The Netherlands: sluggish growth in 2023

Dutch GDP is forecast to grow by a mediocre 0.4% in 2023 and a close-to-normal 1.4% in 2024. A short and mild recession is forecast to last until the first quarter of 2023, with GDP moderately picking up during the rest of 2023. Inflation has peaked but remains high, as core inflation is still on the rise. Fiscal expansion is the main driver of growth

2022 closed with another contraction, despite robust private consumption

While inflation in the Netherlands was among the highest of its peer economies in the eurozone, Dutch domestic private consumption held up surprisingly well, even going into the fourth quarter of 2022. Although not buoyant, retail sales and domestic consumption volumes have been showing stability or even some growth. Large amounts of savings (accumulated during lockdowns, particularly in the upper half of the wealth distribution), the €190 payout households received via their energy bill in November and December, accelerating wage increases, continuing low unemployment, and the certainty provided by the energy price ceiling for 2023 seem to contribute to robustness in consumer spending at the end of 2022, despite an environment of higher core inflation and low measured consumer confidence. As such, household consumption is forecast to have continued to grow in the fourth quarter of last year.

As the outlook for net trade and investment has worsened with tougher financing conditions and high input cost inflation throughout Europe, Dutch GDP is nevertheless likely to continue to contract in 4Q22. Despite contractions in the last two quarters of 2022, the annual growth figure of 4.3% for that year represents a strong expansion. This stems from the strong rebound out of lockdown in the first half of the year.

2023 starts worse before it gets better on the back of public spending

Government spending will be the main driver of GDP growth in 2023, while net trade and investment will be a drag on the GDP development, and private consumption is set to only expand negligibly.

Private consumption may start the year in the first quarter with a decline: as energy taxes and the VAT on energy were normalised, the €190 lump sum terminated, and the energy price ceiling was introduced as of 1 January 2023, energy costs net of taxes may de facto have risen for some households – depending on their energy consumption level and contract – and fallen for others. Still, consumer confidence is low. Falling house prices and a lower number of home sales will provide a lid on consumption growth and are a risk for weaker-than-expected consumption. As inflation will fall, private consumption is expected to expand (although sluggishly) for the year on average. It indirectly benefits – via the multiplier effect – from the increased execution of ambitious plans in the coalition agreement and is still directly supported via the energy crisis support measures and some structural policy changes.

Companies are increasingly signalling a downward pressure on profitability. This, the recession in the eurozone, and the prospect of a weakened global business cycle, makes it less attractive to invest, for instance in machinery. Higher financing costs due to interest rate increases also put a brake on investment. The development of building permits, due to insufficient capacity in municipalities and due to the nature of protection policies, indicates a decline in investment in construction work in 2023. This concerns housing and commercial premises and mobility infrastructure. In 2023 there is a risk that investment in buildings will fall for the first time since 2013. Both exports and investment will benefit however from backlogs in transport equipment. Due to previous major issues in global supply chains and the resulting delays in production and delivery, there are still many orders from 2022 that will be fulfilled this year. This is particularly true for passenger cars and to a lesser extent for heavy vehicles such as trucks and busses. Without this shift in time, the outlook for exports and investment would have been worse for 2023. For vans, the prospects are somewhat weaker, while ordered vessels may not be delivered until 2024.

