Macro headwinds to keep pressure on copper prices

Copper has lost all of the gains it made this year as inflation has climbed higher, interest rates have risen, and energy costs keep surging. The short-term demand outlook for the red metal remains weak amid recession fears, China's slowdown and weakening global manufacturing activity

Copper fails to hold onto gains

LME prices are now down around 30% from their peak in February following Russia’s invasion of Ukraine when the three-month LME copper price reached $10,580/t. Despite copper’s fundamentals looking supportive, the red metal has failed to hold onto its gains, as global slowdown fears remain elevated.

China remains the big question mark

Covid-19 lockdowns in an already-slowing Chinese economy have continued to dampen the demand outlook for the red metal with the country’s property sector remaining a big question mark for the copper market looking ahead. For almost two decades, China’s property sector growth and the country’s rapid urbanisation have been the key driver of growth for copper demand, which represents almost a quarter of the nation’s total demand.

The country’s GDP grew 3.9% year-on-year in the third quarter of 2022, faster than the consensus forecast of 3.3% YoY and 0.4% YoY in the second quarter, but real estate contracted 4.2% YoY due to uncompleted projects that almost paused activities from land bidding to housing starts in the industry. However, more recently, hopes have grown that fresh stimulus measures will boost demand for the red metal after moves to shore up the country’s property sector and ease Covid restrictions.

China's relaxation of its Covid-related quarantine measures reduces the quarantine period for inbound travellers and the close contacts of those who test positive. In addition, secondary contacts will no longer need to be traced. The government also said it will bolster vaccinations among senior citizens, although it stopped short of issuing mandates to help raise inoculation rates.

However, while we are seeing these changes in policy, China is also experiencing its highest numbers of daily Covid cases since April. Beijing recently saw the country’s first Covid deaths in six months with the city tightening its restrictions. Guangzhou has locked down its largest district with cases continuing to soar. Reports of Covid protests in China will also likely prove harmful for general sentiment.

The latest easing in quarantine requirements is certainly a step in the right direction, but the market will likely need to see further easing if this enthusiasm is to be sustained.

China has also recently implemented 16 property measures to help the weak property sector. Some of these measures include debt extensions to the industry and relaxing deposit requirements for homebuyers. These could potentially boost the usage of industrial metals, including copper. Around 23% of China’s copper end-use comes from civil and building construction.

For now, the uncertainty surrounding Covid-19 restrictions in the country continues to take its toll on demand for the metal.

In October, imports of both metal and ore fell to their lowest in more than a year amid slowing factory activity. We believe consumption and imports of the red metal will remain muted until the end of the year with the property market and economy set to remain weak, while concerns over China’s economy will continue to put pressure on copper until the government eases the country’s Covid-19 restrictions further.

We believe the Chinese government is likely to stick to its zero-Covid policy through winter and will look at easing some of the curbs further after the National People’s Congress in March or April next year. Preferential policies on property developer financing could limit the further increase in uncompleted residential projects. We expect China to gradually improve but remain sluggish until 2H23 with its zero-Covid strategy likely to remain in place until then.

China's property woes weigh heavily on copper

Caught between weakening demand and shrinking supply

On the supply side, disruptions in South America continue to be in the spotlight for copper.

Chile's mined copper production, which accounts for about a quarter of world supply, slumped by 6% in 2022 through July, according to the most recent International Copper Study Group data, due to lacklustre ore grades, labour woes and water scarcity.

Last year, Chile’s production represented a 1.84% annual decrease from 5.73 million tonnes in 2020, and the lowest since 2017. The country’s ore quality has also been steadily declining. Average copper mining grades were 1.41% in 1999 but are now around 0.60%.

Codelco, the world’s biggest copper producer, has lowered its guidance for the year by 100,000 tonnes to about 1.5 million tonnes.

In Peru, protests by local communities in key mining areas have also continued this year. Most recently, Las Bambas copper mine in Peru, owned by Chinese miner MMG, which accounts for 2% of the global copper supply, has started to reduce operations due to recent blockades. In August, MMG lowered its forecast for annual copper production at Las Bambas to 240,000 tonnes.

Despite the high level of disruptions, mine production continued to grow strongly in the third quarter of this year. CRU is forecasting year-on-year global growth to reach 3.2% in 2022. The ramp-up of Ivanhoe Mines’ Kamoa-Kakula in the Democratic Republic of the Congo is partly responsible for the growth as well as Anglo American’s newly-commissioned Quellaveco mine in Peru, which started operating in July.

CRU is forecasting the copper market will move from an almost 200,000 tonne deficit into surplus over the next three years, as additional mine supply is expected to hit the market.

Meanwhile, Codelco has reported its customers are demanding longer-dated contracts because they are worried about future availability of the metal. Customers in Europe have reportedly signed three and five-year contracts rather than the usual one-year contract.

