FX: Mid-terms are key for the dollar

The US mid-term elections are key for US dollar pricing. If Republicans are able to maintain control of the House, the dollar will likely stay stronger for longer, possibly due to fresh fiscal stimulus. But this isn't the consensus and we're more likely to see a modest dollar decline- though not a full knockout

US mid-term elections will test the conviction levels of USD bulls

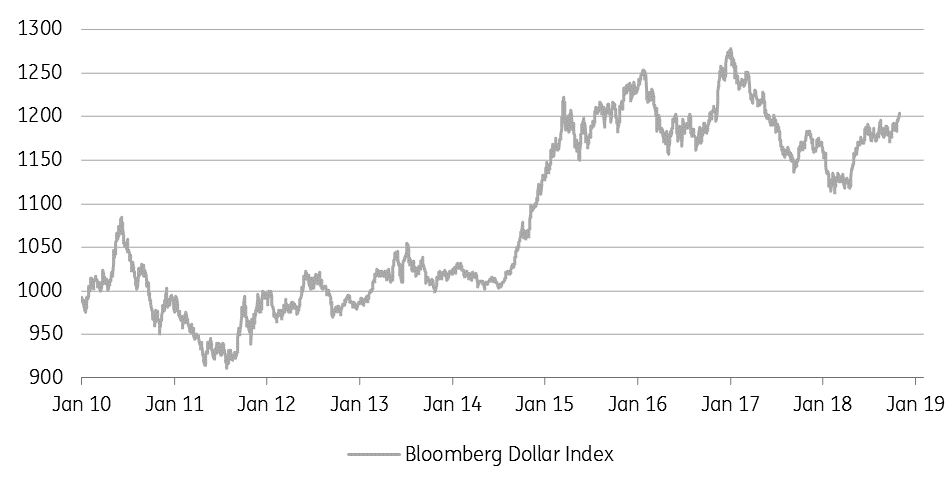

Global investors continue to back the US growth story and the dollar. And several measures of the trade-weighted dollar are pushing to new highs for the year. There is not a strong case for altering that positioning right now, but the outcome of the US mid-term elections – and its implications for the US fiscal-monetary policy mix – will test the strength of those convictions. At the same time, a reassessment of the eurozone growth/monetary policy story has led us to downgrade our EUR/USD profile.

The 2018 de-synchronised global growth story rolls on. US growth continues to outperform the Rest of the World and we suspect we are at the point in the US cycle where the Phillips curve reasserts itself and US wages break higher. Such a development would support Fed tightening expectations and, without further US fiscal stimulus, help characterise the US as a late-cycle economy. That’s not necessarily bad news for the US dollar.

Dollar Index pushes to a new high for 2018

However, US mid-term elections will play a crucial role in USD pricing. The consensus expects the Democrats to win the House, raising expectations of: i) a fiscal impasse in Congress (be it no fresh stimulus and/or a battle over the debt ceiling) and ii) possible impeachment of President Trump. This looks like a modest dollar negative, but not a knockout blow since protectionism and pressure on European and Chinese growth will continue into 2019.

More US fiscal stimulus would keep the dollar stronger for longer

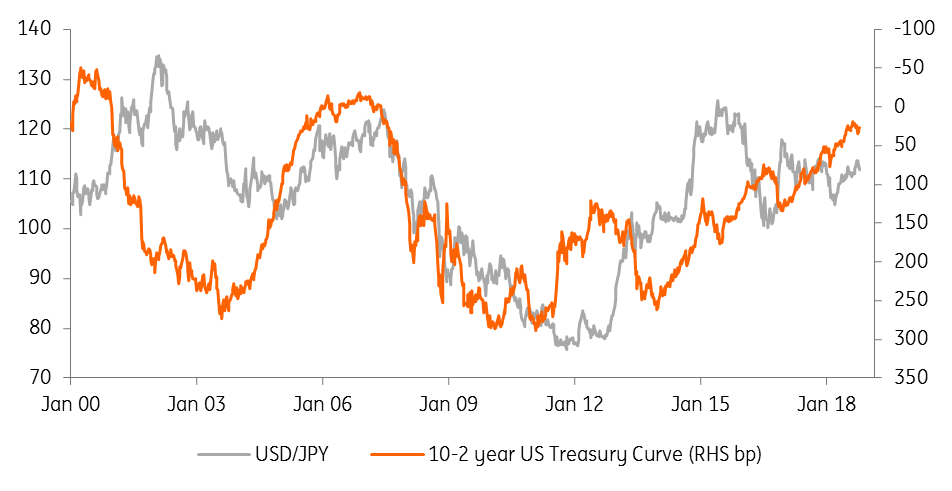

Republicans retaining control of Congress would be the more surprising outcome. Additional fiscal stimulus, delaying the point at which the US converges on weaker global growth, would keep the dollar stronger for longer. Perhaps even into 2020. For the time being, we assume no new US fiscal package, US market interest rates topping in 1Q/2Q19 and the dollar trending lower into 2H19 as the US growth premium erodes. That story is probably best shown in our USD/JPY profile, which we see staying firm into 1Q19 before turning lower.

US yield curve flattening keeps USD/JPY supported

The EUR has unique challenges

The EUR, however, has more unique challenges. Our prior call for EUR/USD ending 2019 at 1.30 looks untenable at this stage. It was premised on a normalisation of ECB policy and the convergence in US and European economies, which would allow equity investors to rotate eastwards across the Atlantic.

Sub 1.10 EUR/USD forecasts could make a surprise comeback

This month our eurozone team is taking a big chunk out of eurozone growth forecasts for 2019/20, plus delaying the first ECB rate hike into 4Q19. If EUR/USD is to move higher through 2019, it looks increasingly as if it will have to be driven by a weaker dollar rather than a stronger euro. We now see EUR/USD staying pressured near 1.15 into year-end 2018 and making a weaker recovery by late 2019. And a surprise Republican hold of the House and fresh US stimulus could see sub 1.10 forecasts make a surprise comeback.

Download

Download article

2 November 2018

November economic update: A changing of the guard This bundle contains 8 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more