Korea: Central bank policy stalemate

Slower growth and rising inflation put the Bank of Korea's policy in limbo, supporting our forecast of no policy change through mid-2019

Forward-looking Korean confidence indicators paint a picture of dim growth for the coming months, while inflation continues on an uptrend. These developments put the central bank's policy in limbo. We aren’t forecasting any change to the 1.50% BoK policy rate through mid-2019.

Weakening business confidence

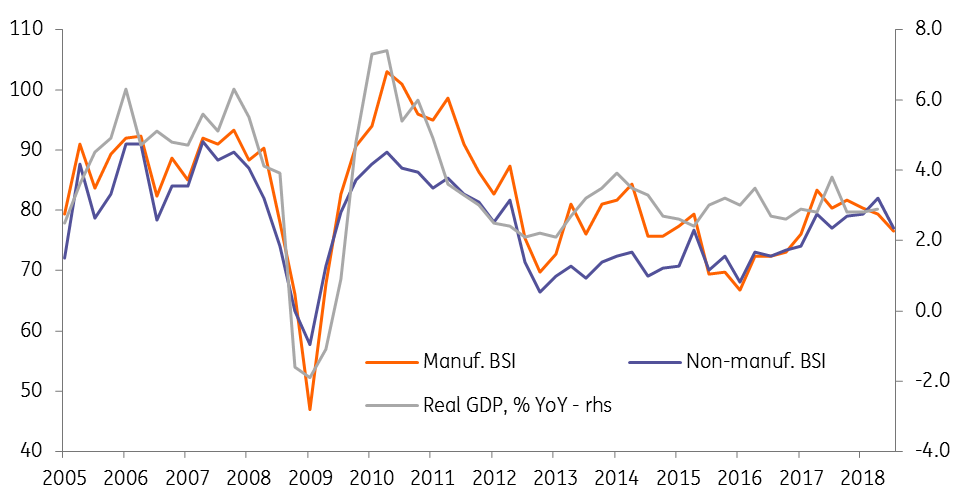

The BoK released its manufacturing and non-manufacturing business survey indexes (BSI) for July. The focus typically is on the forecasts of these indicators for the upcoming month, in this case, August. And they posted their steepest decline in three years, from the point of 80 for both in July to 73 for manufacturing and 74 for non-manufacturing in August. These indexes indicate the continued tapering in GDP growth in the period ahead (see figure).

Weakening business confidence point to slower GDP growth

Evolving growth-inflation dynamics

Besides this, the releases tomorrow of trade and inflation data for July will shed more light on evolving growth-inflation dynamics of the Korean economy. We consider consensus forecasts of 7.4% YoY export growth and 17.0% import growth- implying a significant improvement over -0.1% and 10.7% in June- to be optimistic. We anticipate a contraction on the order of 2.6% YoY in exports and 1.3% in imports, which will be associated with a near-halving of the trade surplus to $3.2 billion in July from $6.2 billion in the previous month.

Our 1.7% YoY July inflation is in line with the consensus. Inflation bottomed at 1% at the start of the year in January and has since accelerated to 1.5% by June as a result of the double-whammy from firmer global oil prices and a weaker Korean won (KRW). While these factors will remain in play through the rest of the year, the higher trade tariffs and the low base effect will also add to the upward inflation pressure.

Download

Download article

1 August 2018

Good MornING Asia - 1 August 2018 This bundle contains 5 articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).