Dutch exporters, already feeling the Brexit pinch

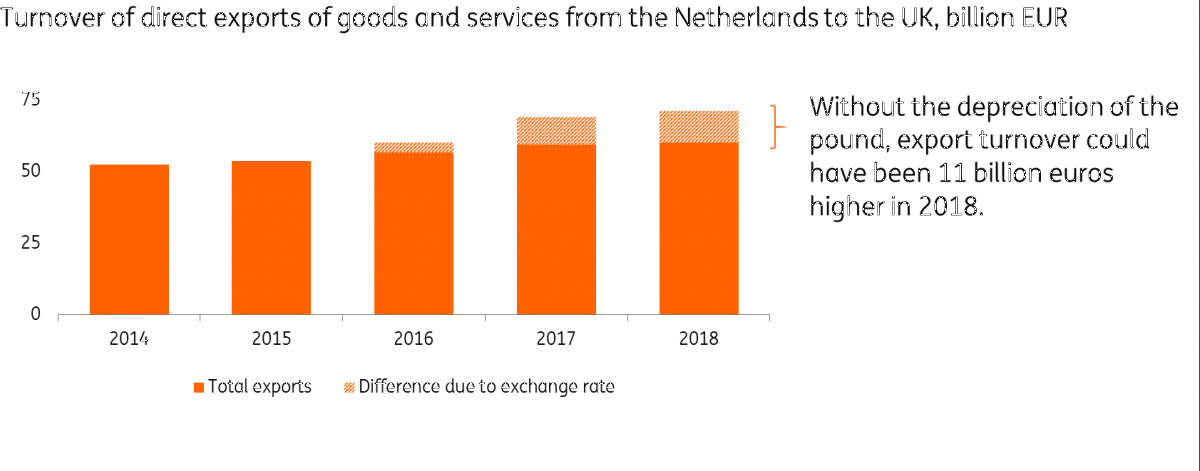

Since the Brexit referendum, the growth of Dutch exports of goods to the UK has virtually come to a standstill while exports of goods to other countries grew by 17%. According to our analysis, the fall of Sterling reduced the value of Dutch exports to the UK by nearly €11 billion in 2018

Growth in output value under pressure, thanks to Brexit

The economic pain of Brexit is evident, even before the UK leaves the EU and this is particularly noticeable in exports. Since the referendum in 2016, the growth of Dutch goods exports to the UK has virtually come to a standstill.

This is due to two factors: the fall of the pound against the euro, i.e., the 'currency effect' and the cooling of demand among British consumers and producers. The fall in the value of the pound has made products from outside the UK relatively more expensive, and as a result, the position of Dutch suppliers has deteriorated compared with British competitors.

It's estimated that in 2018 alone, the currency effect reduced the export value of goods and services by nearly €11 billion *, but simultaneously, in the last three years, total exports to other European countries have increased sharply, so this positive trend has so far alleviated Brexit pain for Dutch businesses.

