The buses of the future: Another Covid-19 casualty

Electric buses are the future of public transport as many European countries decarbonise their economies. But the coronavirus crisis has dramatically impacted passenger numbers and given all this uncertainty, uptake is slowing

Investments are at stake

The Covid-19 pandemic has had a tremendous impact on European public bus transport. Passenger volumes dropped significantly and recovery to previous levels will take several years. As the crisis slashed ticket income and promises to change travelling behaviour, investments are at stake. This slows the transition to electric buses rather than speed it up.

In recent years, the electrification of public buses has been leading the way within heavy-duty vehicles. The EU's fleet of battery-electric buses started accelerating from 2018 and more than doubled to 3,500 in 2019, but growth remained limited to an extra 500 units to 4,000 in 2020 so far (of an estimated 190,000 in total).

This shows Covid-19 is already impacting the transition and there is little doubt that this trend will continue in 2021.

A green recovery might need more government support

All this comes at a time when all things electric are becoming increasingly attractive. Several countries have already adopted minimum targets for 2025 and the transition becomes even more important with the focus on clean air and plans to raise the CO2-reduction target to 55% in 2030.

Both public transport authorities and operators have been challenged to find a route to fulfil that ambition and keep the transition going. However, with the current uncertainties about future ridership and income, a green recovery might need more government support, especially when private operators are responsible for investments in the fleet.

The characteristics of the public bus transport market

Public transport is a mature market, but growing within urban areas

The public bus market is mainly concentrated on shorter-distance public transport and more than 75% of this traffic happens in urban areas. The market is developed and has shown moderate growth in most Western European countries in recent years. Covid-19 now impacts the market dynamics significantly even while the ambition to reduce the footprint quickly grows. As the Netherlands is a front runner in the electrification of the public bus fleet, we take a look at the Dutch situation in more detail.

Public and private interests meet in public transport, government influence differs

Public transport is vital as a public service assuring connectivity for travellers and visitors. Consequently, it is a blended field where public and private interests meet. Under the European PSO-regulation, the market for public transport has been opened via a system of concessions although in-house procurement is still possible.

Local governments still have a critical stake as a major funder. This means the supply of public transport is highly dependent on the fiscal budget and that gives authorities an influence in the energy transition.

Bus transportation volume is determined by multiple drivers

- Main short-term drivers

Employment growth leads to more travellers

Commuters represent a significant part of travellers in public buses, mostly for distances between two and 30 km and more people commuting results in larger travel flows. Consequently, there’s a positive relationship between travel volumes and economic growth.

- Main structural drivers

Population growth: Developing urban areas stimulate traffic

In the long run, passenger transport is directly linked to population growth and urbanisation. Demand for public bus transport increased with the ongoing growth of urban (city) areas and the need to manage the daily travel flows smoothly and efficiently. Due to Covid-19, this has completely changed, at least in the short term.

Economic development: More wealth, more car ownership

Another influential factor is economic development. In countries with a lower per capita income, public bus transport tends to play a larger role. However, when it’s affordable people more often will choose to drive their own car.

Availability and ease of alternatives: Getting from A to B is the main objective

The relative importance of bus transport also depends on the availability of alternatives and local circumstances and (cultural) preferences. In countries with intensive and widely spread train and metro networks in cities, the role of public buses will be smaller. And in the Netherlands, for instance, transport plays a smaller role than elsewhere due to the country's cycling tradition.

The importance of bus transportation

The public transport sector and its green ambitions for the fleet

Electric public buses are the future; new generation covers 90-95% of the lines

European countries are increasingly adopting the ambition to decarbonise the fleet, improve air quality and reduce emissions to zero.

To reach this goal, battery-electric buses (BEV) are most in focus. The latest models of electric buses have a range of over 400km which covers probably 90-95% of urban area dominating European public bus connections. The purchasing price of battery-electric buses is still substantially higher than diesel buses (with € 400,000 – 500,000 against € 200,000 – 250,000) and charging infrastructure is required as well.

