How the plastics industry can function without fossil fuels – and at what cost

The plastics industry is adopting technologies for reducing fossil fuel use, but not without a cost. This article aims to provide corporate leaders with insights into the business case of hydrogen-based plastics, bio-based plastics and recycled plastic – all of which provide an opportunity to move away from fossil fuels

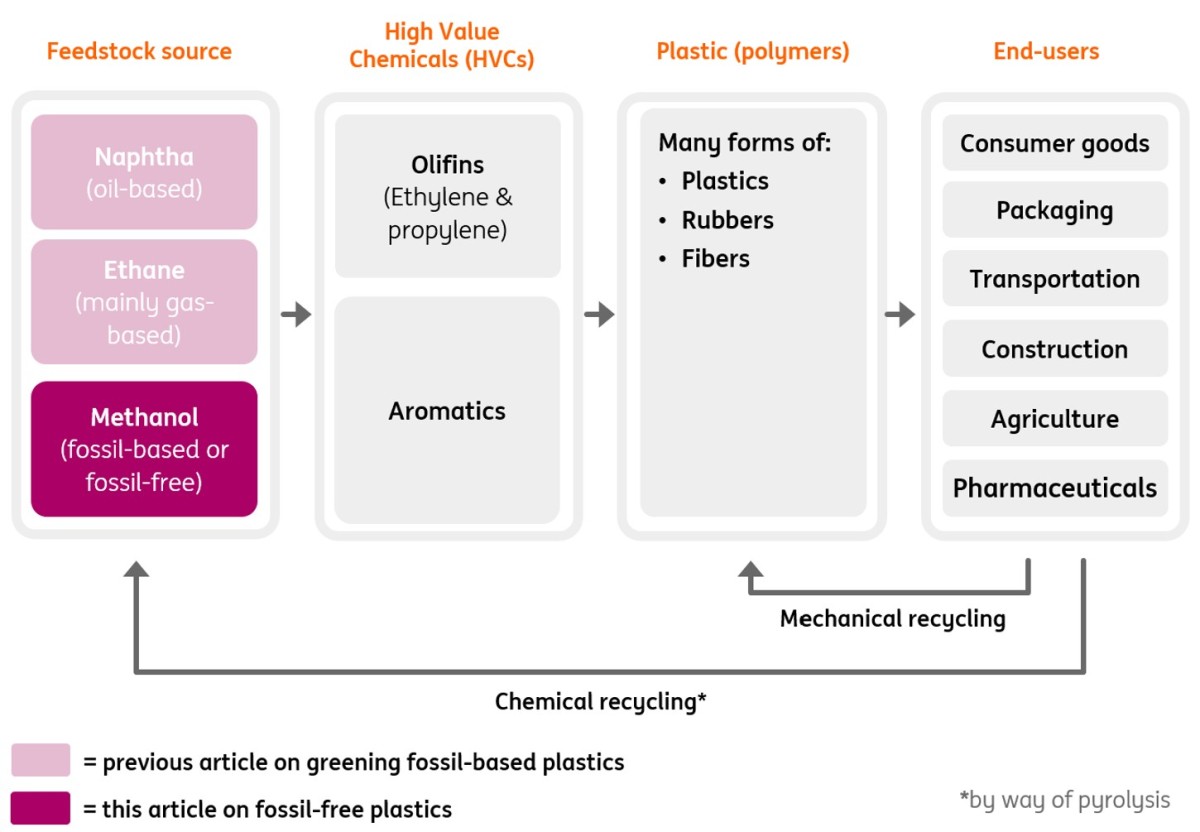

From decarbonisation to defossilisation of the plastic industry

There are many ways to mitigate the CO2 impact of plastics derived from oil and gas, and we've explored those in detail here. These include, for example, carbon capture and storage (CCS), plastic recycling and electrification of the heating source. While there are ways to lower its carbon emissions, the plastics industry continues to rely on fossil fuels as a feedstock. In turn, we view these measures as an evolution, not a revolution.

