FX markets: Back from the brink?

News from President Trump that a trade deal with China is ‘moving along nicely’ has seen risk markets rebound and the dollar sell off. Whether this is a ploy to help US equities into the mid-term elections remains to be seen, but clearly, November will be a big month for the dollar

A trade deal by the end of November?

Following a phone call with President Xi on Thursday, President Trump has said that a trade deal is moving along nicely and raises (modest) expectations that some kind of bilateral agreement can be reached by the end of November when the two presidents meet at the G20 in Argentina.

It’s probably far too early to be shifting base-case views on protectionism – e.g. does Washington merely want to reduce the bilateral trade deficit or does it have more strategic ambitions to slow China’s ‘Made in China 2025’ ambitions? - but the (limited) prospects of a trade deal at the end of November could prove a cushion for risk assets and catch out fund managers overweight cash – largely USD cash.

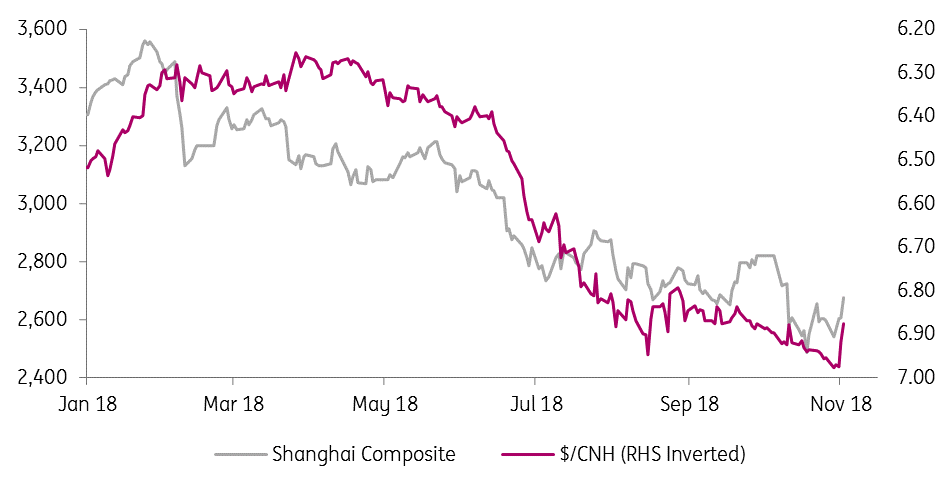

Today’s news has served to drag USD/CNH away from the psychological 7.00 area – a level which had been protected by the People's Bank of China over recent months via: i) making forward Renminbi sales more expensive, ii) closing loopholes for capital outflows and iii) re-introducing greater PBOC control in daily USD/CNY fixings.

Today’s market moves will prove a double-edged sword for the Chinese leadership. While some relief from the ‘Sell China’ market mentality will be welcome, the moves are a demonstration of the power of Washington policy on the world’s financial markets.

'Sell China' takes a break

Activity currencies enjoy temporary respite

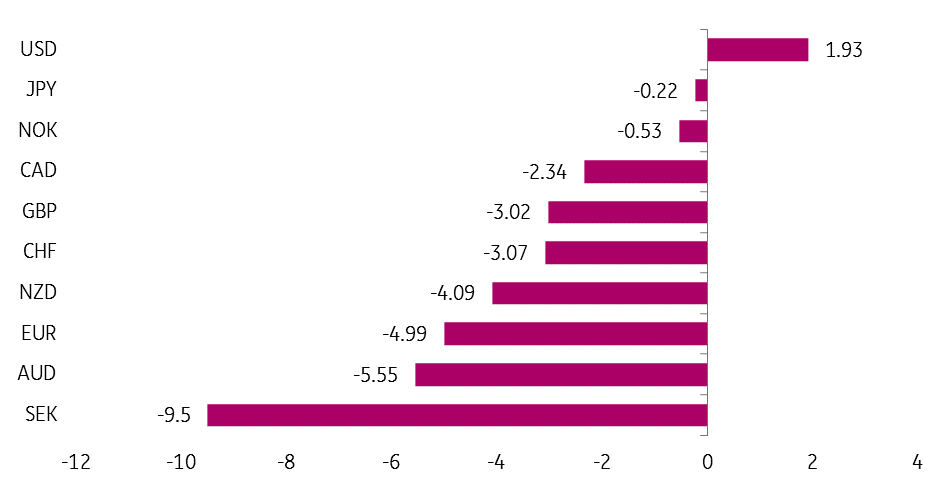

Some re-assessment of Washington’s stance on China has allowed activity currencies to recover. The open economies of Europe and Australasia have suffered heavily on this year’s protectionism.

The chart below highlights year-to-date performance versus the US dollar in terms of total returns. The Swedish krona has been a big underperformer in the G10 space, while the total return nature of the chart serves as a reminder that USD rates have delivered nearly 2% year-to-date. A similar chart for emerging markets shows significant outperformance of the Mexican peso, largely a function of improving relations with the US and high domestic interest rates.

Year to Date Total Returns versus USD (%)

Hold your horses

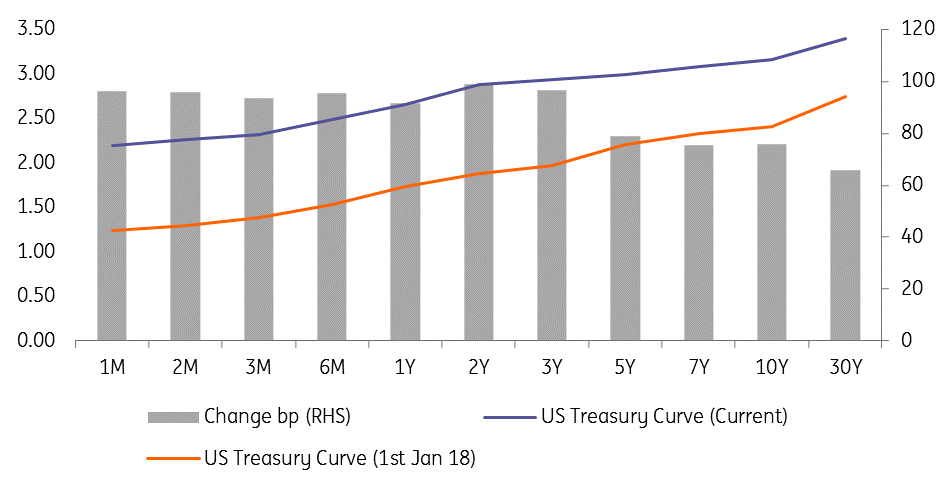

But before we get too gung-ho on the demise of the dollar and an aggressive recovery in activity currencies, we’ve got to remember the US rate story. US rates have risen 75-100 basis points across the US Treasury curve this year and arguably less aggressive US trade policy makes it more likely that the Fed delivers on four more hikes by the end of 2019. That’s not particularly good news for EM or activity currencies.

While expectations of a trade deal might provide a little support to risk, we think US mid-terms will also have a big say in the next big trend for the dollar. A Republican loss of the House is the consensus now and a surprise hold in the House would be US dollar/equity/yield positive - so let's see what the mid-terms have to offer.

In short, it looks far too early to declare that the de-synchronised global growth story has run its course for the time being and we suspect the current adjustment in short activity FX/long dollar will be limited. That should mean EUR/USD struggles to break back above the 1.1550/1620 area in November.

US Treasury Curve: Bear flattening

Download

Download article

2 November 2018

In case you missed it: Change of guard This bundle contains 9 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more