German car trouble and the CEE

Central and eastern europe's direct exposure to the US car market is relatively small. However, its indirect exposure via Germany is much larger. Were the German auto sector to face another leg lower this year, we expect the likes of the Czech Republic, Romania and Hungary to bear the brunt of the challenge

- Inventory reductions knocked 0.6% QoQ off German GDP growth in 4Q18 – an outcome largely blamed on the auto sector. While it seems unlikely this sector will fare as badly this year, China, Brexit and President Trump’s threat of auto tariffs add to the sense of uncertainty.

- With regard to the US tariff threat, the CEE’s direct exposure to the US car market is relatively small. However, its indirect exposure via Germany is much larger. Were the German auto sector to face another leg lower this year, our team expect the likes of the Czech Republic, Romania and Hungary to bear the brunt of the challenge.

Germany: How bad is it?

From fast lane to slow lane – the German economy’s car problem

The second half of 2018 saw the German economy grind to a sudden halt. While increasing global uncertainties, looming trade wars and one-off factors like the low water levels in many of Germany’s rivers also mattered, the automotive industry has probably been the most significant driver of the growth disappointment. From fast lane to slow or crawling lane within less than six months, how could this happen?

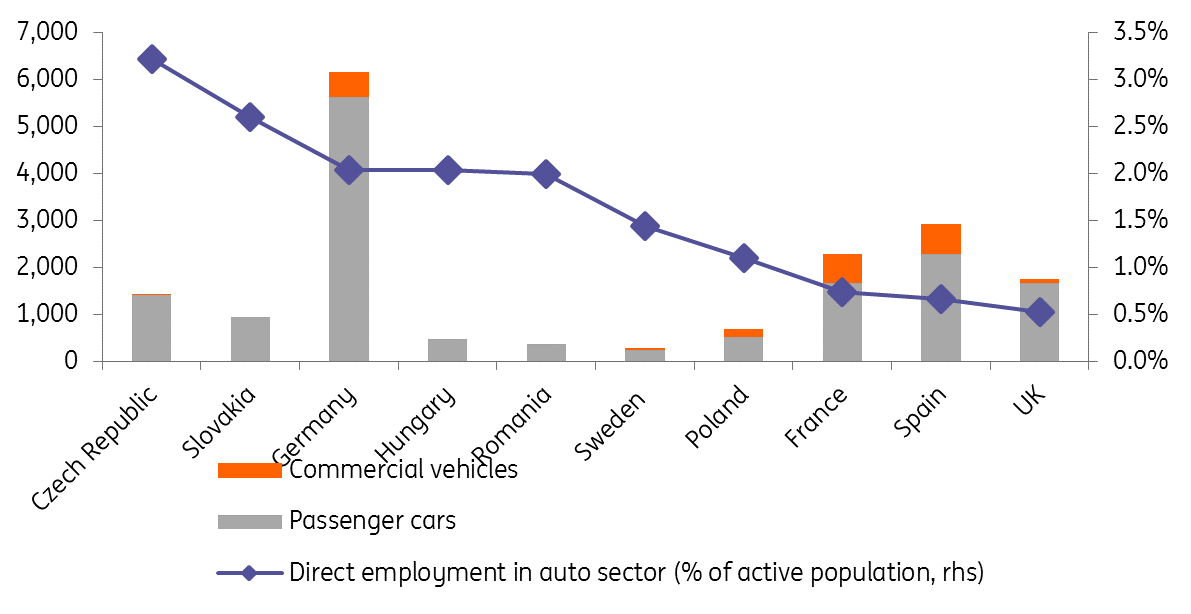

Importance of the automotive sector for the German economy

Let’s start with a reminder: the German economy is not only about cars, but cars do play an important role. Currently, some 2% of total employment is in the automotive industry. However, adding second and third round effects (just think of entire villages close to production plants), between 7% and 8% of the entire German economy is linked to the automotive industry. And there is more. Between 70% and 80% of automotives produced in Germany are exported making automotives one of the most important export goods. Also, one-third of all investments in Research and Development in Germany stem from the automotive industry.

Vehicle production in the EU (000 units in 2017) and auto employment (2016)

What caused the current slowdown?

The slowdown in the German automotive industry started in the summer of last year with announcements of city bans for cars with older diesel engines. Some five million cars could become subject to these bans. As a result, demand for diesel cars dropped and precautionary savings of German households increased. More than half a year later, however, there are first rulings that these bans will not be implemented. A complete U-turn looks possible.

Also, the introduction of a new emissions standard (WLTP, worldwide harmonised light vehicles test procedure) and delays in complying with these new standards led to severe disruptions in German automotive production and delivery. Also, the trade war between the US and China and the subsequent slowdown of the Chinese economy have left their marks. However, these marks are still very small and nothing compared with often-heard doomsday scenarios.