In this discussion, we shift our focus to a more radical transformation by considering plastic production without fossil fuels. From a chemical perspective, there are many ways to do this. Avantium, for example, makes plastic out of sugars. Plastic can also be made from methanol, which can be an important component in the production of plastics, synthetic fibres, fibres to make clothing, paints, adhesives, pharmaceuticals, agricultural chemicals, and many other products.

Green fossil-free methanol can be made from renewable biomass or green hydrogen (see the tech explainer on methanol at the bottom of this article). As a result, methanol is likely to become an important feedstock for plastic production in a net zero economy. But at what cost for plastic producers?

Read more here about how to reduce CO2 emissions from plastics made from oil and gas

In this article, we focus on the business case for methanol-based plastics, which provides corporate leaders and politicians with important insights on how to transition to plastics that are both greener (less CO2) and not made from fossil fuels.

The economic reality: Oil and gas-based plastics are the cheapest options

At present, the expense of manufacturing plastics from natural gas, specifically ethane, is roughly €800 per ton of High Value Chemicals (HVC), out of which many specific plastics are produced. In contrast, the cost to produce plastics from oil, or naphtha, is about €1400 per ton HVC. These figures pertain to the traditional method of producing plastics, which relies on fossil fuels. You can read all about this process and business case in this article.

Fossil-free bio-based plastics can cost one and a half times as much, while plastics from green hydrogen can be up to four times more expensive

The methanol based fossil-free plastics from biomass and green hydrogen are significantly more expensive, according to our model. Plastics produced from green hydrogen are, in particular, still very expensive. These plastics are sometimes called e-methanol or e-plastics because green hydrogen is produced with electrolysers that run on electricity.

So while there are ways to produce plastics without the use of fossil fuels, there is still a sizeable price gap that needs to be bridged to make fossil-free plastics cost competitive – which is a prerequisite for scaling up and making them mainstream. That will require, for example, subsidies, clients willing to pay more for green plastics (green premiums), mandatory production targets for fossil-free plastics or taxing current plastic production from oil or gas.

Plastics from oil and gas are the cheapest, fossil-free bio-based plastics and plastics derived from green hydrogen are costliest

Indicative unsubsidised costs for different methanol-based plastics compared to gas and oil-based plastics (in € per ton High Value Chemicals)

Considering the cost range of €800 to €1400 for oil and gas-based plastics, it’s clear from the graph that plastics derived from methanol are pricier, even if the methanol is produced with coal or gas. This can be attributed to the fact that methanol production incorporates an extra (and expensive stage) in the process of plastic production. It’s more cost effective to manufacture plastics directly from gas, rather than initially producing methanol from gas and subsequently converting methanol into plastics. Moreover, the technology for methanol production is less developed compared to ethane and naphtha cracking, which further escalates the cost.

The challenge of making fossil-free plastics cost competitive

Regrettably, achieving cost competitiveness for fossil-free methanol-based plastics – derived from biomass or green hydrogen – with conventional fossil-based plastics is a challenging task.

In the case of bio-based plastics, the cost of bio-methanol would need to decrease by approximately 70% in order to align with the current plastic production cost range of €800 to €1400 per ton HVC.

The task becomes even more daunting for plastics produced from green hydrogen. Even if power prices were to hover around €40/MWh (the long-term average before the energy crisis) and there was a 90% reduction in the technology costs to manufacture e-methanol, these plastics would still be more expensive, costing about €2000 to €3000 per ton HVC.

One could also argue that fossil-based plastics are too cheap. Unfortunately, CO2 prices would need to be between €1,000 and €1,600 per ton to bring the cost of virgin plastic production from oil and gas into the €2000 to €3000 range. This is an unrealistic expectation and significantly exceeds most estimates for the European carbon price by 2030, which generally do not surpass €250 per ton. Additionally, the use of oil and gas as feedstock for plastic production is largely exempt from carbon pricing, and gas used for high-temperature processes partly receives emission rights without charge (free allowances).