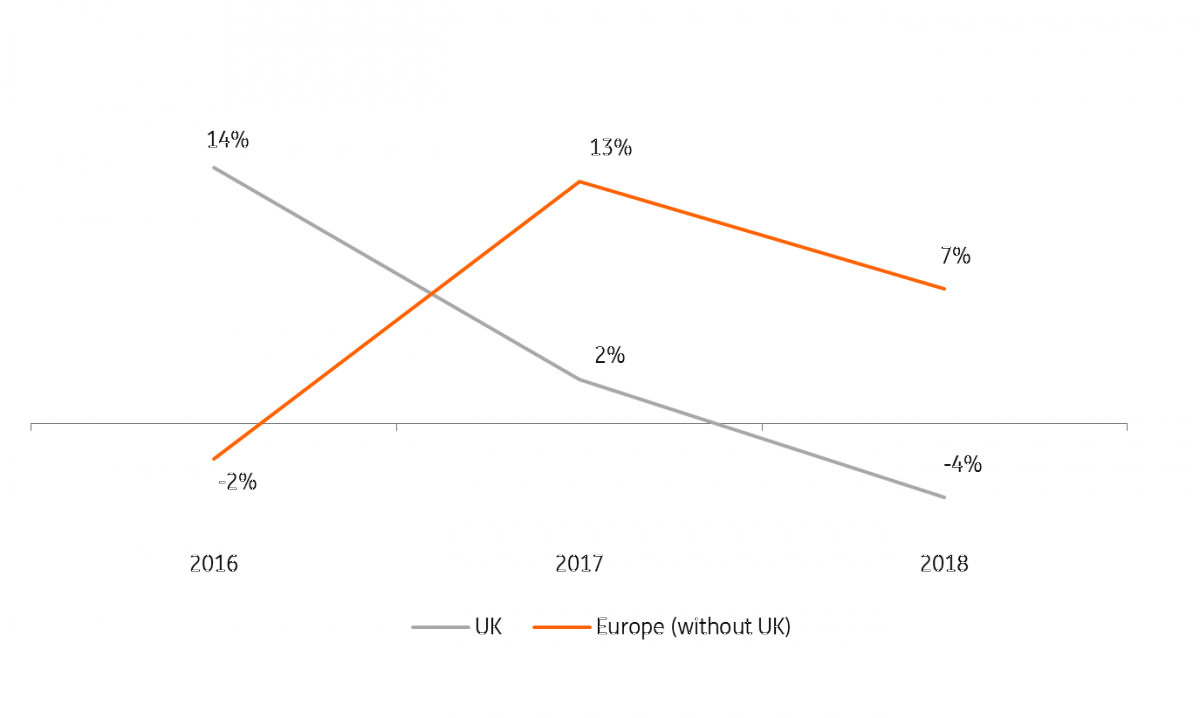

Growth of Dutch goods exports to the UK is lagging

Trend in turnover of Dutch exports, 2018 compared to 2016

Agriculture, industry, transport and wholesale are feeling the pain

The currency effect and the drop in demand have brought negative consequences for Dutch companies that do a lot of business with the UK, as they're experiencing pressure on their margins and/or volumes alongside a greater need to focus on alternative markets.

In particular, companies in agriculture and fisheries, industry, trade, and transport indicate that Brexit affects their business. The proportion of entrepreneurs who expect Britain leaving the EU will affect their business operations in the coming months has increased to 25% at the beginning of 2019.

*We calculated the impact of the currency effect on the export value as follows:

1. The starting point is the long-term development of Dutch exports to the UK, and the euro/pound exchange rate. 2. Using a regression model, we estimated the elasticity of the euro/pound on the Dutch export flow to the UK. The export flow from the Netherlands to the rest of Europe was used to monitor third-party effects. 3. Both goods (monthly data) and services (quarterly data) showed that there was a connection. 4. The elasticity has been used to adjust the export flow for exchange rate changes after January 2016.

Brexit has already had a substantial effect on export turnover

Agrifood

- The export value of Dutch agrifood* products to the UK was almost €6 billion in 2018. But since 2016, development of these exports has been significantly worse than in previous years.

- The export value decreased slightly in 2018. For the three most important product groups (fruit and vegetables, meat, and flowers and plants) the development is even more negative.

- Traders say they are hardly affected by lower sales volumes, but lower prices are playing a role. Companies in the agrifood chain also respond creatively to market developments. Traders often find new markets for their fresh products fairly quickly if necessary or adjust their product range. In British supermarkets, this sometimes results in shrinkflation. For example, to keep prices at the same level, a bouquet is sold containing one less flower.

*agricultural raw materials, foodstuffs, drinks, flowers, and plants

Export growth agrifood to UK well below long-term average

Growth in the export value of the agrifood sector, year-on-year. Long-term average based on developments between1996 -2015

High-tech industry

- The UK accounts for 8.5% of the total export value of the Dutch high-tech industry. Exports to the UK were down in 2017. The figures for 2018 indicate a slight growth due to an increase in re-exports, but exports of goods produced in the Netherlands continue to decline.

- Within the high-tech sector, manufacturers of machines and trucks, among others, are being hit by British companies postponing or cancelling replacement and expansion investments.

- More than 40% of entrepreneurs in the industry expect Brexit will influence their business operations in the next three months. Only in agriculture is this share higher, according to the statistical office of the Netherlands and Consumer Survey in early 2019.

Automotive industry

- The negative effects of Brexit are noticeable in the automotive industry. The low level of British consumer confidence is causing a decline in car sales. In addition, car production in the UK is also declining. This is not only because of lower domestic demand, but also because manufacturers choose to produce in other countries.

- The market conditions for Dutch dealers and suppliers to the automotive industry are therefore more challenging. Despite this, companies in the Netherlands managed to maintain the export value and re-export value of cars and car parts to the United Kingdom in 2017 and 2018.

- Indirectly, Dutch suppliers may face declining orders from other countries due to a drop in demand in the UK. For example, German manufacturers have a strong market share in the British market. If the British demand for cars falls, this could also lead to lower production volume at German factories.

Decline in car production and sales in the UK

Production and sales of passenger cars in the UK, number x 1 million

Chemical industry

- The UK is an important country for chemical products from the Netherlands. Around 90% of Dutch chemical production is exported and the UK is the third largest export destination, with around €6.5 billion and 7% market share.

