Why the corn market is set to tighten

US corn area is set to increase in 2025 and 2026. However, global ending stocks are still forecast to fall, which means some modest upside to prices through 2025. We see an escalation in trade tensions as a key risk to this view

Global ending stocks edge lower in 2024/25

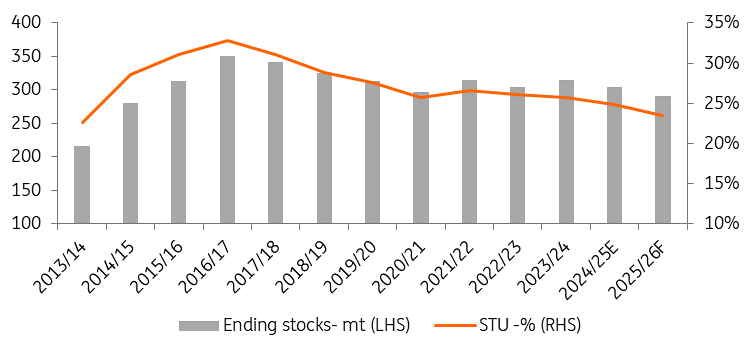

The global corn balance is forecast to tighten over the 2024/25 season. Global ending stocks this season are estimated to fall by a little more than 10mt year-on-year to 304mt, which would be the lowest ending stocks since the 2020/21 season. The move is largely driven by the supply side, where global output is expected to fall by 9.7mt YoY. Large declines are estimated in the US, EU and Ukraine, driven by a combination of lower area and weaker yields.

Despite the global corn market tightening in the current marketing year, prices are still down on the year as corn yields in the US surprised to the upside, partly offsetting the lower plantings seen in 2024/25.

For the 2024/25 season, area estimates for US corn have remained largely stable at around 90m acres. However, there have been revisions higher in yield estimates. They've risen from 181bu/acre earlier in the year to a little over 183/bu/acre currently – a record high and up from 177.3bu/acre in 2023/24. As a result, estimates for the domestic US crop have grown by more than 280m bushels (7.1mt). This leaves this season’s output at 15.14b bushels (385mt), down from a record high of 15.3b bushels (390mt) produced in 2023/24.

Corn production in the EU has been under pressure this year. Output is estimated at 58.8mt, down 4.3% YoY and the third smallest corn harvest over the last decade. This has been largely driven by central and eastern Europe, where weather has weighed on yields. As a result, the EU has relied more on imports this season.

Ukrainian corn production has also suffered in the 2024/25 season, with dry weather weighing heavily on yields. Domestic output is estimated to total 26.2mt, down 19% YoY and the lowest production level since the 2017/18 season.

In Brazil, 2024/25 summer corn plantings are nearing completion, although the second crop is a larger contributor to total production in the season. Total Brazilian corn production is expected to hit 127mt in 2024/25, up 4% YoY, driven by a combination of larger area and stronger yields YoY. However, how the crop performs will also depend on how quickly the soybean crop is harvested, allowing for the planting of the second corn crop.

2025/26 corn balance looking tighter

Our early forecasts suggest that despite a recovery in EU and Ukrainian corn production in the 2025/26 season, global corn stocks will likely edge down towards 290mt next season due to lower US output (with yields returning to more normal levels) and global consumption growth. However, much will depend on how the weather through the spring and summer develops, while trade policy will also be important. The tightening in the balance suggests that there is upside for corn prices through next year and we expect CBOT corn to average US$4.50/bu. However, limiting the upside is the fact that the stocks-to-use ratio is still forecast to be relatively comfortable at more than 23% (vs just under 25% this year), while uncertainty over broader trade policy through 2025 is unlikely to help sentiment.

The market will be paying closer attention to 2025 spring planting prospects. And despite the broader weakness seen in the corn market this year, US farmers are expected to increase corn area for next season. The soybean/corn ratio for next year’s crop is trading in territory where farmers should favour corn over soybeans. The planted corn area is expected to grow by 1.4% YoY and assuming yields aligned with the five-year average (below the record yields seen in 2024/25) would mean that US production still falls year-on-year.

This will, however, be highly weather-dependent. Furthermore, given the potential for further trade tensions throughout the year, there is the risk that farmers increase corn and reduce soybean plantings, given that soybeans would likely be more exposed to a ratcheting up in trade tensions with China.

For the EU, we forecast somewhat of a recovery in corn output assuming a marginal increase in area and yields recovering to somewhere closer to the five-year average. We expect output in the EU to grow by around 5% YoY to 61.7mt.

In Ukraine, early estimates suggest that area in 2025/26 will increase by around 7% YoY. This larger area coupled with yields in line with the five-year average would mean that Ukrainian corn output hits 30mt, up almost 15% YoY.

Global corn stocks set to continue trending lower

How exposed is US corn to trade tensions?

An escalation in trade tensions could have ramifications for the US corn market. However, US corn is less exposed than soybeans and wheat, with a smaller proportion of production exported. Still, in absolute terms, the volume of corn exports exceeds both soybean and wheat export volumes. US corn is also relatively more exposed to China than it was during the 2018 trade war. Back in the 2017/18 season, less than 1% of US corn exports ended up in China. However, in 2023/24, this share grew to 5%. We think this should still be manageable. The bigger risk for US corn would be escalation with Mexico, given that it's the largest destination.

US corn less exposed to escalation in trade tensions

Secondly, if President-elect Donald Trump’s aggressive trade agenda starts soon after he enters office, it could very well see US farmers adjusting their planting plans for 2025/26, as they would have time to react ahead of spring plantings. With 55% of US soybeans going to China, farmers may decide to reduce these plantings, which could result in larger corn area, potentially loosening up the global corn balance.

In addition, trade frictions may not be isolated solely to China. Trump has threatened tariffs for all trading partners, which increases the risk of broader retaliatory tariffs on US agricultural exports.

ING forecasts

Download

Download article

11 December 2024

Commodities Outlook 2025: A bearish horizon This bundle contains 15 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more