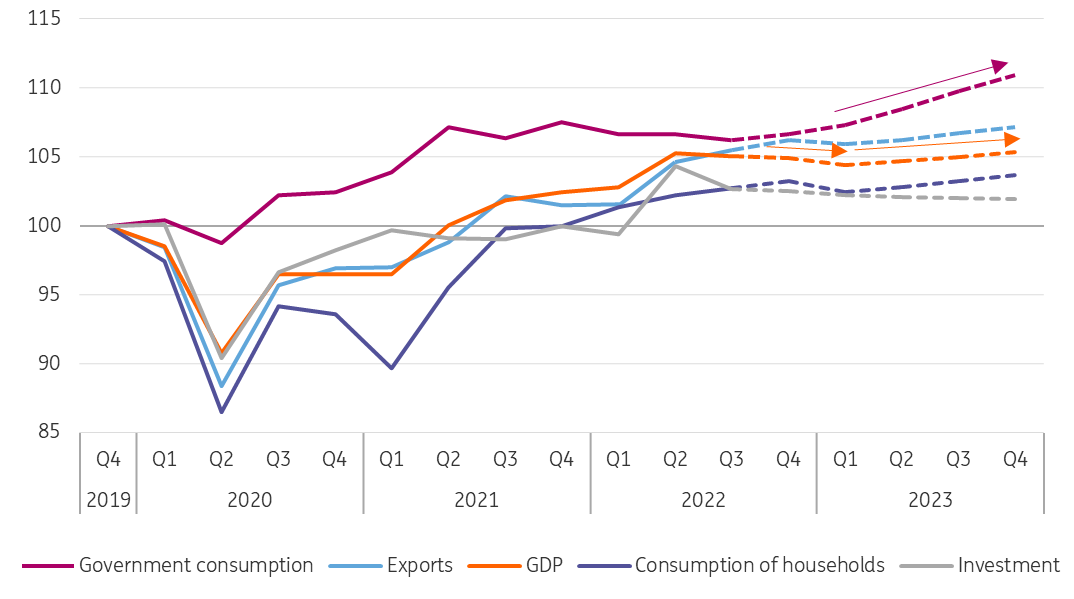

Mild GDP decline continues into 1Q23 as private expenditures weaken, but pick up in 2023 due to government spending

Expenditures* as index where 4Q2019 = 100

Higher financing costs for businesses resulting from higher market interest rates, generally lower profit margins and the challenge of paying back deferred taxes (accumulated during the pandemic) will also contribute to more business dynamics in 2023. This will facilitate a quicker movement of labour and capital from unproductive sectors and firms towards those with more growth potential, which could be beneficial for labour productivity. The number of bankruptcies has indeed recently started to increase recently but is still far below normal rates. A normalisation should coincide with higher unemployment. Yet, we forecast only a mild uptick in joblessness. As ING research shows, when European economies enter a recession with much strain in the labour market, the subsequent increase in unemployment is more limited. This can be explained by labour hoarding: solvent firms are unwilling to let go of their skilled personnel even during a downturn, trying to avoid hiring and training costs and the loss of firm-specific knowledge. Furthermore, while the market sector may have moved in a lower gear, (semi)public sectors will take over some of the employment.

Vast government spending means fiscal deficits. Inflation is keeping the debt burden limited, however. Although the budgetary process was messy lately, with the government not adhering to its own fiscal rules and seems to have more easily led to uncovered additional spending, the ability of the Dutch government to finance its debt is not a serious concern for now: the public debt-to-GDP ratio is still low by international standards.

Inflation is past the peak, but remains high

HICP headline inflation reached its peak in September 2022, but at a forecast of 4.5%, it's set to remain quite high in 2023. As gas prices have come down in wholesale markets and the energy price ceiling was introduced in early 2023, energy will contribute less (and in some months negatively) to inflation. Selling price expectations of non-financial businesses remain very high though. This suggests that core inflation might peak somewhere later in 2023. Earlier peaks in purchasing prices of inputs like raw materials, transportation, and energy will still be passed onto consumers, while higher labour costs will also continue to drive inflation up. The reversal of the following temporary policies will also contribute to rising prices for consumers in 2023:

- The energy tax (on gas and electricity) was temporarily lowered for 2022. This will be normalised in 2023.

- The VAT rate on energy was temporarily lowered from 21% to 9% for July-December 2022. This will be normalised in 2023.

- The excise duty on fuel (gasoline and diesel) was lowered temporarily to 21% for April-December 2022. This will be normalised in 2023.

- College tuition fees halved during the Covid-19 pandemic period and normalised in September 2022. This will drive 2023 inflation upward (+0.25% points).

- Covid-inspired regulation kept a lid on the increase of rents in both the social housing sector and the liberalised sector, at least until policy changes as of 1 July 2022 and 1 January 2023. Normalisation and reforms of the policies might on average be more inflationary for 2023, although there are also some lower-income households for which the reform is beneficial (as more will be income tested).

- The excise tax on a pack of cigarettes will be increased in two substantial steps, to €10. The first step in April 2023 is estimated to have a nonnegligible effect on the HICP inflation rate of +0.6% points in 2023.

Inflation past peak but still high

Change in harmonised index of consumer prices for the Netherlands year-on-year in % and contributions in %-points

The expiration of the energy price cap at the start of 2024 will result in higher inflation that year. Combined with some remaining pressure in core inflation, headline inflation might still be close to 4% in 2024.

The Dutch economy in a nutshell (%YoY)

Download

Download article

19 January 2023

Eurozone Quarterly: Better is not good enough This bundle contains 10 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more