Key events in developed markets next week

Things are moving very quickly in the Brexit arena, and at the time of writing, UK prime minister Theresa May has written to the EU requesting a Brexit extension until 30 June 2019. Hopefully, things will be much calmer at next week's ECB meeting as the central bank continues to keep its cards close to its chest

US: The Fed's "patient" stance, will the FOMC minutes shed any light?

It is a relatively quiet week in the US, with the highlights being inflation numbers and the National Federation of Independent Businesses survey.

US gasoline prices started February at around $2.25/gallon but ended up at nearly $2.70/gallon by March-end. As such, energy prices are going to be a major contributor to the rise in consumer price inflation. We look for headline CPI to rise 0.3% MoM and for the core to increase by 0.2%. This would leave the annual rate of core inflation at 2.1%, which is broadly in line with the Federal Reserve’s medium-term target of 2.0%.

The NFIB survey has been soft in recent months but rose last month. We expect to see another increase this month as diminishing trade concerns and rising equity markets, coupled with decent ISM surveys, provide a boost.

We will also get the minutes to the March FOMC meeting, which saw officials remove the two rate hikes they had previously pencilled in for 2019 from their forecasts. The narrative surrounding this development will perhaps give some clues as to what it may take for the Fed to deviate from their current “patient” stance on monetary policy. We continue to look for stable rates through 2019.

Brexit delay in focus ahead of crunch European Council Brexit meeting

Things are moving very quickly in the Brexit arena, but at the time of writing, the prime minister has written to the EU requesting a Brexit extension until 30 June 2019.

One way or another, it looks like either a customs union (potentially combined with single market access) is most likely to prevail, but the question is whether this can happen in time for Wednesday’s ad-hoc European Council meeting. European leaders will meet to decide whether to allow a further extension to the Article 50 period.

The EU’s view has reportedly hardened when it comes to a further delay, particularly if there is no good reason for doing so. That said, our base case is that Brussels will grant an extension assuming the UK gets the ball rolling on holding European parliamentary elections in May. However, any extension is likely to last much longer than the prime minister might want. Some form of ‘flextension’ is possible, where Article 50 is extended by 9-12 months, with an option to shorten it if parliament approves a deal.

Eurozone: Little 'entertierment'

In the eurozone, the focus will also be on the ECB meeting on Wednesday next week. However, after all the action in March, the meeting is likely to be relatively calm. We don't expect the ECB to announce further details of the built-in incentives for the next TLTROs or of any tiering system already next week, although (as mentioned above) European leaders will be meeting to decide whether to allow a further extension to the Article 50 period. The ECB will continue with the balancing act between demonstrating that it is not running out of ammunition while still keeping its cards close to its chest.

Introducing a tiering system will be investigated but probably only announced in case the economy has not started to rebound by June. Still, “tiering” remains the current buzzword in the ECB universe. Many financial market participants are getting overly excited about possible new steps by the ECB, even though it is clear that the real answer to tackling any next protracted economic slowdown in the eurozone should come from fiscal and not from monetary policies. Nevertheless, we don't expect the ECB to enter-tier us next week.

The domestic focus will be on February's industrial data, or more interestingly how the Eurozone's industrial slump is developing. January industrial production was stronger-than-expected, but it seems unlikely that this positive start to the year has continued into February. German industrial orders surely suggest they didn’t...

Scandi inflation in focus

Next week sees inflation data for both Norway and Sweden. We expect headline inflation will continue to slide in both countries, as last year’s energy price rise continues to unwind. In Sweden, core inflation is likely to recover a little after the very weak February figure, but at 1.6% it will still be some way short of the 2% target.

Conversely, Norwegian core inflation is likely to fall back slightly to 2.5% after a surprisingly strong figure last month, but that will still leave price pressure at robust levels that will continue to support Norges Bank’s hawkish policy stance.