However, the operational cost of these buses is much lower as electricity is cheaper than diesel, less maintenance is required and the economic life will be longer. In combination with fast charging the new models, electric buses could already be competitively deployed (source: BNEF).

Battery-electric buses leading the zero emission charge rather than hydrogen

The question is often raised as to whether hydrogen would be a viable option for public bus transportation.

Given the moderate weight of passenger transport buses, the loss of energy in production and the usage of hydrogen and the relatively high total cost of ownership of fuel cell buses, we expect the battery-electric buses to be dominant at least until 2030. Hydrogen might play a larger role in public transportation as well, but heavy users without alternatives, such as the chemical industry, are expected to benefit first when (green) hydrogen production goes up and prices drop.

As soon as green hydrogen is abundantly available the trade-off between electricity and hydrogen might change.

The size and composition of Europe's bus fleet

Share of public buses higher in North-West European countries

The total rolling stock of buses over 3.5 tonnes in the EU adds up to roughly 770,000 units (2018). An estimated 190,000 (app. 25%) of these vehicles are qualified as public transport buses. The remainder is other (privately deployed) buses and coaches.

Southern and Eastern European countries such as Greece, Romania and Poland have relatively large but old fleets with a small fraction of public buses. In-service public use in Belgium, the Netherlands and Sweden has a respective share of 48%, 51% and over 70% of the fleet. In new registrations, the portion of public transport buses is relatively high as public buses are intensively used and regularly replaced in concession cycles.

The UK and France are the largest European markets for new buses.

