Eurozone: Politics in motion, weaker growth momentum

With Merkel throwing in the towel and the Italian government still not yielding to the European Commission's budget pleas, Eurozone governance is becoming increasingly hard. And the slowing growth momentum won't help either

ECB calls current situation as loss of growth momentum

At its October meeting, the Governing Council of the European Central Bank decided to proceed with the phasing out of its net asset purchases despite some signs of decelerating growth. The ECB downplayed the recent turmoil in financial markets and characterised the current situation as a loss of momentum, but not a downturn. We tend to agree, although a loss of momentum will already bring Eurozone growth rates to a level that could create new discussions regarding the need for a more expansionary budgetary policy.

What’s in a name? Whether you call the recent batch of less upbeat economic indicators a loss of momentum or a downturn, it all boils down to lower growth

The first estimate of third-quarter GDP growth was only 0.2%, a clear disappointment. There are without a doubt a number of headwinds with the still undecided Brexit deal, the tensions between Italy and the European Commission and international trade tensions as the usual suspects. But more recently the tensions on financial markets, if sustained, could also constitute a brake on growth.

Several headwinds remain

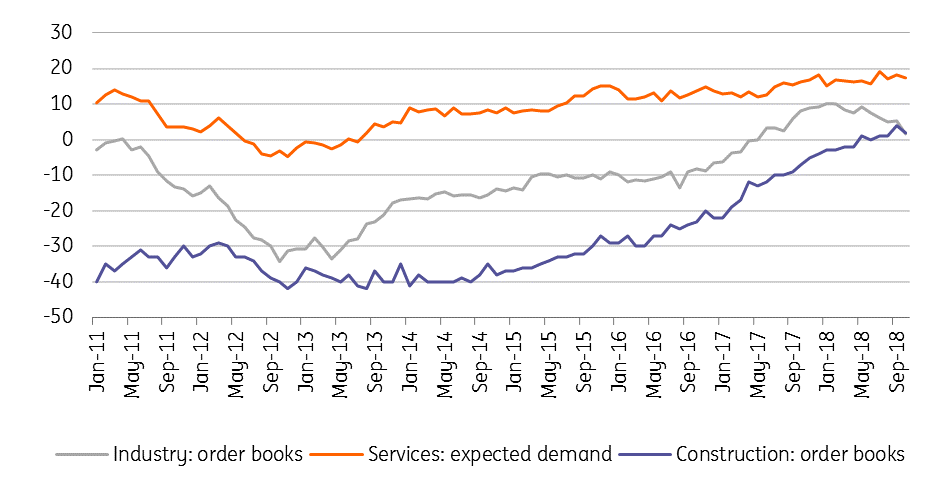

While the wealth effect is in general smaller in the Eurozone than in the Anglo-Saxon economies, it is not negligible either. Recent work by the ECB estimates a 0.1 % impact on consumption from a 10% change in the stock market. So, even if a 20% stock market correction would not derail the recovery, it would surely dent the growth outlook. The flash Eurozone composite PMI fell to 52.7 in October, down from 54.1 in September and reaching its lowest since September 2016, with especially the manufacturing sector losing momentum. So there is definitely already some pain and the fourth quarter is unlikely to see a strong growth rebound.

Slowdown mostly in industry for now

Underlying momentum remains strong enough to keep growth in positive territory

Shouldn’t we consider the risk that the headwinds will bring the economy to a standstill? While this is not impossible, it’s still rather unlikely for the coming quarters. The ECB’s bank lending survey still paint a relatively upbeat picture, corroborated by healthy credit growth. Net credit demand continued to increase across all loan categories in the third quarter of 2018. A high level of capacity utilisation and the low general level of interest rates continue to drive credit demand for fixed investments. And the same holds true for mortgage loans and consumer credit, boosted by a supportive economic environment and a very low level of interest rates. In October 2018, consumer confidence actually increased slightly in the Eurozone, not a sign that consumers are particularly depressed. The eurocoin indicator, which tracks the monthly GDP growth pace, rose for the second month in a row in October.

Loan Survey: Net change in credit demand

We expect a softening of the growth pace

So our scenario pencils in a continuation of the growth story. But that said, we feel the underlying growth momentum is likely to soften further. Whereas in 2017 quarterly growth still hovered around 0.7% and in the first half of 2018 around 0.4%, we believe that this will weaken to 0.3% between 2019 and 2020. Because of base effects, our 2018 GDP forecast remains at 2.0%, but we have downgraded our 2019 and 2020 forecast to respectively 1.4% and 1.3%.

Chancellor Merkel might not stay on for a full term

At the same time, the political backdrop is not helpful either. While some observers already see the end of Angela Merkel’s government in Germany, after disappointing state elections in Bavaria and Hesse, we would caution against jumping to conclusions too quickly.

The fact that Merkel is no longer candidate for the party leadership shows that a generational change is being prepared

Indeed, the significant electoral losses of both centrist government parties are a testimony of the fragmentation of the political landscape, not only in Germany but in most European countries, which makes governing more difficult. At the same time, neither Merkel’s CDU nor the social-democrats have an incentive to seek general elections now. That said, the fact that Merkel is no longer candidate for the party leadership shows that a generational change is being prepared and that Merkel might not necessarily stay on as chancellor for the full mandate. With Merkel, one of the unifying German voices within the European Union would go.

Italy enroute a collision course?

Meanwhile, the Italian government remains on a collision course with the European Commission. The Italian government rejected the Commission's demand for a redraft of the budget. It remains to be seen whether the Commission will be ready to launch an Excessive Deficit Procedure on the back of too slow a decline in the debt ratio. But even then the whole process will take months.

Within the Italian government some voices are looking for a compromise and the European Commission will try to avoid to start a fight in the run-up to the European Elections. Bottom line is that the uncertainty will continue to linger for some time to come. At the same time we doubt that the fiscal push will have a big impact on Italian growth as some of its positive effects will be neutralised by higher interest rates on credit to the private sector on the back of the higher government bond yields.

ECB interest rate hikes could be delayed

The ECB is also unlikely to come to Italy’s rescue with additional QE. That said, a new TLTRO in June 2019 to help the banking sector might be feasible. We have also changed our interest rate call on the back of the weaker growth outlook. While inflation came in at 2.2% in October, underlying inflation is still only 1.1%, and the pick-up looks to remain very gradual.

We now expect only one deposit rate hike in 4Q19, meaning that money market rates will remain negative throughout 2019. A second rate hike (both deposit and refi) might come in 1Q20, but that is a close call. Anyway, we don’t see it going further afterwards. The low-interest rate environment is thus going to remain with us for quite some time.

Download

Download article

2 November 2018

November economic update: A changing of the guard This bundle contains 8 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more