FX: Non-dollar opportunities

The Fed pause and the US: China trade truce has improved the external environment and allowed under-valued currencies to recover. As long as the trade truce holds, we expect this positive environment to continue and the dollar to stay gently offered. However, a serious risk event this month is the threat of US tariffs on auto imports

We cautiously expect the rotation out of defensive positions to continue

It has been a positive start to the year for risk-sensitive currencies, especially those backed by the commodity cycle. Despite much talk of slowing global trade volumes amidst weak growth in China and Europe, a common theme in the FX world has been of investors rotating out of defensive positions in the US dollar and into undervalued currencies – especially in emerging markets. We cautiously expect this theme to continue over coming months, but accept that Washington trade policy could easily pull the rug from under what has otherwise been a good year for risk assets.

A Star Wars analogy - if readers will allow it. Turbo-charged US growth last year saw the US play the role of the all-powerful Death Star in our galaxy. The relatively high returns offered in US – helped in part by Fed tightening – saw the tractor beam of US financial markets suck in global portfolio flows at the expense of most other economies. This supported the dollar across the board and left emerging markets – especially those in need of external financing – vulnerable.

This year it is perhaps Fed Chair, Jay Powell, who has taken the role of Obi-Wan Kenobi and switched that US tractor beam off. The surprising switch to a neutral Fed stance in January – taking further tightening off the table – has allowed breathing room to emerge for other asset classes outside of the US and for portfolio flows to drift away from defensive positions in USD cash. Of course the temporary US-China trade truce has helped here as well.

Flows into EM Equity ETFs pick up this year

Expect EUR/USD to languish in a 1.13-15 range through the early part of the year

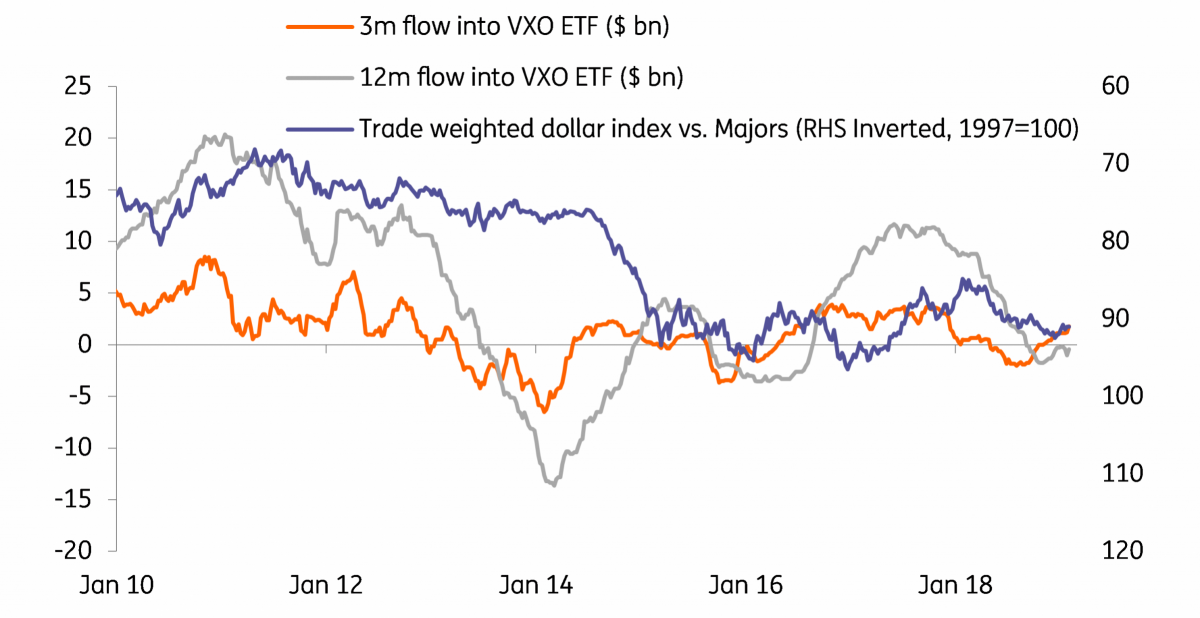

A common refrain amongst the buy-side this year has been the switch into undervalued emerging market assets. Some evidence of this can be found in the flows into Exchange Traded Funds (ETFs), which track EM equities. One of the most closely followed ETFs in the EM space is the VXO, a Vanguard fund which tracks the performance of the FTSE Emerging Markets equity index. On a three month basis, this ETF is now seeing the largest amount of inflows since December 2017.

As long as the US-China trade truce holds, we would expect this theme of rotation away from the US to keep the dollar gently offered across the board – especially against the high yielding, activity currencies, many of which are found in emerging markets.

However, sluggish growth in the eurozone and the Brexit debacle are preventing much of a recovery in European currencies. And it’s hard to see that story changing substantially over coming months. As such we expect EUR/USD to languish in a 1.13-15 range through the early part of the year, before embarking on a move to 1.20 by year-end if the European Central Bank is in a position to hike the deposit rate in 3Q19. Clearer signs of a US slowdown would help this narrative too.

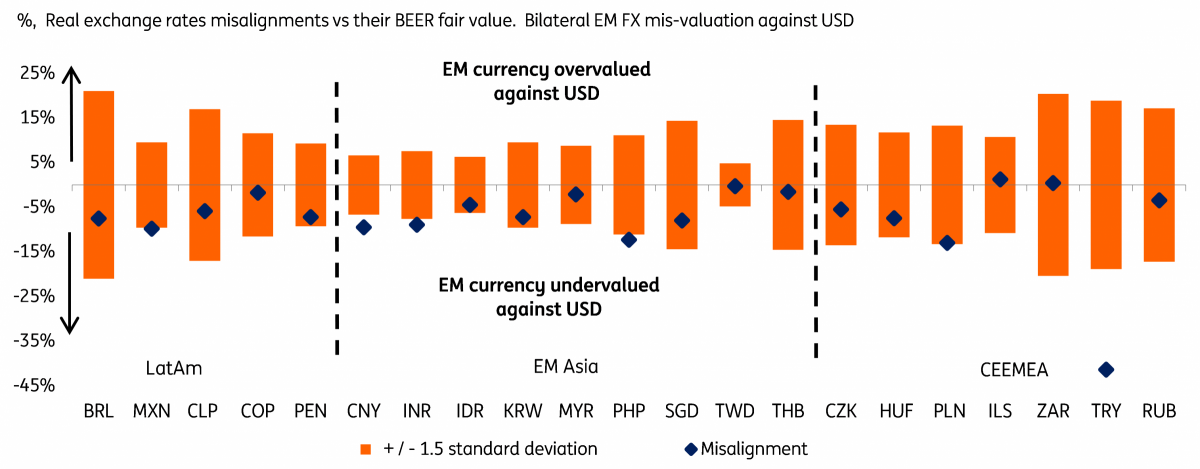

After a torrid year in 2018, EM currencies are still largely under-valued

Trade remains the big risk

Probably the biggest risk to all of the above is Raoul Leering’s potentially much more negative scenario on trade. A full revival of the US-China trade war – as we saw last summer – would pull the rug from the emerging market re-rating story.

Equally, a possible Commerce Department ruling by 17 February that auto imports prove a national security threat could smash European currencies. Whether President Trump chose to implement any recommendation would determine the full impact on the euro – but such a move would indeed represent the use of a big stick and likely send EUR/USD under 1.10. The sliding euro would also drag auto supply chain currencies in CE4 with it.

Download

Download article

8 February 2019

February Economic Update: Stick or twist? This bundle contains 9 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more