In 2018, total car sales in China dropped by some 4% YoY - the first decrease in twenty years. German car manufacturers, however, saw their sales increase by 2%. A slowdown, but not a contraction. In 2018, almost one quarter of all cars sold in China were German. More than one third of all cars sold by VW, BMW and Daimler went to China. VW sold almost 40% of its cars in China.

Outlook – between gloom and rebound

Contrary to the last crisis in 2008/09, the German automotive industry is currently not suffering from significant excess capacities. Nevertheless, the (German) automotive industry is facing an entire list of challenges. Some are external, like Brexit, the trade wars or a cooling of the Chinese economy; others are sector-specific, like electric mobility, CO2 emission reductions, autonomous driving or car sharing; and some are intertwined. The current trade US-China trade war has already affected German car producers in several ways as BMW is, for example, the single largest US car exporter.

The most imminent threat for the German automotive industry seems to be any Chinese slowdown

The most imminent threat for the German automotive industry seems to be any Chinese slowdown - given the abovementioned importance of the Chinese markets for German car manufacturers. Here, the fact that fiscal stimulus should lead to an overall rebound of the economy as well as the fact that there is still ample room for growth in the Chinese market (currently some 14 cars per 100 inhabitants, while in Germany it is 56), both bode well for a gradual rebound.

The elephant in the room

As regards the two other external risks, Brexit and trade wars, the downside risks are far greater than any upside. Aside from short-term disruptions of supply chains for some German car manufacturers, a hard Brexit could lead to a drop of around 30% of German car sales in the UK (according to Deloitte). The biggest elephant in the room is possible US tariffs on European cars.

The biggest elephant in the room is possible US tariffs on European cars

In theory, President Trump is due by mid-May to follow up on the Commerce Department’s as yet unpublished findings as to whether US auto and auto-part imports are proving a national security threat. For reference, the three largest German car manufacturers import more than half the vehicles they sell in the US from other countries (Daimler about 50%, BMW around 70% and VW more than 80%). Not all imports come from the EU, they also come from Mexico. German car exports to the US account for between 3% and 12% of the three companies’ annual sales. BMW and Daimler export around 50% of the cars produced in the US to countries outside the US.

Effect of US unilateral import tariffs on GDP (import tariffs of 25% on cars, % of price-adjusted GDP)

The threat of tariffs

The introduction of tariffs on European cars is therefore a very complex and complicated issue. Next to the pure sentiment effect, the actual impact of a 25% import tariff on cars would, according to the Ifo index, lead to a reduction of German GDP by 0.16%. Given the inter-linkages of German automotives and automotive suppliers, the short-term impact could be even higher. In our view, the US administration will try to leverage the threat of tariffs on European cars for as long and as much as possible. This could be done without even imposing these tariffs.

The German automotive industry could leave the crawling lane in the coming months

All other structural challenges the (German) automotive industry is currently facing are longer term with unclear implications currently. The only thing that is clear is that the sector will undergo further changes and shake-ups. At the current juncture, this means that cost pressures will probably mount, investment needs will increase and restructurings will occur. How far and when this will play out at the macro level is impossible to tell.

Nonetheless, we believe the German automotive industry could leave the crawling lane in the coming months as some of last year’s braking factors should disappear. A quick return to the fast lane, however, looks unlikely and unexpected collisions cannot be excluded.

Poland - less exposed to autos, more insulated on the fiscal side

The Polish economy, and its export structure, is one of the most diversified among the CEE economies. Also, Poland’s reliance on the automotive sector is one of the lowest in the region. As a result, only limited value added (0.03% of GDP) is linked to car exports to US. We worry about the secondary effects via Poland’s main trading partner, Germany, where the reliance on the US car market is much higher (up to 0.34% of German GDP is linked to value added created by cars sent to the US). Moreover, US car tariffs would hit already weak German manufacturing, which has fallen into recession.

So far, the Polish production sector has demonstrated an impressive resilience to the slowdown in German manufacturing. We think strong domestic demand in Germany and the eurozone is probably offsetting the weakness of the markets for Western Europe’s exports. Should US car tariffs (or other factors) start to impact German labour markets and domestic demand,

Polish production may start suffering and deduct from GDP growth. Still, due to the significant fiscal stimulus announced ahead of the October 2019 general election, Poland may prove to be among the least sensitive of the CEE economies to the eurozone and German slowdown. Some CEE peers might have lower fiscal room (especially Romania) or are much more open economies (such as the Czech Republic and Hungary).

Top four trading partners for exports of goods, 2016

Czech Republic – in the firing line on autos

Car production represents the most important industrial and export segment in the Czech Republic, having an almost 30% share in total Czech exports. In 2018, there were 1.4 million cars produced in the Czech Republic (1.7% YoY increase), which makes it one of the countries with the highest car production per capita in the world, after Slovakia. There are three main car manufacturers, Škoda Auto (61% share), Hyundai Motor Manufacturing Czech (24% share) and Toyota Peugeot Citroën Automobile (15% share).