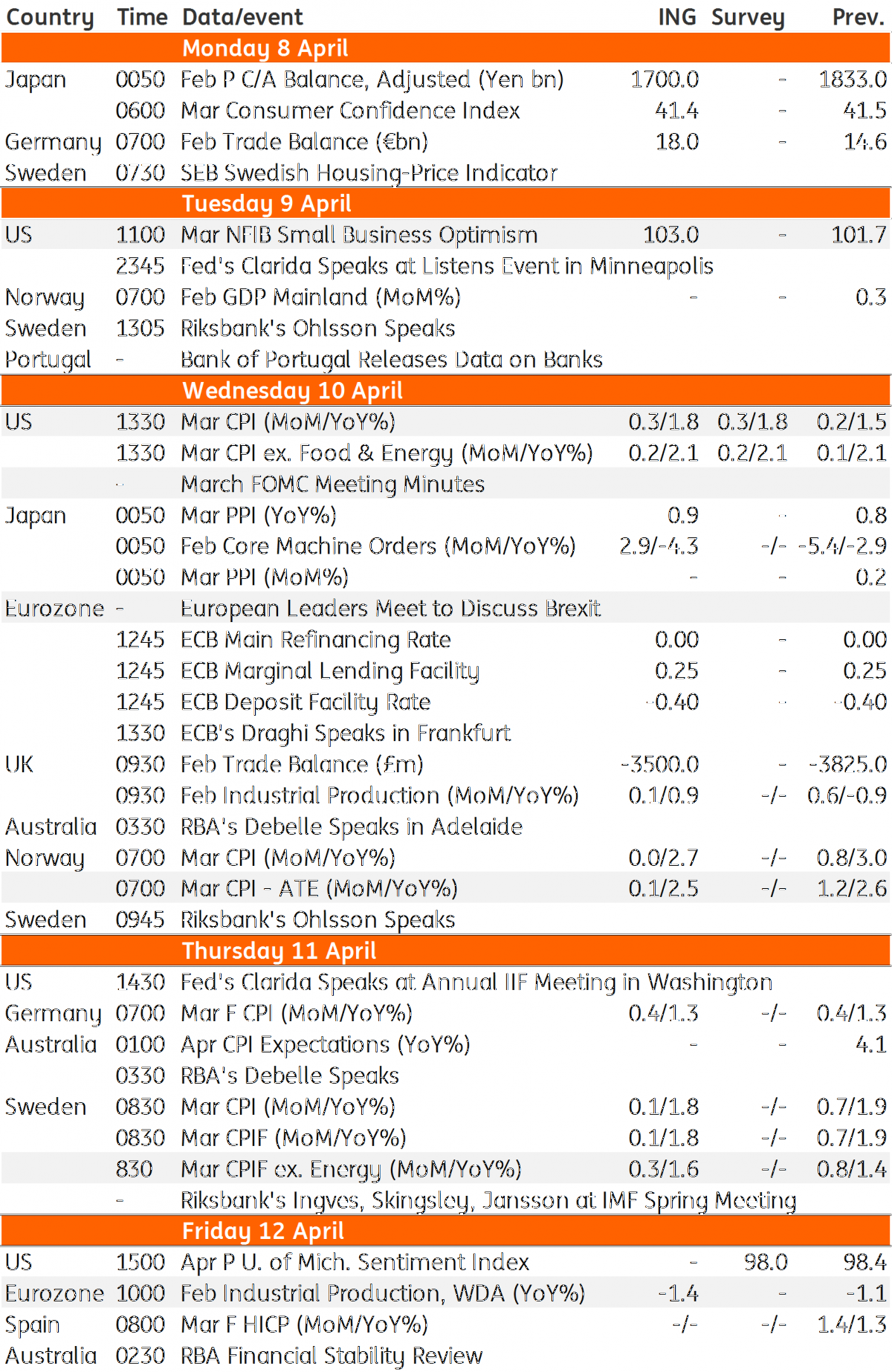

Developed Markets Economic Calendar

Download

Download article

5 April 2019

Our view on next week’s key events This bundle contains 3 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more