The European bus market

Where we stand on electrification

Electrification of public buses was gaining traction before Covid-19

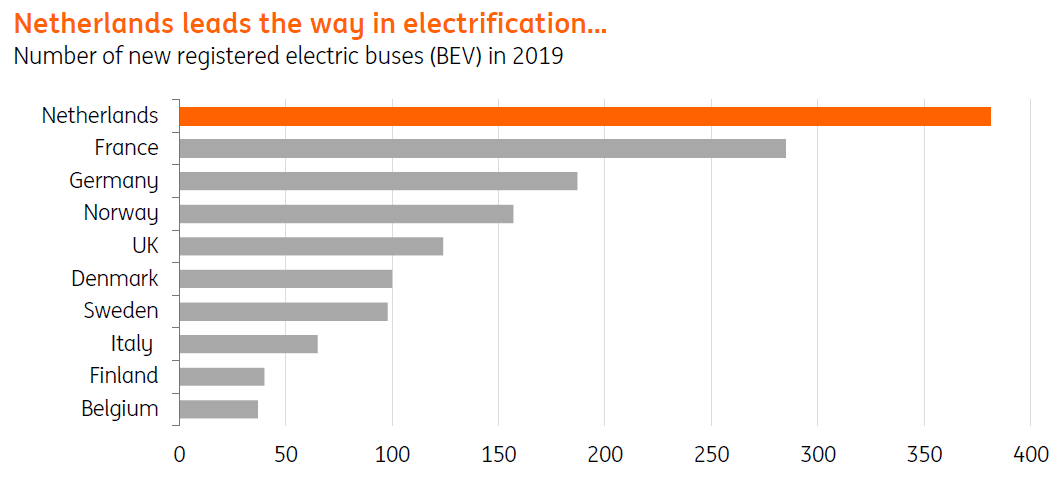

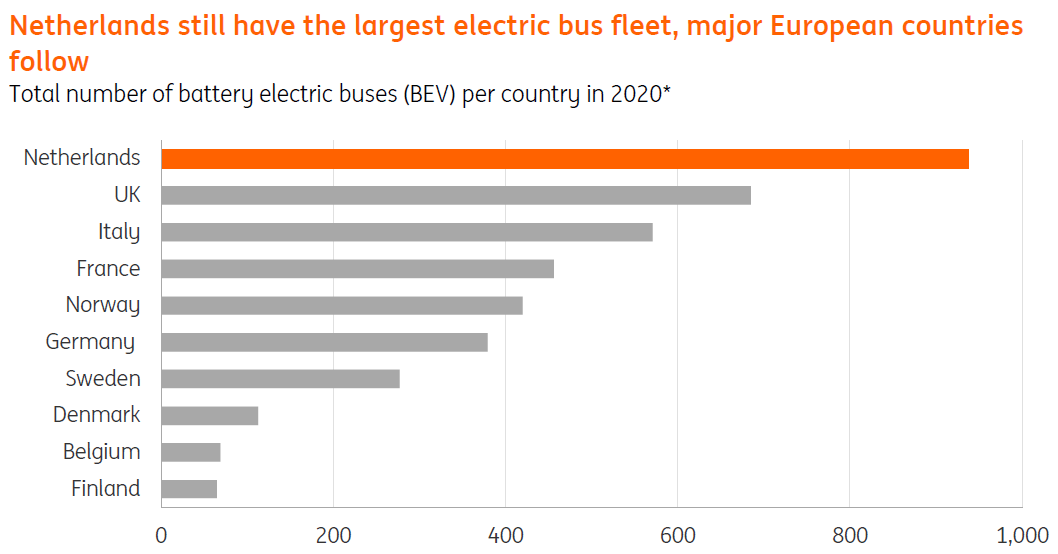

China is the world leader in the electrification of buses to improve air quality in cities, but in Europe, this process started just five years ago. Before the pandemic, in 2019, the inflow of battery-electric buses accelerated and the total fleet more than doubled from 1,500 to 3,500, but that growth slowed to 4,000 in November 2020.

The Covid-19 effect on the electric bus fleet

The Netherlands leads the way in Europe

The Netherlands leads the way in the electrification of public buses following the ambition to meet the 100% zero-emission target for new registrations by 2025 and decarbonise the full fleet by 2030.

In 2019 more than 40% of total new registrations were electric buses and with deliveries of pre-Covid ordered buses in 2020, it will probably hit 50%. For public buses, this figure was only exceeded by Denmark in 2019 (by 60%) and other Scandinavian countries are also making good progress.

In terms of the total number of electric buses, countries like France, Germany and the UK will soon become the largest European markets.

Electrification in Europe; the Dutch lead the way

And Nordic countries follow in new sales

Share of electric bus fleet

Trolleys still responsible for most of the electric fleet in Europe

Europe has a number of trolley cities, especially in Eastern Europe, but also in Switzerland and Italy. These buses are connected to the electricity grid and won’t have to make a shift to zero-emission.

Often cities have a tradition of using trolleys, but nevertheless, to reduce costs, there might be cities which switch to battery-electric in the future. As of the first of January 2020, Europe still accounted for more than 5,000 of these buses (source: CROW-KpVV).

How Covid-19 has affected the public bus market?

Passenger numbers dropped dramatically following lockdown measures and changing travel behaviour

Public transport passenger volumes suffered heavily from Covid-19 and subsequent lockdown measures. As people were discouraged to travel and advised to work from home if possible, they experienced a steep fall across Europe. In the Netherlands, for instance, passenger numbers dropped initially to a fifth of the 2019 levels in the first lock-down phase.

In the UK bus passenger numbers followed a similar pattern. Even in Sweden, which had a relatively mild lock-down, as well as Germany, the impact was severe with a drop of 40-50%. During the summer there was some revival, but halfway this stagnated and fell back again during the second wave in the autumn.

Decline in passenger numbers

Recovery of passenger volumes will take several years

During the Covid-19 crisis, many commuters learned how to work from home and meet via video conferencing. People also chose to cycle and walk more and avoid public transport by using their own car. On the other hand, there might be some shift back to public transport if business lease options are reduced. This reassessment of travelling will also have its post-coronavirus effect on travel figures, although that effect will differ throughout Europe.

