Japan: Tilting towards Asia

Japan is an oasis of calm in the world right now and is gradually strengthening relationships throughout Asia. But stronger ties with China may come at a price

Japan is one of the few calm spots but expect temporary growth drags

Compared to what is going on in the rest of the world, Japan looks positively tranquil:

- Relationships in the Asian region are being fostered

- Sustainable growth is being nurtured

- Economic reforms are being implemented

- Policy changes are slowly and almost imperceptibly being altered

This does not make for exciting reading, but maybe, it makes for a better long-term investment. Marring the tranquillity, earthquakes and typhoons have hit Japan in 3Q18, and this could cause a brief and minor downtick to GDP growth figures in the short-term, whilst nudging up inflation for a while. But these are distractions. The main story remains one of ongoing consumer resilience, supported by extremely low unemployment, and continued growth in wages

Inflation is low and will remain low

Inflation remains predominantly absent, with inflation rates excluding energy and typhoon-affected fresh foods at only 0.1% year-on-year. But the authorities are choosing to focus on the broader core measure, which excludes only fresh foods. Thanks to higher oil prices, this is a relatively robust-looking 1.2%. Though not for long. 1.2% is still way off the official 2.0% target. But it is sufficiently close for the Bank of Japan (BoJ) and government to suggest no pressing need to chase this further.

Risk aversion has impacted Japanese markets

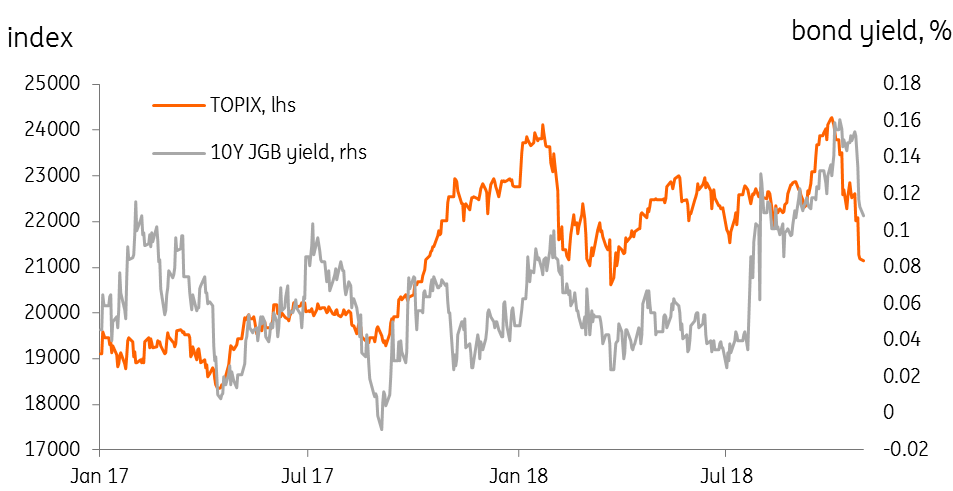

BoJ policy, according to Governor Kuroda, will eventually be altered through changes to the 10-year Japanese Government Bond (JGB) target. With the target currently at 0.1%, the benchmark issue was recently trading at about 0.14%. A fairly rapid reversal has taken it back to 0.1% in recent weeks. No hint, therefore, that a change in the target yield value is being planned imminently.

Equity markets in Japan have not been immune to global forces. The Nikkei 225 is down more than 7% year-to-date in yen terms, with the broader TOPIX index down 12.4%. This compares with a fall of only 0.6% YTD in US dollar terms for the S&P 500. This might explain why the 10-year JGB yield has been brought back into line with the official target, instead of being allowed to drift higher.

Japan equities and 10Y yields

Japan looks to improve relations in region but is careful not to upset US

Japan’s Prime Minister Shinzo Abe has used his re-election as head of the LDP to pursue a pattern of relationship building in the region. A state visit to Beijing should not be viewed as merely cosmetic. 500 business deals were signed on the trip, valued at about ¥260 billion, and including a $30 billion currency swap arrangement with China. The trip also marked an end to Japanese foreign aid to China, but a commitment to partnership in infrastructure projects, including the Belt Road Initiative, which Japan has avoided until now.

The rapprochement with China is significant, as it signals a choice between good relations with China at the potential expense of those with the US. Abe won’t want to sour Japan’s relations with the US, but he can’t afford to take sides with the US against China, even if that may incite a reaction from President Trump.

Japanese export destinations

Japan's tilt towards Asia looks set to continue

Rather than driven by emotion, Japan’s actions come across as reassuringly pragmatic. In the last 12 months, Japan has exported more to China than the US, and China is Japan’s number one unique export destination. As recently as six months ago, the US had the top spot.

The US now holds second place followed by South Korea, which absorbs almost a third as many Japanese exports as the US, followed by Taiwan, Hong Kong, and Thailand. It is only then that the rest of the G-7 becomes involved, as Germany enters the ranks, and then we are quickly back to the Asia Pacific region with Australia, Indonesia and Malaysia. In short, in the words of Barack Obama, it looks like Japan has tilted towards Asia.

Download

Download article

2 November 2018

November economic update: A changing of the guard This bundle contains 8 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more