Bio-based plastics and plastics from green hydrogen can lower emissions

Indicative emissions for different methanol-based plastics (in ton CO2 per ton High Value Chemicals)

Hydrogen-based plastics contribute to CO2 reduction only if they are entirely produced with renewable or nuclear power

Methanol, when synthesized using hydrogen from electrolysers, is referred to as E-methanol because the electrolysers are powered by electricity. Consequently, the plastics derived from this process are sometimes termed e-plastics, which are depicted at the bottom of the graph.

Unfortunately, electrolysers demand a substantial amount of electricity, making the power source crucial in determining the carbon footprint of hydrogen-based plastics.

If the electricity is sourced from gas-fired power plants, the emissions are up to four times higher than those of conventional plastics, which are directly produced from gas or oil. Emissions are even more alarming if the power comes from coal-fired power plants as they are five to seven times more carbon-intensive.

When comparing E-methanol made with electricity from gas or coal fired power plants to methanol produced directly from coal or gas, the former does not benefit the climate. It’s simpler to produce methanol directly from coal or gas than from electrolysers that run on power supplied by coal or gas-fired power plants. However, this is not the case if the carbon emissions from the methanol plant are captured and stored permanently through CCS. In such a scenario, the emissions are lower than those from the conventional oil and gas-based plastics.

So, hydrogen-based plastics only contribute significantly to emissions reduction if the hydrogen used is almost entirely produced with carbon-free electricity, such as nuclear power or renewable power from solar panels, wind turbines and hydropower plants. In this case, the plastics serve as a carbon sink, as both carbon and hydrogen are required to produce syngas and methanol (refer to the technical explainer at the end of this article).

Hydrogen-based plastics can temporarily store CO2 in products, albeit under stringent conditions for low carbon electricity. Regrettably, this positive impact is temporary, as the carbon is re-released as CO2 again once the plastics complete their lifecycle and are incinerated for energy purposes or recycled. And, as explained earlier, these temporary benefits still come at a huge cost disadvantage.

Bio-based plastics can reduce emissions, but don’t be overly optimistic

Biomass provides an appealing alternative for fossil-based plastics. Plants take carbon from the atmosphere while they grow, and that can be a green carbon source for plastics production. For many it simply feels good to use organic feedstock over oil or gas, especially if the biomass comes from locally grown sources. Or to drink your favourite soda from a bio-based bottle instead of one that is made from oil or gas. Although, many would rightly point out that the biomass needs to be sourced in a sustainable way. So not from cutting down mature trees, but from organic waste residues.

The complex topic of defining sustainable bio-based plastics

Bio-based plastics are plastics derived from renewable biomass sources, such as vegetable fats and oils, corn starch, straw, woodchips, sawdust, and recycled food waste. This article specifically discusses the production of methanol from solid biomass, including waste streams from forests and agriculture like trees and plants.

This leads us to the crucial question of the sustainability of biomass. Essentially, sustainable biomass involves the production, processing, and utilisation of biomass in a manner that is environmentally friendly, efficient, and aids in reducing greenhouse gas emissions. The European Commission has established numerous sustainability criteria for biomass, which include aspects like land use, soil quality and carbon protection, forest biodiversity, sustainable harvesting practices, and emission accounting procedures.

It’s important to clarify that the term ‘bio-based’ does not imply ‘bio-degradable’. Bio-degradable plastics are a category of plastics that can decompose into water, carbon dioxide, and biomass due to the action of living organisms, typically microbes. This property is not dependent on the source of the plastic, but rather its chemical structure. In other words, a plastic that is 100% bio-based may not necessarily be biodegradable, while a plastic that is 100% fossil-based could be. So, the topic of biodegradability is complex and distinct from that of bio-based materials.