- Exports of chemical products (raw materials and semi-finished products) to the UK were clearly lagging behind in 2017 and contracted in 2018, despite higher oil prices and higher output prices.

- Supplies to manufacturers of medicine and personal care products account for nearly €2 billion export sales. In this market, the export value declined as a result of lower sales of British cosmetics producers.

Decline in exports of chemical products to the UK

Development of export value of chemical products

Wholesale sector

- According to Statistics Netherlands, off all sectors, the wholesale sector earns the most from exports to the UK, and this was €3.8 billion in 2017.

- The top five categories of exports to the UK include ICT equipment, petroleum and petroleum products, fruit and vegetables, medicines, and cars. Therefore, wholesalers active in these segments will be relatively harder hit by Brexit. A large proportion of these export products are re-exports.

- Especially many smaller wholesalers are purely re-export companies. Re-exports are becoming increasingly important for the Dutch economy. For example, the volume growth of re-exports has been stronger over the past ten years than for exports of products made in the Netherlands: 60% versus 40%.

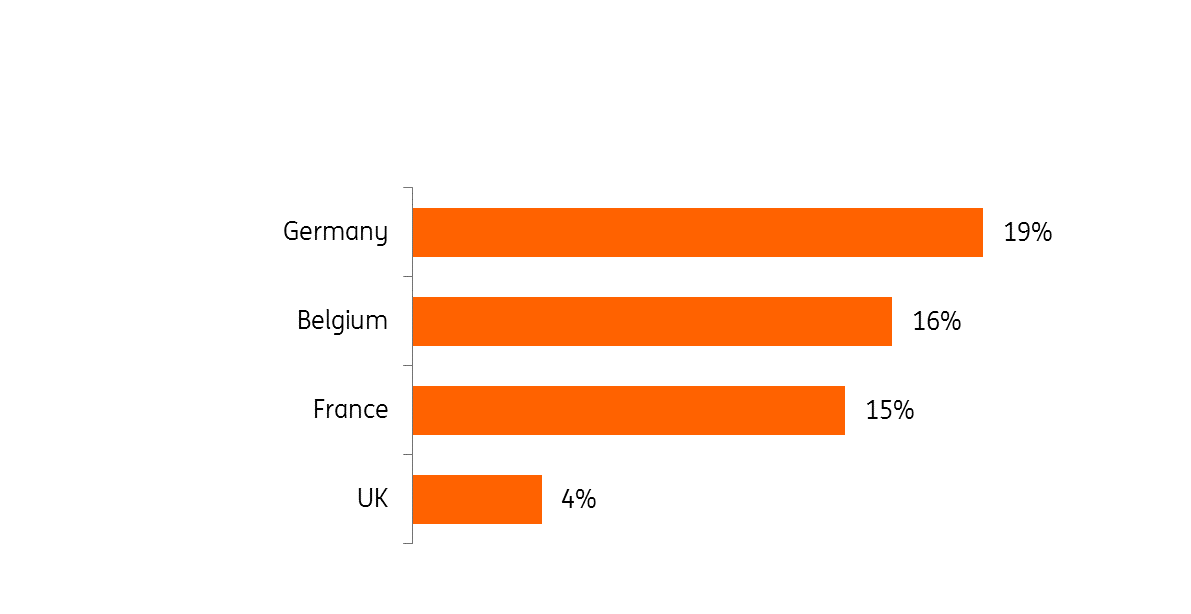

- Half of the export value to the UK consists of re-exports of goods, which is in line with the European average. However, the development of re-exports in 2018 compared to 2016 lags well behind the three other top four exporting countries.

Growth in re-exports to the UK lags well behind

Re-export value development of the four main export partners of the Netherlands, 2018 compared to 2016

Transport and logistics

- Because of its favourable location, by sea, the Netherlands is the most important trading partner for the UK. In addition to the export of Dutch products, there is also a great deal of intercontinental freight transport from the rest of the world via the ports of Rotterdam (including Hoek van Holland) and, to a lesser extent, Vlissingen and Amsterdam to the British Isles.

- Because of the many small and medium-sized British seaports, ferries are typical for transport to the UK. Between 2013 and 2015, annual growth in freight transport per ferry ('roll on/roll off') was almost 7%. This has more than halved since 2016, despite the favourable economic climate in Europe. Logistics service providers note that export growth to the UK is lagging, although this is disguised by the ongoing stockpiling at the beginning of 2019.

- From the Netherlands, Stena Line, DFDS, and Cobelfret provide intensive services to the UK. In 2018, 16.5 million tonnes of goods were transported by ferry, mainly to Harwich/Felixstowe and Immingham.

