More people will benefit from 5G connection in 2024 but speed improvements vary

5G already covers densely populated areas, however, a lot of effort is required to add network capacity and to optimise the use of frequencies. Therefore, speed improvements currently vary widely

Strong growth of 5G subscriptions expected to continue in 2024

The rollout of the 5G network and the availability of (affordable) handsets has seen 5G services take off. In its 2023 mobility report, Ericsson estimates that at the end of last year, 20% of all mobile subscriptions globally were a 5G subscription, this amounts to 1.6 billion global 5G subscriptions. So, 5G subscriptions showed strong growth in 2023; roughly 600 million new subscriptions were added, a year-on-year growth rate of 63%. Ericsson also estimates that in 2029, more than five billion people will be connected to 5G networks, and 85% of the global population will have coverage access by then.

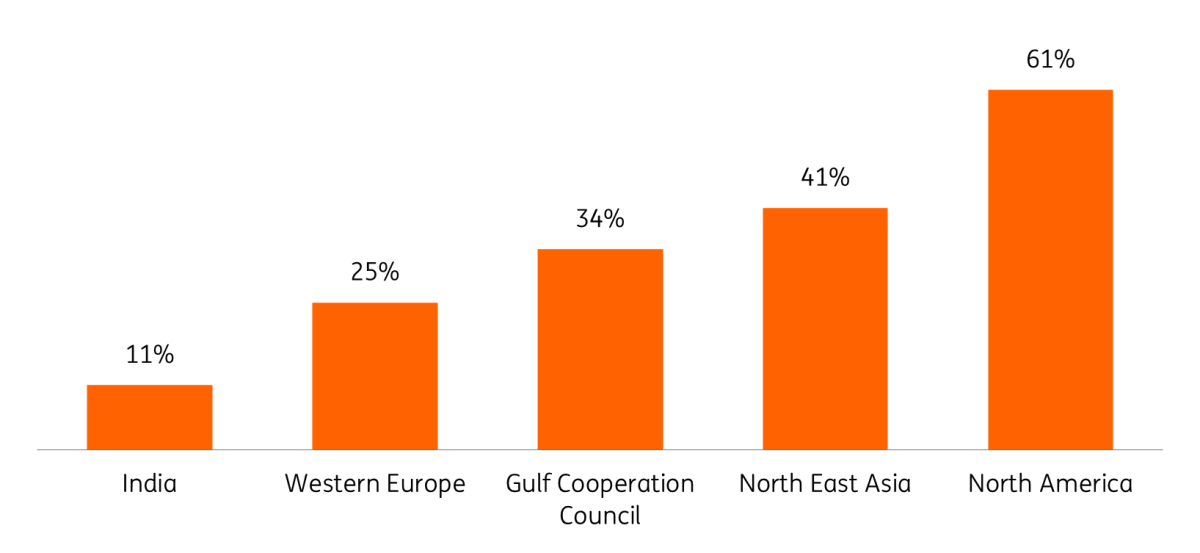

Meeting the estimated number and coverage rates of 5G connections in 2029 would require a 22% compound annual growth rate in the next six years. This, in turn, requires higher penetration rates across the globe. Currently, North America has the highest penetration rate, followed by North East Asia, the Gulf Cooperation Council, and Western Europe. Higher penetration rates hinge on affordable smartphones, such as the Samsung Galaxy A14 and Motorola Moto G Stylus 5G that sell for under €200, meaning that fast 5G connections are available to an increasing number of people.

5G penetration rates by region

Regions below 10% are excluded

5G speeds and speed improvements vary across Europe

Despite increasing 5G adoption, average download speeds and speed improvements vary widely across Europe. There are several reasons why speeds vary across regions. In densely populated areas, public networks that deal with a lot of traffic can have connectivity issues as towers have limited capacity to manage requests from many devices at once. In addition, proximity to a 5G tower and the surrounding environment/interference matters for speed. Moreover, the hardware used matters, as well as the speeds that the network is capable of. Lastly, in several countries, spectrum clearing and auctioning, as well as equipment deployment need more time and effort to improve.

Taken together, these factors explain why speeds and speed improvement from 4G to 5G across countries diverge. Spain, for instance, saw speeds improve almost six times, whereas speed in the Netherlands has only increased 1.8-fold. Furthermore, Bulgaria, Sweden, Denmark and Norway top the list for the highest average download speeds in Europe, while the Netherlands, UK, Italy, Czechia and Poland lag behind.

Download speeds

Speeds per network operator also vary

Speeds also differ depending on the network operator, and market leaders tend to offer the fastest connections. In Norway, market leader Telenor offers an average download speed that is roughly 30% faster and an upload speed that is about 12% faster than the second-fastest network (Telia).

In the Netherlands, the picture is very similar. Market leader KPN has download speeds that are 20% faster than the number two (T-Mobile) and 70% faster than those of Vodafone. Upload speeds also differ: KPN is nearly 10% faster than T-Mobile and almost twice as fast as Vodafone.

Conversely, the fastest operator in the UK (Three) is not the market leader. Yet, it offers download speeds that are more than three times faster than the slowest operator (O2), and upload speeds that are roughly 60% higher than those of O2.

In short, 5G differs per region and city. Telecom operators with a large market share and/or provide the fastest speeds have opportunities to monetise these advantages. In addition, market leaders may be able to offer new services such as applications that require low latency like livestreaming or high-frequency trading.

For 2024, we expect that the rollout of 5G standalone will gain traction while we see more trials with private networks based on 5G technology. Companies like Telia in Finland have completed a 5G standalone network, which means that they operate with a modern cellular infrastructure based on 5G radio technology, but also based on a 5G core network. This will improve the operating efficiency of the mobile network and unlock further services such as private networks. Companies such as Verizon and Deutsche Telekom have offered, in trials, private wireless networks to customers which are based on a new 5G technology, network slicing. The broader 5G technologies will therefore gain further traction in 2024 also because more spectrum will become available and the user experience will be enhanced further as a result.

Download

Download article

1 February 2024

Telecoms Outlook 2024: Stepping into the future This bundle contains 8 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more