A further slowdown in global car production would have greater implications for the Czech economy

According to the Czech Automotive Industry Association (AIA, AutoSAP) the automotive industry employs around 150,000 people directly (3% of total workforce), but there are a further 400,000 jobs linked to the automotive industry indirectly. As such, due to the significant supply chains related to the automotive industry, the total share of the automotive sector for the Czech economy represents around 9% of GDP. Official statistics imply a weaker dependence as the car segment represents around 20% of industry, which had a 29% share in GDP last year. This equates to around 6% of GDP, but this figure does not include the abovementioned supply chains producers. Due to the relatively limited link of the Czech automotive industry with the US market, the impact of US-EU car tariffs would not be significant, slightly below 0.1ppt, based on IFO estimates, as you can see in the chart above.

However, a further slowdown in global car production, mainly affecting German producers, would have greater negative implications for the Czech economy. That said, carmakers in the Czech economy were operating at stretched capacity last year, so there is no expectation of any further growth in the car industry this year anyway.

As such, some decline in demand should resettle the economy towards more balanced growth, with very limited negative consequences for the Czech economy. However, a more prolonged and severe slump in global car demand would hit the Czech economy sooner or later, as currently-solid domestic Czech demand would not be enough to compensate for a slowdown in one of the most important sectors of the economy.

Passenger car production plants across Europe

Hungary – insulated by high margin brands?

There are several reasons why Hungary would be among the most affected countries by tariff impositions and any impact on Germany. The Hungarian automobile industry produces about 5% of GDP, also it employs (on some measures) 4% of total workers in the country. Most cars and car parts are produced by German companies (VW Group and Daimler), and 90% of the production is exported. About 10% of exported cars go to the US, thus tariffs would cause a 0.2% decrease in the GDP - the highest in Europe.

There are several reasons why Hungary would be among the worst affected countries

On the other hand, the Hungarian economy has been more driven by domestic demand over the past couple of years. Indeed, export activity has decoupled somewhat from European and German trends.

If we consider industrial production in 2017 and 2018, the growth structure is more balanced than before, meaning that the car industry is not the key driver of growth currently. So despite being the biggest contributor to GDP, mid and lightweight manufacturing sectors are boosting growth in industry, counterbalancing the issues in car manufacturing. Also German carmakers (Audi and Mercedes and soon-to-arrive BMW) produce luxury cars, where demand is not really price-elastic – thus US tariffs would perhaps not hit the Hungarian auto market as much as it would hit mid-level car producers.

All things considered, the direct effect of higher US tariffs in the real economy would be relatively small, although it could cause a major turbulence in the FX market. Should a tit-for-tat trade war arise between the US and EU, it would have more serious consequences for the region than we see for it right now.

Romania – very much in the mix

Germany is the largest export partner for Romania with a 22.9% share of total exports. Around two-thirds of total exports are automotive related. Hence, automotive-related exports to Germany account for about 15% of Romanian exports, representing roughly 10% of Romania’s GDP and employing approximately 90,000 people.

A slowdown in the German auto industry would have a direct negative impact on Romanian exports, planned investments by German companies and GDP growth with subsequent implications for the currency, especially considering the twin deficits are at or above warning levels.

Turkey – competitively positioned

Turkey is the leading CEE contributor to vehicle production as a large base for global original equipment manufacturers (OEMs) while it has been increasing its component exports over recent years, where Germany is now its number one export market. As of end-2018, automotive exports to Germany stood at US$4.25 billion, having more than a quarter share in total exports to this country.

Exports of motor vehicles and components are roughly balanced. These numbers show a relative sensitivity to German demand, but Turkey’s cost and competitive advantages, helped by a competitive Turkish Lira as well as a quite diversified export market structure, will likely help Turkey weather any slowdown in the German automotive industry.

Russia

Russia seems more-or-less isolated from the travails in the global auto sector. According to 2018 statistics, Russia exports only 6% of light vehicles it produces locally, or 0.1 million out of 1.6 million. In USD terms, car exports total US$1.3 billion, or 0.3% of the country’s total exports.

One potential channel of pass-through is via higher costs of imports and local production. Russia imports around 0.3 million new and used cars annually, worth US$7.3bn, or 3% of imports, which does not seem significant. However, it is worth mentioning that depending on the model, around 40-60% of local production requires imported investment and intermediary goods. Therefore, the global trade tensions can potentially affect at least half of Russia’s US$30bn car market.

Conclusion

The German car industry faces an uncertain environment and certainly the imposition of US tariffs would be a very unwelcome headwind. Looking across the CEE space, the Czech Republic and Romania look most exposed, while Hungary will hope that its concentration in the luxury German car space will provide some insulation.

This article is from our major report, Directional Economics: CE4 policy tools for the next downturn: Who's got the firepower?

Download

Download article

5 April 2019

In case you missed it: Europe’s challenges This bundle contains 8 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more