Our 3 calls for central banks

Global central banks are facing unprecedented challenges. Here's our focus on the main ones

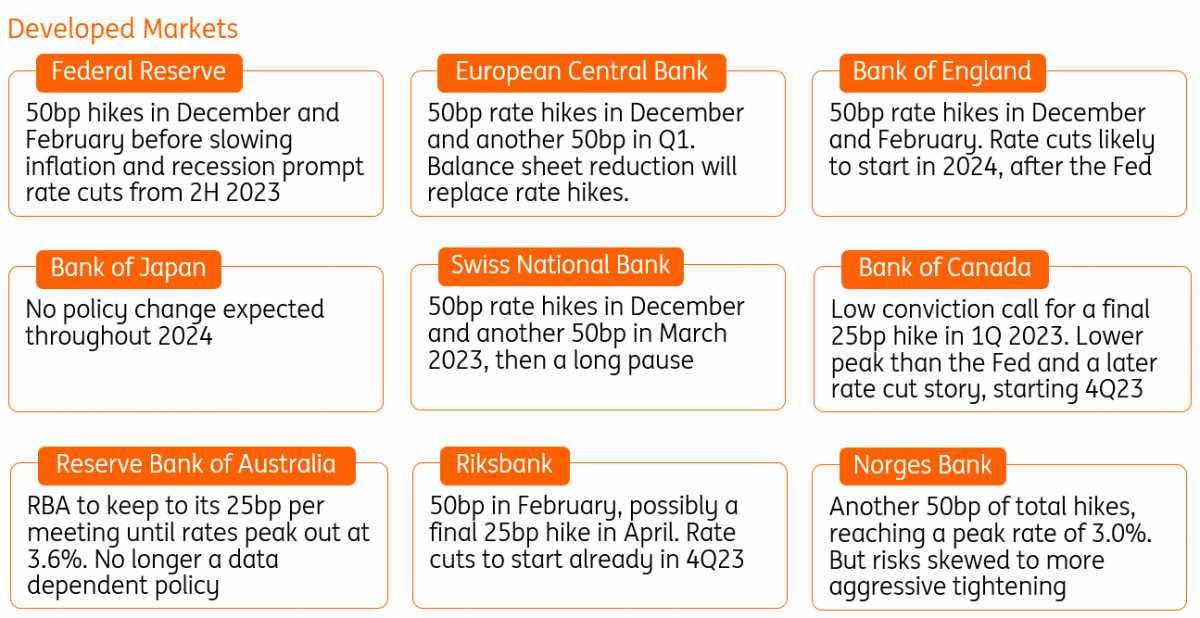

Developed markets: Our calls at a glance

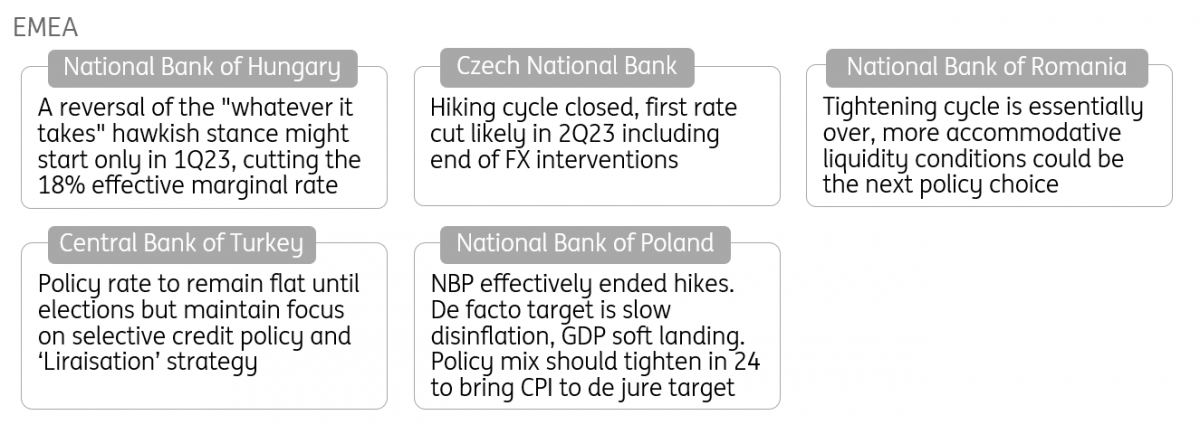

Central and Eastern Europe/EMEA: Our calls at a glance

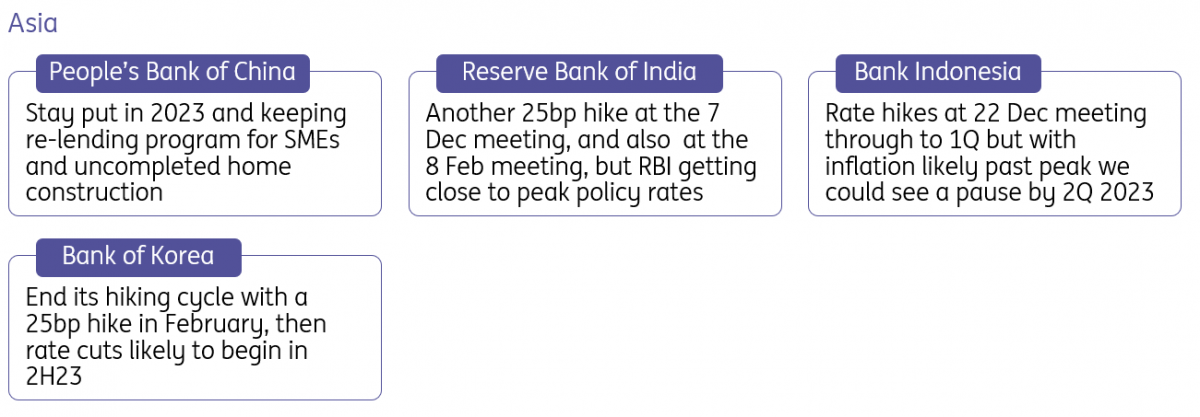

Asia (ex Japan): Our calls at a glance

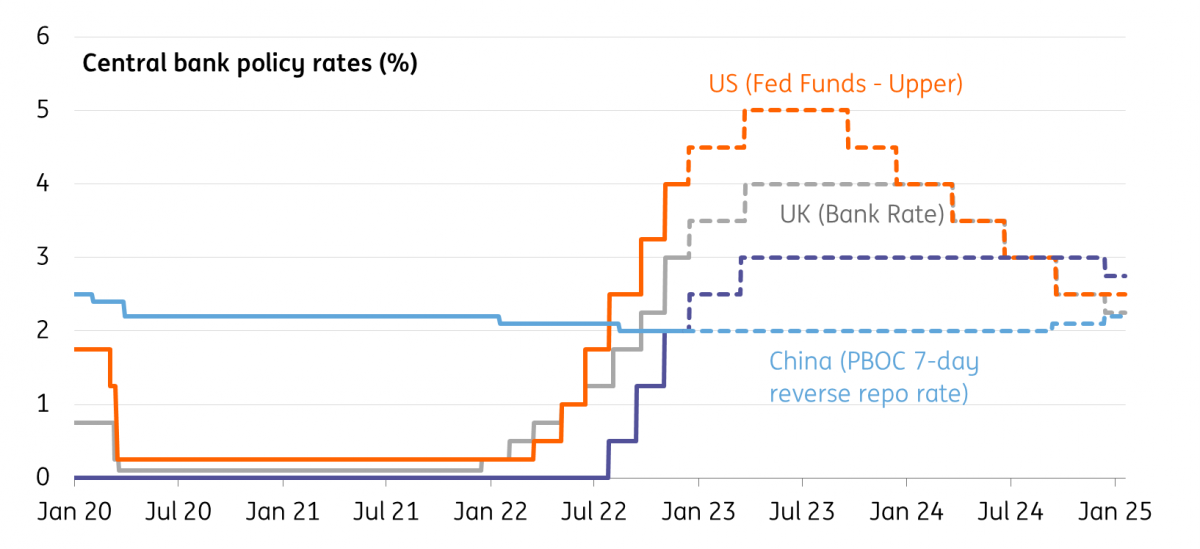

Central banks: Our forecasts

Federal Reserve

After 375bp of rate hikes since March, including four consecutive 75bp moves, the Federal Reserve has concluded that it is now time to move in smaller increments. Nonetheless, the market doubts the Fed’s intent and the recent falls in Treasury yields and the dollar are undermining the central bank's efforts to defeat inflation. Officials have been trying to convince the market that the ultimate/terminal interest rate will be above where they had signalled in September, but this is falling on deaf ears. The market is focused on soft inflation readings, coupled with a sense that recession is around the corner. While we agree that the second half of 2023 will be about rate cuts, we think there is the risk of a more aggressive response to inflation in the near term, with upside potential to our call for 50bp rate hikes in December and February. We could even see the Fed consider a faster run down of its balance sheet in an effort to re-steepen the Treasury yield curve at a higher level.

European Central Bank