Business services

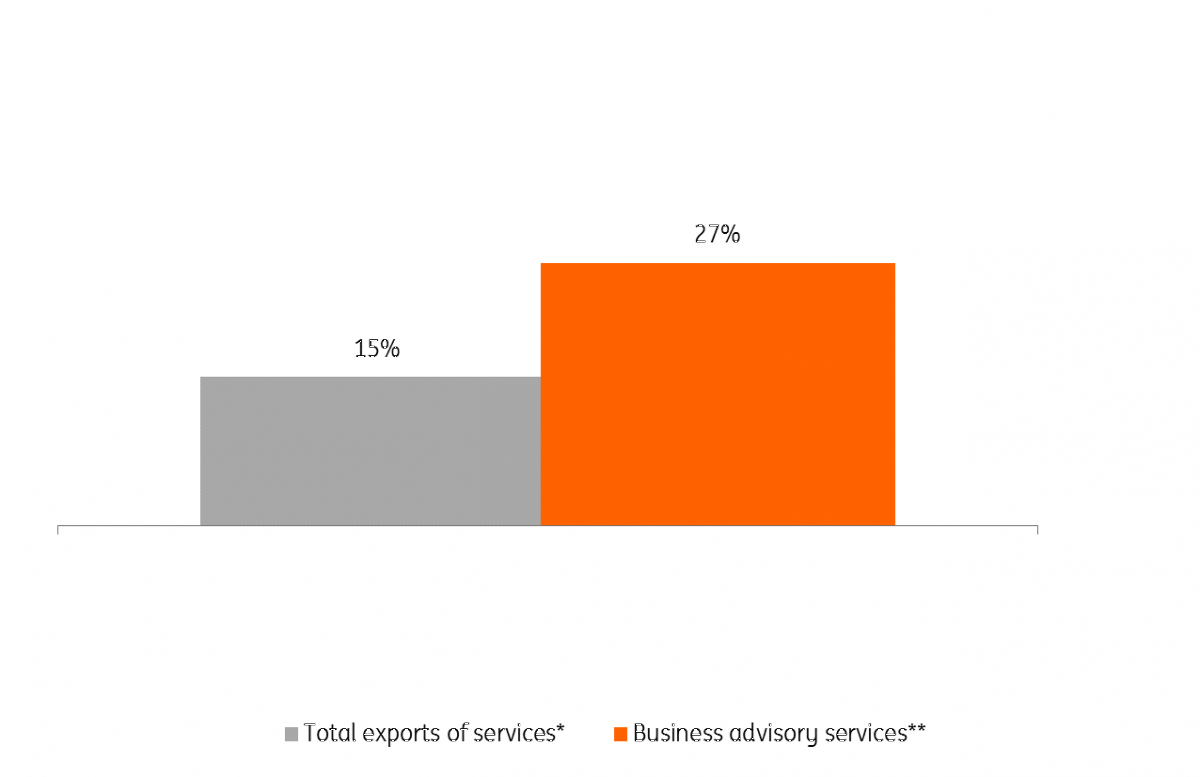

- Dutch export of services to the UK amounted to more than €20 billion in 2018. The total growth of the export of services over the past three years has been reasonably in line with European trends.

- A large part of the export of services to the UK consists of business services. Among other things, British demand for business advisory services, including legal advice and accountancy, rose sharply. Therefore, Dutch service providers appear to benefit from Brexit preparations made by British companies, especially those that tend to have activities on the European continent.

- In general, the export of services is less price-sensitive than export of goods. The impact of a weaker pound on the export of business services appears limited, at least for the time being. Usually, when hiring specialists, country knowledge and skills of the hired foreign service provider are more important than an increase in prices.

Strong increase in export of business advisory services* to the UK

Development of Dutch export value to the UK, 2018 compared to 2016

Tourism

- Britons are the third largest group of foreign tourists in the Netherlands, after Germans and Belgians.

- The number of foreign tourists in the Netherlands breaks record after record, but since 2016, the number of British people staying in the Netherlands has grown less rapidly than the number of guests from other European countries.

- This was particularly the case in 2018. Low UK consumer confidence and the unfavourable exchange rate are two reasons for consumers to reign in spending.

- We estimate that without Brexit the growth of British tourism would have been more in line with the European trend. This could have resulted in approximately 275,000 extra (hotel) overnight stays.

- British travellers spend an average of €240 per day during a trip to the Netherlands, mainly on travel and accommodation. 275,000 extra overnight stays are equivalent to a turnover of €65 million. This is about 4% of the annual tourist expenditure of Britons in the Netherlands, which is around €1.5 billion.

Not as many Brits going to Netherlands now

Percentage change in the number of room nights in Dutch hotels, hostels, and bed & breakfasts

Download

Download article29 March 2019

In case you missed it: Self-fulfilling prophecy? This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more