Indonesia: Reforms needed for lift-off

Indonesia has seen growth plateau at the 5% range since 2016. After targeting 7% since taking office in 2014, President Jokowi looks to secure a fresh term with the current administration forecasting the fastest pace of growth in the next two years

Recent Growth and outlook: On cruise control with elections ahead

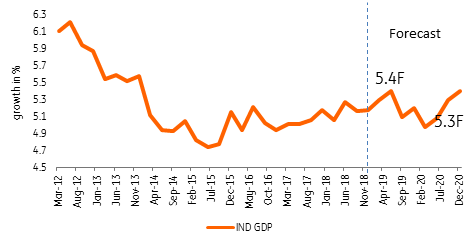

Growth in Indonesia has hovered about the 5% level in recent quarters and given the nation’s solid fundamentals will likely keep to this range in the near term. The administration however is now forecasting economic growth to average 5.3% in 2019 and at 5.3-5.5% in 2020 against a backdrop of benign inflation. The elections in April are expected to boost economic growth on the consumption side but more investment and reforms will be needed to achieve lift-off and break free from the 5% level.

Inevitably the growth trajectory will depend largely on the elections, with incumbent Joko Widodo (Jokowi) vowing to continue his infrastructure and investment push while challenger Prabowo Subianto (Prabowo) has pledged to ban imports of agricultural products, lower the reliance on imported oil and reinstate fuel subsidies cut by Jokowi.

Indonesia GDP growth (2010 base year) actual and forecast values

Inflation and outlook: well-behaved and on course to stay within target

Price pressures have been subdued with the basic food component pushing headline inflation closer to the lower-end of the 2.5-4.5% inflation target. Meanwhile, prepared food, beverages, tobacco and utilities were the main contributors to the latest 2.57% inflation reading for February. Meanwhile, core inflation, which strips out some food items as well as government influenced transport and utilities was also well-behaved, settling at 3.06% for the month of February.

One factor that has helped inflation settle at the lower-end of the 2.5-4.5% target has been the ability of Indonesia to import important grains which has ensured adequate supply domestically, something that Prabowo has vowed to cancel should he take power.

On the other hand, Prabowo has also campaigned on a promise to reinstate fuel subsidies and lowering reliance on imported fuel via higher biofuel content, something that would also affect the inflation dynamic should he wrest the presidency from Jokowi. For the time being, inflation is forecast to remain within the lower end of the inflation target with Bank Indonesia (BI) shifting focus to financial market stability over price stability.

Indonesia inflation (in %) actual and forecast values

Monetary policy and interest rates: BI on hold for now but rate cut now on table

In 2018, Bank Indonesia (BI) unleashed a flurry of rate hikes at the height of the emerging market currency rout, citing the need to establish financial market stability as they looked to steady the Indonesian Rupiah’s fall. Governor Warjiyo hiked a total of 6 times in 2018, beginning in May, to bring BI’s 7-day reverse repurchase rate to 6.0% by November with the last rate hike catching some market players by surprise. BI had maintained that raising rates aggressively and acting in a “pre-emptive” manner was done in order to maintain the stability of the economy and financial system by keeping financial assets attractive to foreign funds. The ability to keep the IDR stable is in line with the overall government move to keep the current account from ballooning.

The widening of the trade and current account deficits had been flagged as a major concern for foreign investors and one of the main reasons cited for the flight of capital at the height of the EM rout in 2018. In the coming months, the central bank will remain vigilant to ensure IDR stability, although the Fed’s recent reversal in outlook coupled with Governor Warjiyo’s comments indicating that he felt rates may be “close to peak” hint at the possibility for a policy reversal in the coming months. Should the IDR remain stable, with an appreciation bias and global market conditions remaining favourable to emerging markets, we believe Warjiyo will be afforded a window to dial back 2018’s rate hike salvo to help boost economic growth in an environment of slowing global growth.

Country specific highlight: Narrowing the current account

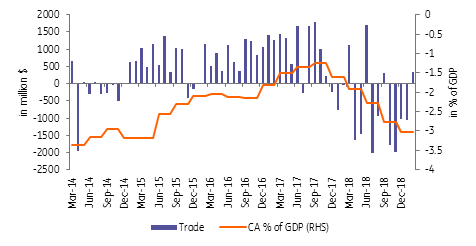

The twin threats of 2018 - a trade war between the United States and China moving in tandem with a hawkish Federal Reserve - buffeted currencies across emerging markets. The three currencies that had been hit the most were those whose economies ran substantial current account deficits, with the IDR joining the INR and PHP at the back of the line. For the year, Indonesia recorded a current account deficit of 2.98% of GDP, the widest since 2014 as the deficit swelled to $31.1bn. With the trade gap ballooning to $8.496bn, Indonesia rolled out several reforms to help boost exports, with incentives and tax perks doled out to exporters while some infrastructure projects requiring substantial imports were postponed in order to achieve import compression.

Indonesia is now targeting a current account deficit of 2.5% of GDP which should alleviate some pressure on the IDR, especially with the turn in risk sentiment in the first quarter of the year. In 2019, market players will continue to monitor whether Indonesia can continue to whittle down the current account deficit, with early 2019 trade data showing a surplus recorded, but at the expense of a large contraction in imports.

Indonesia trade balance and current account % to GDP

Currency movement: IDR depreciates then steadies as foreign flows return

The IDR was one of the worst performing currencies in 2018 with stark risk-on sentiment forcing foreign investors to head for the exits, noting the outlook for the Fed and the US-China trade war. At the height of the emerging market currency rout, the Rupiah had lost 12.72% from its level at the start of the year on renewed concerns about Indonesia’s current account position. Bank Indonesia was called into action, actively participating in the foreign exchange market, setting up a domestic non-deliverable forward market and revising rules on export revenue repatriation to limit outflows. 2019 brings a more favourable environment with the Fed taking a more dovish tack while US and China appear amenable to some form of agreement, hopefully in the near term. The IDR has managed to appreciate for the most part in 2019 as portfolio flows have returned as a result of the improved sentiment. With the currency stable and growth expected to receive a boost from the elections, Bank Indonesia has held off on adjusting monetary policy while vowing to help boost liquidity to offset the ill effects of its recent aggressive tightening cycle. If risk sentiment continues to favour emerging markets, we could see the IDR appreciating further as Governor Warjiyo still views the currency as “undervalued” with the possibility of a policy reversal from the central bank now gaining some steam.

Indonesia foreign portfolio equity flows

Summary: on cruise control but reforms needed for lift-off

Growth prospects for Indonesia remain favourable, given still robust domestic consumption which will be aided further by benign inflation dynamics. Elevated borrowing costs, raised last year to ensure IDR stability, however may limit capital formation to some extent but government spending is expected to continue to provide a lift. Reforms and investment may be needed in order for the economy to break out of the 5% trend, something that incumbent Jokowi has pledged to do with improvements in infrastructure seen as a priority. Meanwhile, Indonesia will need to secure other more stable sources of foreign currency, given the economy’s susceptibility to foreign outflows and its reliance on low value added exports for foreign currency. A shift to higher value added export products would help address two concerns at once by securing a stable source of foreign flows and at the same time offering an alternative outlet for the young labour force in the manufacturing sector. Regardless of the outcome of the election, Indonesia’s growth trajectory will lean heavily on the next president’s ability to boost investment in order to improve productivity and increase efficiencies. Growth of 5% is highly achievable but reforms to push a shift to higher value added production will be key to not only secure Indonesia’s external position but also provide another stable source of growth via higher value added manufacturing.

Download

Download article

5 April 2019

What’s happening in Asia ? This bundle contains 9 articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).