Eurozone inflation is close to its peak, unless energy prices surge again next year, but the road towards the ECB’s 2% target will be long and bumpy. The pass-through of wholesale gas prices, as well as still high selling price expectations, suggest that there is still inflationary pressure in the pipeline. It could take until 2024 before inflation has returned to 2%. For the ECB, this means that its job is not done, yet. At the same time, the looming recession, the risk of a subdued recovery and increasing government debt bring the ECB closer to the point at which rate hikes become overly restrictive. As a consequence, we expect the ECB to bring the deposit rate to a maximum of 2.5% in the first quarter of 2023. The reduction of the balance sheet, a.k.a reducing the ECB’s bond portfolio, could become the ECB’s main policy instrument to fight inflation.

Bank of England

The Bank of England may have hiked by 75bp in November but it made it abundantly clear that this was likely to be a one-off, and that investors were overestimating future tightening. Admittedly, recent data has been slightly hawkish, and the committee is alive to the risk that services/wage inflation may only fall gradually despite the forthcoming recession. But the Chancellor’s Autumn Budget probably did just about enough to assuage the BoE's concerns about fiscal and monetary policy working at cross purposes. While much of the fiscal pain was delayed to future years, the government still scaled back energy support for households next year. We expect 50bp rate hikes in both December and February, marking a peak Bank Rate of 4%. With labour shortages unlikely to disappear next year, and wage growth therefore likely to stay more elevated than in past recessions, we suspect the BoE’s first rate cut may not come until 2024, and after the Federal Reserve.

People's Bank of China

The PBoC cut the reserve requirement ratio (RRR) by 0.25 percentage points, effective in December, following a cut in April. There were also two 10bp cuts in the 7D reverse repo policy rate and 1Y Medium Lending Facility (MLF) rate back in January and August this year. The loosening of monetary policy has been mild relative to the slow rate of growth, which averaged 3.0% over the first three quarters of 2022. We believe that Covid measures are more likely to ease in 2023. But external demand could be weaker compared to 2022. Overall, growth in the domestic market should outpace the potential contraction of exports. Still, inflation should be absent in China. As such, the PBoC may choose to stay on hold next year as the central bank has hesitated to lower the 7D interest rate to near the 1% level to avoid falling into a liquidity trap. We do not expect the PBoC to cut the RRR or interest rates in 2023. That said, the re-lending programme for specific targets, e.g. SMEs and unfinished home projects, should continue at least in the first half of 2023.

Download

Download article

8 December 2022

ING’s Economic Outlook 2023: ‘May he live in interesting times’ This bundle contains 21 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more