidence of the ECB following up verbal intervention with action

Lane has explicitly stated that the central bank would use the flexibility of the pandemic emergency purchase programme (PEPP) to prevent any undue tightening of financial conditions. As of now, there has been limited evidence that the ECB is following up verbal intervention with action.

ECB has already increased weekly volumes somewhat, but with little effect

What to watch: PEPP volumes, duration and capital key deviations

The ECB presents more detailed data for its asset purchase programme at the end of each month. But since the pandemic, the PEPP is the most important one in terms of volumes and impact. Here, we get a detailed set of data only every other month. Unfortunately, the next set will only be available in April.

So we are left in the dark as to whether the ECB geared the parameters other than the volume of its most effective tool towards reining in bond yields and spreads as it did very effectively in the first phase of the pandemic. The volumes aside, we could eventually see, for instance, whether the ECB chooses to purchase further out in the maturity spectrum or relatively more in the periphery bond markets, thus again deviating more strongly from the ECB’s guiding capital subscription key after a recent period of normalisation.

We are left in the dark as to whether the ECB geared the parameters other than the volume of its most effective tool

All we can do for now, though, is look at the headline weekly and monthly volumes. And even they come with a lag. The ECB’s weekly data reports settled trades. So a figure released on Monday for the portfolio size as of the previous Friday actually covers trades executed until the end of business on Wednesday.

On Monday the ECB will report its asset holdings again. Over the past two weeks, we have seen net PEPP buying of a bit more than €17bn each week, previously up from just above €13bn per week since January. That is already a 30% increase, which however has had little impact on the trajectory of rates so far.

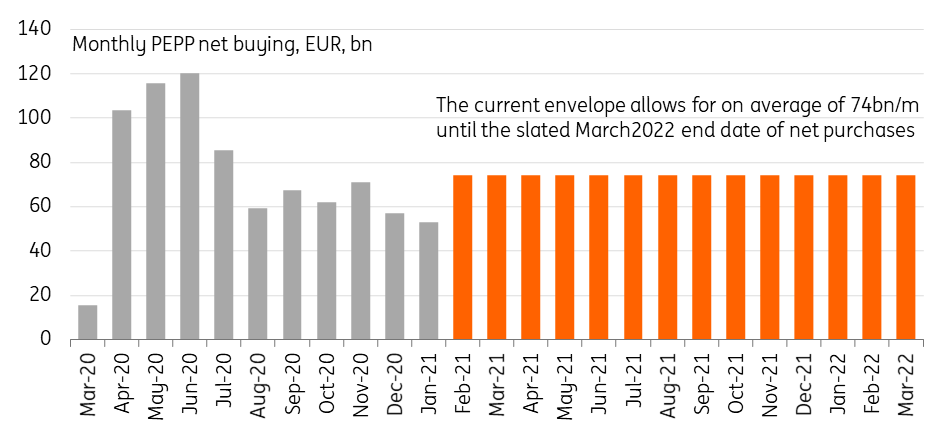

Ramping up PEPP purchases above €74bn/month implies less buying later under the current envelope

Bringing back the October spirit

The current pace would set the PEPP on track for a monthly net buying volume of roughly €70bn in February. That is well above the sub €60bn levels of December and January and similar to those of last November. Remember, that was the effect of Joe Biden winning the US elections which put upward pressure on yields, and an emerging second virus wave in Europe putting widening pressure on bond spreads in the eurozone. And the ECB had just pledged to “recalibrate” its monetary policy toolset at the end of October, sparking speculation about an expanded PEPP envelope and driving a wedge between US and eurozone rates. Markets appear to want more of that spirit right now.

The ECB will be judged by its impact on yields and not the purchase volumes

In the end, the ECB will be judged by its impact on yields and not the purchase volumes. If PEPP proves effective, the volumes will tell us more about the state of the market than the ECB itself. However, if yields rise nonetheless, the volumes will tell us how far the ECB is willing to go.

The amounts that will be spent will also influence any extrapolations on how far the remaining €1tn of the envelope will last. At the latest pace of just above €17bn per week, it would continue until the end of March 2022, which is also the currently stated end date of net purchases under PEPP. That means any increase in the pace now implies a slower pace at a later stage or exhaustion of the envelope ahead of the stated end date. A renewed discussion about the sufficiency of the current envelope could be the result.

Average EUR yields could be pushed higher by Italy without ECB intervention

The Italian canary in the bond market coal mine

We doubt that the recent bond market sell-off has shaken the deeply-rooted consensus that economic conditions in the eurozone do warrant low rates for longer. This is helpful. This means appetite to hedge against a USD-style rise in core EUR rates (core government bonds and swaps) will remain contained in our view.

There is still near-term upside for rates

Still, a number of large rates portfolios' hedging strategy is more formulaic and we suspect does require a non-negligible amount of swap paying, which means there is still near-term upside for rates.

We are more worried about the fate of carry trades in higher-beta fixed income. As with any investment, expected returns, carry here, is a function of the risk investors are taking. As a key measure of underlying risk, here rates' volatility, increases, so should the carry and thus the yield in their investments.

Higher volatility means carry trades, such as Italian bonds, become less attractive

Higher Italian yield potential could spur the ECB into action

Italian bonds are a case in point. This isn’t always true but, in periods of calm political developments in Italy, the correlation between rates' volatility and yields is high. As the largest sovereign bond market in Europe, and also as one of the most volatile, this would quickly push up the ECB’s favourite GDP-weighted average 10Y bond yield indicator. That's why, even if market participants agree that higher core rates are just a blip, the potential for higher Italian yields could be enough to spur the ECB into action.

Download

Download article

26 February 2021

Advanced warning of the bond sell-off spooking investors This bundle contains 7 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more