ECB president succession: Nationality matters…sometimes

Our analysis of eurozone central bankers’ communication shows nationality matters, but not really in the ECB’s board. And once the appointment is made, the national bias won't be as significant as many ECB watchers think these days

When European leaders meet in Brussels this week, they won't only be discussing ways to further deepen the monetary union but also scratching their heads on how to best fill the top European jobs.

As we've discussed in detail before, an already complex musical chairs game has become even more convoluted as it also includes replacing the ECB president Mario Draghi. In the past, the ECB president was appointed in an exclusive process but due to the timing of Mario Draghi’s term ending - 31 October, the position has been included in the bigger game. Nationalities, gender, political affiliations and previous jobs, everything matters.

As hard as it may be for market participants and ECB watchers to understand, leaders will first choose the next president of the European Commission before appointing Draghi’s successor.

No real front runners as the presidency is part of horse trading

Given the deadlock in the talks up until now and particularly the increasing differences between France and Germany, chances have increased that this week’s summit won't tell us ‘who is who’ in European politics.

We think it's very hard not seeing one of the Spitzenkandidaten as the next European Commission president. While the German politician Manfred Weber has the backing of the largest party in the European Parliament - the EPP, there is growing resistance against Weber. This could open the door for the Danish-born Competition Commissioner for the EU, Margrethe Vestager or the centre-left Dutch politician Frans Timmermans. If Weber doesn't get the job, chances of another German, Jens Weidmann, to take over Mario Draghi’s seat increase.

In any case, while many observers believe this round of European musical chairs would bring both France and Germany a top job each, a scenario in which neither country gets one should no longer be excluded.

We think it's very hard not seeing one of the Spitzenkandidaten as the next European Commission president

Zooming in on the next ECB president, there is no real news on a front-runner. It still looks as if Draghi's successor will emerge from the group of Germany's Jens Weidmann, France's Francois Villeroy de Galhau or Finland's: Oli Rehn and Erkki Liikanen plus the outsider or compromise candidates including Klaas Knot, Ardo Hansson or Benoit Coeuré. While the European Treaties ‘only’ say that the ECB president (as well as all other Executive Board members) should have “recognised standing and professional experience in monetary or banking matters”, it's hard to imagine any candidate without central bank experience.

Does nationality really matter?

Officially, nationality shouldn't matter. However, given that the Draghi-succession has now become part of the bigger European horse trading, nationality will matter.

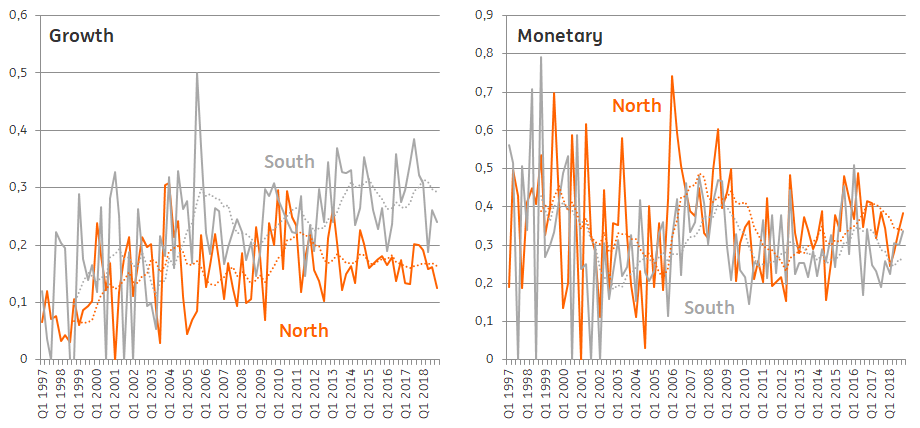

We all know of the prejudices about core European hawks and Southern European doves. To lift the issue of nationality out of the cocktail party sphere to a more analytical level, we find that that there is indeed a significant difference in terms of topics that central bankers discuss. Southern European Governing Council members are much more concerned with growth-related issues, while Northern European Governing Council members have more of a tendency to discuss monetary issues like inflation and price stability.

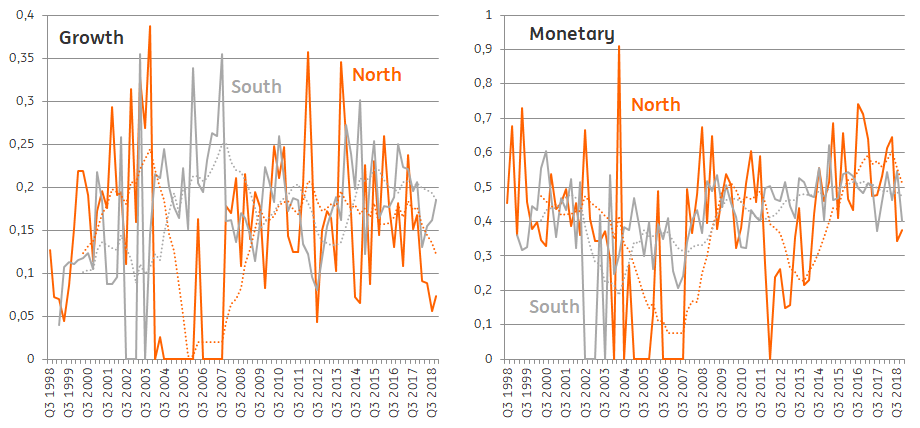

However, surprisingly, this national bias tends to disappear in the ECB’s Executive Board, as our analysis finds that ECB board members discuss less diverging themes based on their background.

Governing council members see clear differences between South and North in terms of topical discussion in speeches

ECB executive board members have less clear divisions in terms of themes discussed in speeches

Leaving the national passport at the door

Even if the European musical chairs game currently looks set to continue after this week, giving all commentators more time and material to gossip and engage in tea-leaf-reading on who will get which job, the ECB presidency remains the most important nomination for markets.

The results of our analysis give hope that even though nationality will matter during the appointment process, the national bias won't be as significant as many ECB watchers think these days

Now that the ECB has moved towards a new easing bias, opening the door for rate cuts and other monetary action, any Draghi successor will not only be questioned and tested on “whatever it takes” but also on the continuation of the latest dovish shift. In this regards, we could see marginal differences between a more hawkish new president, let’s call him Jens Weidmann, and a more dovish president, let’s call him Benoit Coeure. This difference won't be apparent in the pace of normalisation but rather in the depth and determination of additional easing.

In the broader sense of things, the results of our analysis give hope that even though nationality will matter during the appointment process, the national bias won't be as significant as many ECB watchers think these days. Chances are much higher that the ECB president will be presidential, leaving his or her national passport behind at the security control of the EuroTower on 1 November this year.

Footnote

Our analysis of the ECB speeches is done using word count methodology based on Ernst and Merola (2018).

The vertical axis depicts the relative intensity of the topic in speeches where one means all of the speech were about a single topic. The thematic categories “monetary” and “growth” consist of five keywords central to the themes (for growth: expansion, recovery, productivity, GDP and economic growth, for monetary: inflation, interest rates, money, assets and quantitative).

The country grouping north includes Germany, Netherlands, Luxembourg, Ireland, Finland, Estonia, Lithuania, Latvia, Slovakia and Austria. The country grouping south includes Italy, Spain, France, Belgium, Portugal, Greece, Slovenia, Malta and Cyprus.

Download

Download article

28 June 2019

In case you missed it: It’s wait-and-see time This bundle contains 9 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more