There was also a sharp increase in European benchmark cathode premiums for 2023. While high energy costs have been the key driver of the increase, the rise has been partially attributed to consumers avoiding Russian metal. Aurubis and Codelco reportedly raised cathode premiums to $228/t and $234/t, respectively, for next year, a substantial increase from $123/t and $128/t for 2022 contracts.

While in the short-term, macro headwinds and recession fears are likely to put downward pressure on the copper market, the long-term fundamentals are looking more supportive amid low visible stocks, supply disruptions and expectations of a China recovery.

Global exchange stocks at record lows

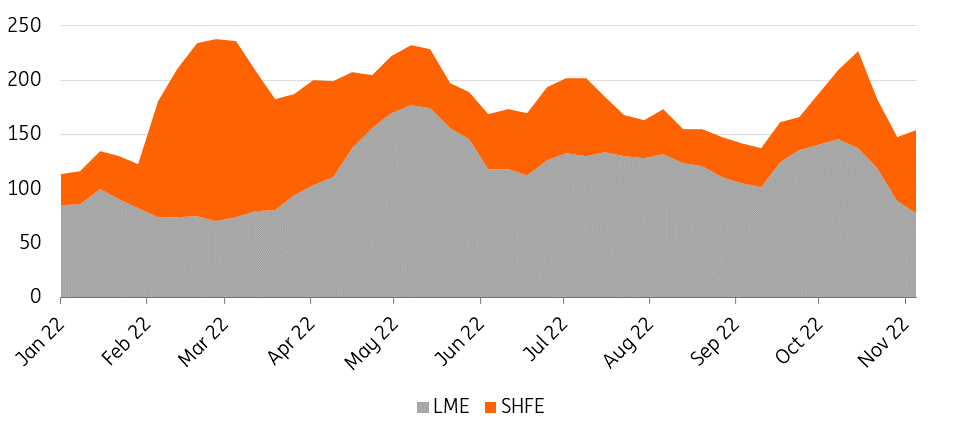

This all comes against the backdrop of low inventories. Copper stocks in LME warehouses remain low, representing just two days’ worth of global usage. Inventories on the SHFE and COMEX are also dangerously low. Between the three exchanges, the global copper inventories are now down to just a few days of consumption.

At least, for now, the copper market has a bit more clarity following the LME’s decision to take no action on the delivery of Russian metals into LME warehouses after receiving a number of responses to its discussion paper. The LME was looking at potentially banning the delivery of Russian metal into its warehouses, limiting Russian flows or taking no action. In the lead-up to the decision, there were a number of producers who were quite vocal in calling for Russian metal to be banned, while consumers were keener for there to be no changes.

The LME said that instead it will start regularly disclosing the origin of all metal stocks on warrant from January 2023. As of 28 October, 58.1% of copper live tonnage was of Russian origin.

Russian copper is not officially sanctioned, but if we continue to see an increasing amount of self-sanctioning of Russian metals going into next year, the risk is that we see more Russian metal being delivered into LME warehouses, which could potentially mean that LME prices trade at discounted levels to actual traded prices.

The LME also announced that it will restrict new deliveries of copper and zinc from Russia’s Ural Mining & Metallurgical Co. and one of its subsidiaries after the UK sanctioned the company's co-founder Iskandar Makhmudov. Starting immediately, metal from UMMC or Chelyabinsk Zinc unit can only be delivered to LME warehouses if the owner can prove to the exchange that it won’t constitute a breach of sanctions, including that it was sold before Makhmudov was sanctioned by the UK on 26 September, and that neither company has any economic interest in the metal.

The LME said that UMMC copper which is currently listed in the LME warehouse system is not subject to the sanctions, and there is no zinc produced by Chelyabinsk in LME warehouses.

Russia produced 920,000 tonnes of refined copper last year, about 3.5% of the world's total, according to USGS, out of which – Nornickel – produced 406,841 tonnes. Asia and Europe are the main export markets for Russian copper.

Global exchange stocks are at multi-year lows

Near-term headwinds but upside risks to dominate long-term

Recession fears, China's slowdown due to its Covid-19 restrictions, and the Fed’s interest rate hiking path will continue to drive copper’s short-term price outlook, however tightening supply should maintain the red metal’s price support above $7,500/t throughout 2023.

We believe copper prices will remain under pressure until the global growth outlook starts to improve. Tight supply will then become the key focus for the market, which should support prices above $8,000/t in the last quarter of 2023.

Longer-term, we believe copper demand will improve amid the accelerated move into renewables and electric vehicles (EVs). In EVs, copper is a key component used in the electric motor, batteries, and wiring, as well as in charging stations. Copper has no substitutes for its use in EVs, wind and solar energy, and its appeal to investors as a key green metal will support higher prices over the next few years.

ING forecast

Download

Download article

30 November 2022

2023 Commodities Outlook: Stormy seas ahead This bundle contains 13 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more