Sources: Bioplastics Europe, Plastics Europe, European Bioplastics, European Commission, National Geographic

Unfortunately, bio-based plastics from methanol come at a cost. They are around +150% more expensive compared with regular plastics. And the extent to which they benefit the climate depends on critical assumptions.

Just as with plastic recycling, we shouldn’t be overly optimistic about the climate impact of bio-plastics as we enter the complex, non-transparent and very challenging world of calculating what is called ‘avoided emissions’ from biomass use.

The production of methanol from biomass is a process that generates CO2. These Scope 1 emissions come from the gasification of biomass. Scope 2 emissions from the energy that is needed to generate the high temperatures at which gasification happens. Here, everything is quite easy.

It gets murky with ‘avoided emissions’ – a term used to refer to the emissions that are prevented from arising by using bio-plastics instead of oil and gas-based plastics. Think of the following:

- The CO2 that is captured from the air by the biomass during its lifecycle.

- The avoidance of resource depletion as no oil and gas is needed. Biomass can be grown and renewed in a lifecycle that spans months (waste from crops) or years (branches from trees) rather than the hundreds of years in which oil and gas are formed.

- The avoidance of CO2 emissions from bio-based plastics compared to the production of virgin plastics from oil or gas in steam crackers.

The basic question is whether to attach a negative carbon content to avoided emissions. If one does, biomass feedstock becomes a carbon offset.

In doing so, the feedstock counts for negative emissions, while the process of making biobased methanol accounts for positive Scope 1 and 2 emissions. The net impact is highly debated at best, but more often simply not mentioned or specified at worst.

Unfortunately, there is no policy rule or common practice that treats these emissions in the same way. That’s why we see a very wide range of CO2 emissions for bio-based plastics. We also notice that most cases use very optimistic assumptions for the CO2 capturing, resource depletion and the avoidance of CO2 from virgin plastic production. We don’t feel very comfortable with that. Yes, CO2 is captured from the air by biomass – on that we can agree. But avoidance, as the name clearly indicates, is not actual emission reduction. And it is the level of actual carbon emissions that matters for global warming. We aren't so comfortable with applying large carbon offsetting values. In practice, that’s done a lot though, and the outcome matters.

Whether or not bio-based plastics reduce fossil fuel demand and at the same time lower carbon emissions depends on the carbon offsetting assumptions for biomass

Bio-based plastics yield negative emissions under the most optimistic assumptions for carbon offsetting, even though the production of bio-based plastics generates emissions. On the other extreme, bio-based plastics are more polluting compared to oil and gas-based plastics if no carbon offset is applied. To summarise, whether or not bio-based plastics reduce fossil fuel use and reduce emissions depends on the carbon offsetting assumptions for biomass. In other words: whether defossilisation equals decarbonisation depends on the biomass offsetting assumptions.

So, how do we deal with this?

We take a more balanced approach by applying a moderate value for carbon offsets. In doing so, we acknowledge the fact that biomass takes out CO2 from the air and the fact that the production of bio-methanol generates emissions. We don’t, however, stretch the concept of avoided emissions.

Under such a set of assumptions, emissions from bio-based plastics are lower compared to steam cracking, but it's not a major difference (see the graph). It also does not yield negative emissions for bio-based plastics, which might give the false impression that the production of bio-based plastics takes out carbon from the air and is therefore a strategy to create negative emissions. For bio-based plastics, this is less clear compared to hydrogen-based plastics from renewable power, where CO2 is directly used in the production process and these plastics in turn act as a temporary carbon sink.

Bio-based plastics need a carbon offset to outperform oil and gas-based plastics from steam cracking

Indicative emissions for bio-plastics with different carbon offsetting values (in ton CO2 per ton High Value Chemicals)

Clear guidelines are needed on how to account for avoided emissions from biomass

It’s intriguing to observe that the industry has yet to establish clear guidelines for addressing avoided emissions. The European Commission provides clear guidelines for sustainable fuel production through the Renewable Energy Directive, but not for plastic production.

