I wanna dance with somebody

Might the ECB be left dancing in the dark should it start a rate-cutting cycle long before anything the US does? It’s a possibility and not necessarily a bad thing

Why Europe’s dancing to a different tune

ING's Carsten Brzeski on the two key words dominating the global economic discussion: optimism and divergence

Everyone's talking about divergence

Do you remember that viral video 'Leadership Lessons from Dancing Guy” from years ago? Watch it here if you like. It shows a solitary guy who starts busting some moves at a festival. Slowly but surely, he's joined by more until everyone on the hill is on their feet. I thought about it again recently when pondering the lessons for global central banks. Could the ECB really be that dude... the first adopter who eventually starts an entire movement? I am, of course, talking about interest rate cuts.

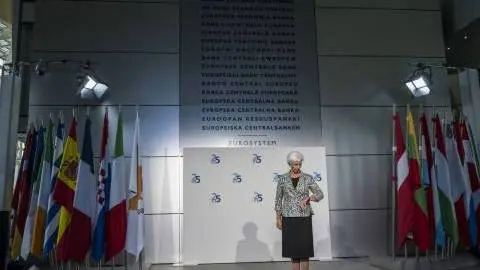

The answer to that is, of course, yes. The European Central Bank is a fully independent institution, and there's no secret agreement between central bankers about who'll be first on the dance floor. And, let's face it, Europe's got its elections before the US chooses between Trump and Biden. And right now, the Eurovision Song Contest is in full s(w)ing... and the US doesn't have that at all, for good or ill.

That said, reality has been somewhat different over the past 25 years. Since the start of the European Monetary Union, ECB monetary policy has broadly followed that of the Fed, albeit with different time lags and with the exception of the years following the euro crisis. On the rare occasions it hasn't, it's later been seen as a misstep. Think of the rate cuts in 1999, when the Fed had already started hiking. Or the even more infamous rate hike in 2008 to prevent feared second-round effects from higher German wages; the Fed was already fighting the financial crisis with aggressive rate cuts. And then there was 2011, when the ECB under president Jean-Claude Trichet, hiked rates, assuming the euro crisis was over, while the Fed kept theirs at record lows to support the economy.

Six months later, the new ECB president, Mario Draghi, had to undo it all and started cutting as the eurozone economy was mired in recession.

Dancing in the dark

Sure, the eurozone has been hit much harder by supply chain frictions, the war in Ukraine, and an energy crisis in recent years, and it has seen less fiscal stimulus than the US. While the American economy has enjoyed strong growth, here in the eurozone, we've been flirting with stagnation and even recession. This is the growth story. And the inflation story's not so different.

Energy prices and transportation costs have come down, while both the US and the eurozone are experiencing strong labour markets and worker shortages. It is exactly these strong markets which seem to be fuelling the risk of reflation. In fact, let’s not forget that traditionally, there has always been a trigger for starting a central bank’s cutting cycle: a recession and/or a severe crisis.

That has yet to happen in both the US and the eurozone. The Fed started hiking rates in March 2022, with the ECB following in July the same year. The last Fed hike was in July last year, and the ECB stopped in September.

So when the ECB almost certainly cuts rates in June, with the Fed most likely waiting until September, it'd be the first time since the start of the monetary union that the ECB would be in the lead. There's nothing wrong with that, of course. But given that US inflation has also led eurozone inflation over the past few years, the Europeans would be well-advised not to categorically reject tentative signs of reflation across the pond. It's not about copying the US but rather understanding the inflation mechanisms over there, even those they've developed quite similarly over the past few years.

There's a high risk this similarity is not yet over. In the video I mentioned at the start, the clue is that the dancing guy needs a first follower to create a movement. It's never about the first mover... it's always about the first follower. The ECB will be hoping that its first dance partner will indeed be the Fed as inflation turns out to be less sticky than currently feared. If not, the risk is high the ECB will be all alone, dancing in the dark.

Download

Download article

9 May 2024

ING Monthly: I wanna dance with somebody This bundle contains 14 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more