Brazil in 2021: The focus is on fiscal policy

Brazil’s forceful policy reaction to the pandemic was crucial to mitigate its economic impact but it requires some correction in 2021. As it stands, the fiscal tightening dictated by current law would pave the way for a credit-fuelled virtuous cycle and higher growth. Another round of fiscal stimulus would, however, create a vicious cycle

Binding fiscal constraints imply binary 2021 outcomes

Brazil’s economic policy response to the pandemic was unusually aggressive by emerging market standards. The monetary easing was perhaps the most forceful in EM when you consider the current level of the policy rate of 2%, relative to the ten-year historical average of 10%. The persistent FX sell-off has been the primary side-effect of that easing, which is, arguably a minor concern in the current low-inflation environment.

Much more consequential has been the fiscal stimulus enacted, especially the household income transfers to help offset wage income lost to Covid-19 movement restrictions.

The combined effect of the larger spending and the recession-related drop in tax collection should result in a major fiscal deterioration in 2020, as you can see in the chart below. And 2021 is likely to be a crucial year for Brazil to reveal its commitment, or not, to a sustainable fiscal trajectory.

Fiscal deficit surged to record-highs, provoking a sharp rise in public debt

With the household income transfers set to end in December and government spending already set to reach the legal limit stipulated in the “fiscal spending ceiling” in 2021, temptation to change the law to accommodate greater spending has increased, resulting in frequent efforts to weaken the fiscal framework.

Those efforts have, so far, encountered severe resistance and we expect them to continue to fail. But uncertainty regarding that outcome would keep risk premium levels elevated and limit prospects for the economic recovery.

Continued monetary stimulus depends on fiscal consolidation

As it stands, the current fiscal framework, centred on the “fiscal spending ceiling” mandate, which has frozen government spending in inflation-adjusted terms, would ensure a gradual improvement in Brazil’s fiscal trajectory.

Our base-case scenario is that this fiscal framework will remain unaltered in the foreseeable future, as advocated by the Finance Ministry. This scenario should not be taken for granted, but we believe there’s enough opposition within Congress, regulators, and the press, along with disciplinary market forces, to prevent the creation of a constitutional majority in Congress to change the law.

A corollary of our fiscal assumption is that fiscal policy will turn contractionary in coming years, paving the way for a prolonged period of expansionary monetary policy. And this monetary stimulus, amid favourable prospects for a credit-fuelled economic recovery, is the main reason to be optimistic about Brazil’s growth prospects.

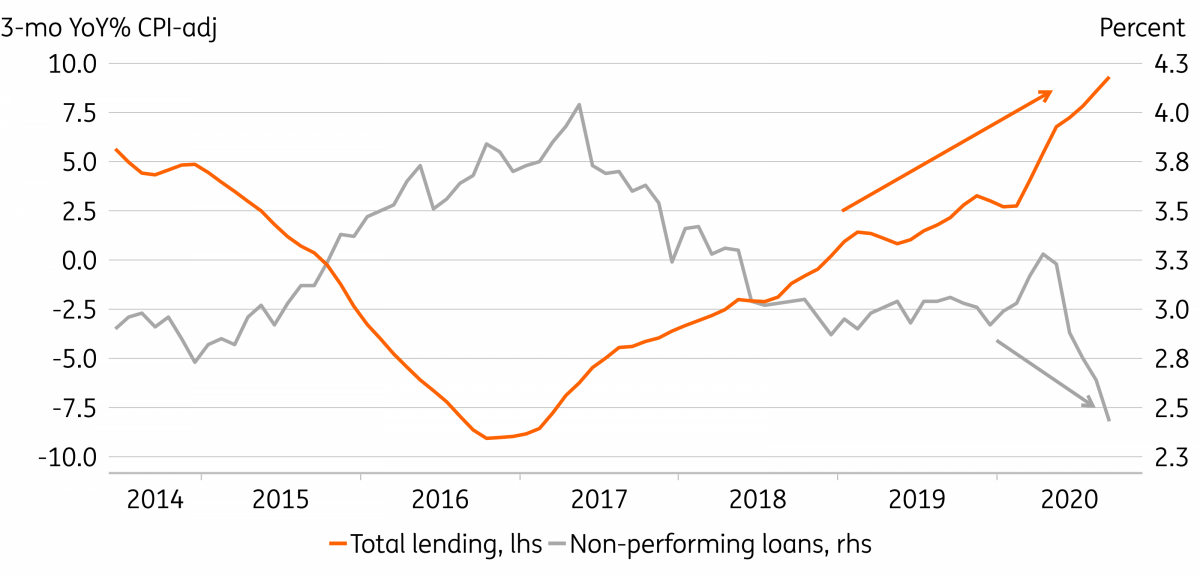

Bank lending continues to rise, amid record-low delinquency

As seen in the chart above, bank lending has surged, despite the pandemic, and the outlook remains favourable, especially in the housing and construction sectors, which should benefit from record-low rates and new financing options.

There are two other growth-enhancing drivers we would highlight. The first is the expected progress in pro-growth legislation such as the approval of the new regulatory framework for natural gas and private sector investment in water/sanitation services. The second is the more competitive FX rate, which should help local producers so long as the inflation outlook remains anchored, as we expect.

Inflation expectations should remain anchored but we see upside risk to GDP growth

Despite uncertainties, our 2021 outlook is rather benign

Overall, we expect the government and Congress to remain committed to the current fiscal framework. This suggests that inflation expectations should remain fully-anchored and the central bank should be able to keep the policy rate unchanged at 2% throughout 2021, providing upside risk to GDP growth expectations.

Inflation risks have risen, amid fast-rising food prices and global supply disruptions, but high unemployment and spare capacity suggest that price pressures are likely to be temporary.

We currently expect Brazil’s GDP to contract by 4.3% in 2020, among the best results in LATAM, and to grow by 3.9% in 2021. Our bias is for a better-than-expected 2021.

The Brazilian real's underperformance since mid-2019 was largely driven by the country's deep interest rate reduction and given that we don’t expect any rate hikes in 2021, the BRL should remain poorly supported by the monetary policy stance.

We expect an appreciation bias for the BRL to gradually emerge throughout 2021 however, as external accounts continue to improve and fiscal risks abate, helped by the recovery and falling debt servicing costs.

An alternative scenario in which Congress abandons the current fiscal framework and opts for fiscal stimulus would, meanwhile, create a vicious cycle. It would exacerbate fiscal risks, elevate risk premium levels and, eventually, stimulate the dollarisation of local portfolios, forcing the central bank to tighten monetary policy, resulting in further deterioration in the fiscal outlook.

Download

Download article

17 November 2020

Global Macro Outlook 2021: The darkness before the dawn This bundle contains 15 articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).