Once a vaccine will be widely available, travellers are expected to return in larger volumes. However pre-Covid numbers are expected to remain out of sight in 2021, which means recovery will take at least several years. It depends on the level of government funding if this will lead to smaller public transport bus fleets.

A dramatic fall in kilometres travelled

Passenger volumes slash variable ticket income

The impact of Covid-19 on public transport operators (PTOs) is unprecedented. In the Netherlands, for example, roughly 35% of the income of PTOs consist of variable ticket income. Fixed costs are relatively high and mainly consist of wages and vehicle costs which makes the setback in volumes hurt even more.

As PTOs have had to cut costs, network frequencies (time schedules), notably in rush hours and at night, are expected to be downsized following lower travel numbers, occupation rates and income. Given the tiny margins in this market, the main question here is how much extra authorities want to spend on public transport to close the financial gap for operators.

The fate of the fleet after Covid-19

A significant drop in total new bus registrations in 2020

The Covid-19 crisis is likely to generally lead to reduced investments in new buses. In the first nine months of 2020, registrations of total new buses had already dropped by more than 25% compared to last year. Germany, Sweden and France showed the smallest drop. Given planning limitations, that effect will no doubt be exacerbated in 2021.

Development of total new registered buses

Uncertainty leads to postponement of investment and lower inflow of electric buses

Currently, there is much uncertainty about future passenger volumes and compensation for PTOs. This makes it difficult for PTOs to give their quotes on new concessions especially when new charging infrastructure is required. This is why various expiring concessions in 2021 and 2022 have been extended in the Netherlands and emergency concessions are implemented. In Denmark and Sweden running concessions have been extended as well.

Consequently, the pace of transition to electric buses will continue to slow as the inflow of new buses will be delayed. This will especially be true for countries where private companies own most of the fleet. In countries where most of the fleet is directly owned by companies linked to public transport authorities (PTAs), such as Belgium and Germany, this is less of an issue, although investment might still have to be reconsidered.

The slow-down in the Netherlands

Manufacturers of electric buses face challenges while expected demand is delayed

For manufacturers of electric buses like VDL and Ebusco, delayed investment in electric buses will create serious challenges as orders are postponed and might be bundled in the years after. As various European countries already adopted minimum targets for 2025 and the green vehicle directive comes into force, we expect there will be a catch up prior to that. This means manufacturers need to keep production capacity and the innovative nature of zero-emission buses going while, at least temporarily receiving few new orders. This could be challenging. As soon as the crisis ends, it might be hard again to fulfil the large numbers of new buses about to be ordered.

Not all actors hit the brakes – some governments already act anti-cyclical

Not all parties in the public transport sector have faced a slow down following the Covid-19 crisis.

In the UK, the government announced an initiative for large investments in green buses in cities as part of a ‘green recovery plan’. In the Netherlands, on a local level, the Amsterdam region (VRA) announced extra investment programmes. Given the uncertainty and larger financial pressure on privatised PTO’s a difference seem to appear between regions where PTOs are directly connected to PTAs and more market-driven regions.

To keep the green track on pace, more government action would seem to be required when private operators are responsible for investments in the fleet.

In a subsequent article, we will have a closer look at the transition targets, how much electric vehicles will enter the fleet and challenges faced to proceed with the transition.

For this report, we conducted a number of interviews with the following:

- Guy Hermans - Gerard van Kesteren (CROW-KpVV)

- Sanne van Breukelen (DOVA)

- Peter Bijvelds (Ebusco)

- Thomas Cuingnet – Bruno Lapeyrie – Julie Watremez (Keolis)

- Peter de Raadt (Transdev Netherlands)

- Aida Abdullah (UITP)

- Ard Romers – Jan van Meijl (VDL)

Download

Download article

27 November 2020

Reasons to be cheerful, part 3 This bundle contains 6 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more