This ambiguity and lack of clarity complicates the debate on the merits of bio-based plastics and their potential contribution on the path towards a net-zero economy. Consequently, it becomes challenging for key stakeholders like governments, financial institutions, NGOs, and research institutions to reach a consensus on the subject of bio-based plastics. In the absence of definitive guidelines, this subject is likely to persist as a contentious issue causing ongoing disputes among scientists, NGOs, chemical companies and politicians.

The paradox of fossil-free plastics

High production costs but minimal impact on consumer prices

Plastic is an incredibly affordable material, with its cost per kilogram roughly equivalent to a litre of milk thanks to fossil-based technology.

Switching to fossil-free plastics raises costs, but it makes hardly any difference in the final pricing to consumers

Therefore, plastic’s contribution to the final price of a product is minimal. Consider your favourite sodas or cars, both of which require plastics. A shift from conventional fossil-based plastics to fossil-free alternatives could quadruple the cost of plastics. However, this increase barely affects the final pricing of these products. For instance, using bio or hydrogen-based plastics would only raise the price of your preferred soda by 2% and 3% respectively. The impact on the price of an average car is even less significant due to its higher sales price.

A transition to fossil-free plastics will be hardly noticed by consumers

Impact of a switch from current plastics to fossil free plastics on consumer prices

The current state of methanol production

An expansion, but not necessarily for plastic production

While plastics are hardly ever produced from methanol at present, numerous global initiatives are underway to construct methanol plants using either biogenic sources or hydrogen.

The Methanol Institute has put together a database of biomethanol and e-methanol projects. As of March 2024, the database tracks 139 renewable methanol projects globally.

Methanol is increasingly becoming a commodity that is bought by the highest bidder, often in the transportation sector

These sites produce a growing amount of green methanol. This green commodity is sold on a global market, where the market forces of supply and demand determine the use of this commodity. In many cases it is used to produce more sustainable fuels for aeroplanes and ships, as companies in these sectors are willing to pay the highest price in order to meet mandatory targets for the use of these fuels. Examples for green methanol use in plastic production are much harder to find:

- Norway: Carbon Recycling International is developing an e-methanol plant using CO2 from a steel plant and renewable hydrogen.

- Denmark: LEGO and Novo Nordisk are investing in e-methanol for manufacturing toys and medical devices, using green hydrogen from wind and solar energy.

- USA/Japan: Asahi Kasei and Mitsui are setting up a bio-methanol supply chain from US biogas and reused CO2 from a nearby chemical plant, aiming to produce engineering plastics with a reduced carbon footprint.

- WACKER and DuPont are producing biomethanol from both petrochemical and plant sources for silicone rubber and biobased ‘Delrin plastics’, used in everyday items like electric toothbrushes, car seat belt buttons, and keyboard mechanisms.

Regrettably, the journey towards increased methanol feedstock for plastic production is fraught with challenges. Plans to construct an e-methanol plant in the Port of Antwerp were recently scrapped due to economic difficulties and high energy costs.

Finally, methanol is often produced in a less sustainable manner. For instance, China, home to the world’s largest methanol production facility completed in 2022, produces methanol next to a coal-based coke oven gas plant where CO2 and hydrogen are captured. Consequently, if this methanol is used for plastic production, it would not result in fossil-free plastics and yield higher carbon emissions compared to conventional plastic production from oil and gas.

The journey towards fossil-free plastics has only just begun

This article highlights potential methods for making plastic production less fossil intensive, for example through the use of methanol from green hydrogen and sustainable biomass. However, these methods come with significant costs, a major drawback in an industry that is heavily cost-competitive. A shift in the plastic production paradigm is therefore required, especially when the economic viability of greener plastics is not yet competitive enough to self-sustain.

