Metals: Bumpy road in search for the bottom

Metals will be seeking to rebalance after the shocks from both the supply and demand-side. They are likely to be on a bumpy road while searching for the bottom over 2Q20 provided that the Covid-19 outbreak in the world follow a similar pattern to the outbreak in China. However, things are likely to get worse before they get better

China returns to normality?

China's March manufacturing PMI reading surprised the market with a V turn, but perhaps it just telling us that things are not as dreadful as they were in February as Beijing took the draconian approach to combat Covid-19. Some positive signs have begun to emerge from China's metals market including tightened nearby spreads across the Shanghai Futures Exchange (ShFE) base metals and inventory drawdown. But what is behind the repricing in ShFE that caused the nearby contracts into a backwardation?

There has been some anticipation of a tax cut to be introduced in 1H20, which began with a rumour that Beijing will restart its Two sessions on 18 April as policies are usually introduced and passed at the conference.

Many measures have been brought forward to stimulate the economy during this pandemic such as rate cuts and fiscal stimulus, but now the market is looking for a VAT tax cut.

Given that, ShFE prices are tax inclusive currently at 13% VAT, last week the nearby contract (cu 2004) had begun to price in a premium at the highest of RMB200/t over the cu 2005 contract. Meanwhile, there has been a similar move across other base metals in Shanghai.

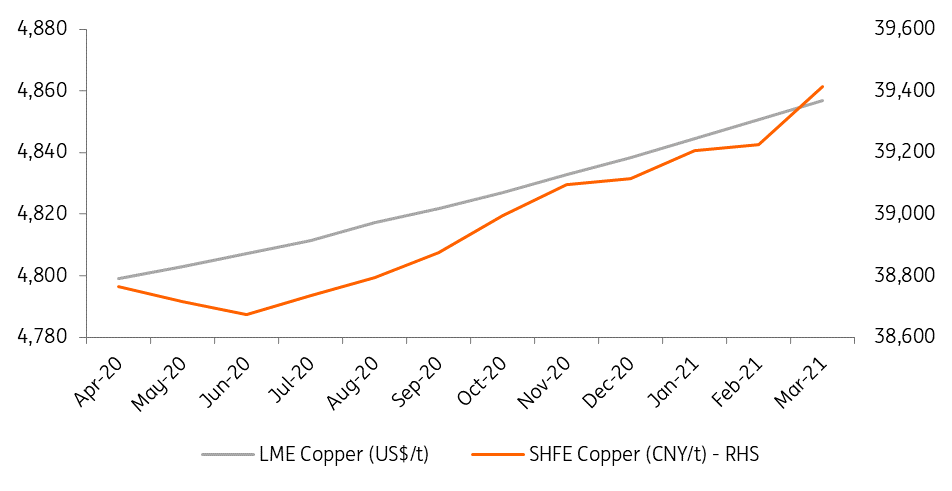

Fig.1 ShFE front-month contract in backwardation

Bloomberg, ING (as of March 30th )

Inventories peaked?

Inventory building in the Chinese market has levelled off and some metals have shown a small decline which provides some sense of relief. This coincides with their traditional seasonal pattern where inventories tend to climb ahead of the Chinese New Year and decline around March at downstream ramp up. While this year a slight delay seems not too bad, but could a recovery at this time compare to the dead first half of February?

There are two aspects to understanding the inventory pattern. Firstly, the exodus of inventory by smelters to ship metals to warehouses have now returned to normality. The second is as China gradually removes lockdowns and people are able to move within the country, business is slowly ramping up at physical trading houses and downstream fabricators and end-users. This could see some metal inventories to decline due to the physical stock replenish.

However, it the extent of all of this is questionable. Export market slump impacts may have just started to negative feedback into the demand. Anecdotal reports showed that zinc alloys and galvanised products have already started to report orders being cancelled. Given more countries have started lockdowns since mid-March, most of the export market problems will only become apparent in April.

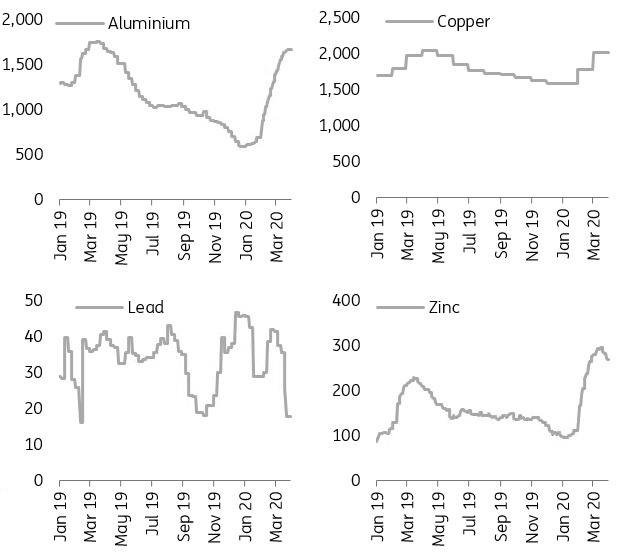

Fig. 2 Some metals inventories in China have started to turn

Bloomberg, ING

Increasing supply risks

As more countries are enforcing lockdowns, some miners and refined metal producers have announced to temporality suspend operations.

Mine disruptions keep climbing in major mining countries including those from Americas and China. The spot treatment charges (TCs) have started to decline primarily on the expectation of shipment disruptions to come. Both copper and zinc TCs in the import concentrate market have decreased. Meanwhile, low prices saw an increased risk of price-related cuts from smelters. By the end of March, around half of Chinese aluminium smelters are in cash negative and small cutbacks (or in bringing forward maintenance) have begun to emerge. Others had struggled raw materials such as waste lead-acid battery as major feeding to secondary lead producers. The secondary lead production is approximately 45% of total lead production in China. Meanwhile, with some major lead-zinc polymetallic mines announced suspensions and wider lockdowns, the risk is also rising from mine supply which they may face with concentrate shipment disruptions.

If we assume a turning tide in the number of cases in late April and early May and lockdowns gradually removed thereafter, base metals demand could fall by an average of 5.5% YoY in 2020. Based on assessing potential production loss from already announced production disruptions, they have yet to offset the demand loss over the period which an average 25% drop in average demand over 1Q20. As a result, there are swelled surplus built in the market and could continue to grow if lockdowns to prolong.

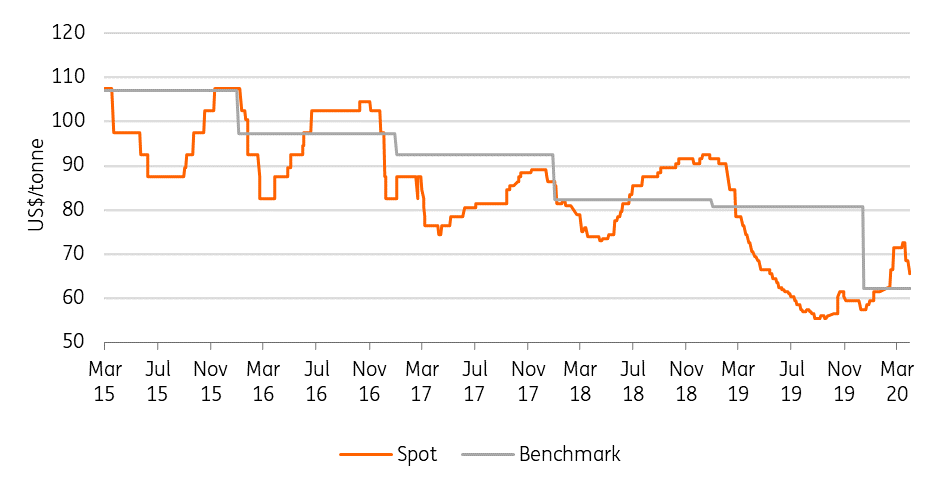

Fig. 3 Spot TCs have declined

Bloomberg, ING

A bumpy road in search of the bottom

Things are likely to get worse before they get better, and the same applies to the industrials metals market.

As for copper, the pessimism saw even the long-dated contracts shift lower along the curve. Some have more drastic moves towards the front end such as lead, the historical steep backwardation saw during last month has eased and contango. Back in mid-March, when things were not as bad as what they are looking today and we were still able to work in offices, the market hadn't been price in what could coming later at that time copper was holding around US$5,300/tonne before it crashed to US$4,371/tonne on 19 March - the lowest since 2016.

We are still not out of woods. In the extreme case, copper might go even lower from what we have just seen two weeks ago. The main risk to the upside is on the supply side at major mine producing countries disruptions. Covid-19 is still the main uncertainty, with some medical experts now predicting a second wave in China around October this year. That could result in another round of lockdowns, however, will the situation be less extreme as what we have seen during the first outbreak? Unfortunately, there is no easy answer to this.

We have cut our 2Q20 copper forecast significantly to an average of US$4,680/tonne and expect gradual recovery mostly during 2H to see full-year price average at US$5,030/tonne.

Download

Download article3 April 2020

In case you missed it: Undone by a pandemic This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).