Currently, most initiatives for greener plastics are in the experimental stage. New methodologies and technologies are being trialled, often with substantial subsidies. Frontrunners in the industry should continue to do so in order to make the technology cheaper. And they should be rewarded for it, for example through higher prices. Labels for green plastics could contribute to that. However, at this stage, that has minimal impact on the conventional practice of producing plastics from oil and gas.

Meanwhile, there is limited progress in fundamentally transforming the industry, such as significantly increasing the cost of producing virgin plastic from oil and gas, or mandating the use of green plastics. Governments can spearhead this change – similarly to how the European Commission banned plastic straws and implemented a deposit scheme for plastic bottles to promote recycling. Such regulations could give early adopters a competitive edge that others would be keen to replicate, driven not by altruism but by self-interest and the pursuit of profit. That seems to be a promising way to make sustainable plastics a mainstream business in a market-driven industry.

Lastly, different stakeholders – i.e., plastic producers, plastic users, plastic recyclers, governments, NGOs, and financial and knowledge institutions – should avoid a myopic focus on the ‘ultimate solution of fossil-free plastic production’. In the medium term, the environment would arguably benefit more from greening the production process of oil and gas-based plastics. In particular, through increased plastic recyclying as this addresses both carbon emissions and the plastic waste issue, even if the majority of these plastics remain fossil-based.

Appendix: The technology explained

This article focuses on the greening of plastics with methanol

Methanol provides the possibility to produce fossil-free plastics

The process of producing methanol chemically is quite intricate, and we won’t delve into all the specifics here. Instead, our focus will be on the economic implications in terms of costs and emissions. For this discussion, it’s sufficient to remember three key points, although a more detailed technical explanation is available at the end of this article:

- Methanol is synthesized from syngas. The term ‘syngas’ is used because this gas comprises all the essential components needed to manufacture methanol, ammonia, and other significant hydrocarbons like synthetic fuels for shipping and aviation.

- Given its critical role and long-standing usage, the industry can safely manage substantial quantities of syngas. The global syngas market is currently valued at approximately €45-€50 billion and is projected to grow at an annual rate of 6% to 10%.

- Up until now, the majority of syngas has been derived from coal or natural gas. However, biomass and green hydrogen offer environmentally friendly alternatives for methanol production in a net-zero economy.

In summary, the petrochemical industry can produce nearly all of its requirements from syngas, a practice it has been following for many years and plans to continue in the future.

Revolutionary shift: methanol paves the way for eradicating fossil fuel dependence in plastics via biomass or green hydrogen

Different production routes for methanol based plastics based on fossil or non-fossil based feedstock

If methanol is derived from either coal or gas, often referred to as grey methanol, the resulting plastics continue to be fossil-based. In Europe, the production of methanol is typically reliant on natural gas, while in countries such as China and India, coal is the preferred source. Despite these current preferences in methanol production methods, the prevailing prices of coal, gas, and carbon in Europe make the production of methanol from gas more economically viable than from coal.

Nevertheless, emissions of plastics from fossil-based methanol can be reduced by up to 65% by capturing and storing the CO2 emissions. This process, as mentioned earlier, is called CCS and this type of methanol is referred to as blue methanol. But the environmental impact comes at a cost, as plastics from blue methanol are almost twice as expensive. Therefore, it would be better to apply CCS directly to the current way of plastic production by adding it to ethane and naphtha crackers, which would raise the cost of plastics by maximum 10% (see our previous article on reducing emissions from fossil-based plastics).

We have not modelled the use of CCS for coal-based methanol production as our focus is on Europe, which is phasing out the use of coal. However, CCS is an effective method for drastically lowering the high emissions from plastic production in coal-rich countries like China and India. Currently, the carbon footprint of plastics from China and India can be five to seven times higher compared to plastics produced in Europe. The footprint would be more or less levelled if China and India were to apply CCS on plastic production.

Finally, methanol is called green methanol when it is produced with green hydrogen – that is, with electrolysers that run on renewable power from solar panels, wind turbines or hydropower plants.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more