Europe faces stiff competition for natural gas

The collapse in European natural gas prices in recent months has created a false sense of security. While the current winter appears to be more manageable, the region will find it more difficult to build adequate storage for the 2023/24 winter. We see higher prices next year

European storage is full

Given the circumstances, Europe could not have hoped for a better situation heading into this winter. Demand destruction and milder-than-usual weather in the early part of the heating season have ensured that the region has continued to build storage deeper into winter – about two weeks longer compared to the five-year average. EU storage continued to grow until mid-November with it reaching nearly 96% full. This is well above the five-year average of almost 88% for mid-November. Given the bloated storage, day-ahead TTF prices have fallen as much as 93% from the peak in August. This leaves Europe in a better-than-expected position for this winter. The next few months should be more manageable. However, it is still vital that the region is cautious through this winter, as Europe needs to try to end the current heating season with storage as high as possible given the expectation of a further reduction in gas flows to the region next year.

European demand has responded to higher prices

Higher prices through much of this year have ensured a significant amount of demand destruction, and as a result the European Commission has been able to stick to its voluntary demand cut of 15% between August and the end of March, rather than imposing a mandatory 15% cut. Eurostat data shows that in August, EU natural gas demand was 15% below the five-year average, hitting the target set by the Commission. Numbers from third-party consultants suggest that in the months since, demand reductions have exceeded the 15% target. However, the risk is that with the more recent weakness in prices, we see demand starting to edge higher once again, which would only add to the tough task that the EU faces next year.

Europe will need to see continued demand destruction through 2023 to ensure adequate supply for the 2023/24 winter. This is particularly the case given the risk that we see further declines in Russian gas supply to the EU.

Russian natural gas flows remain a risk

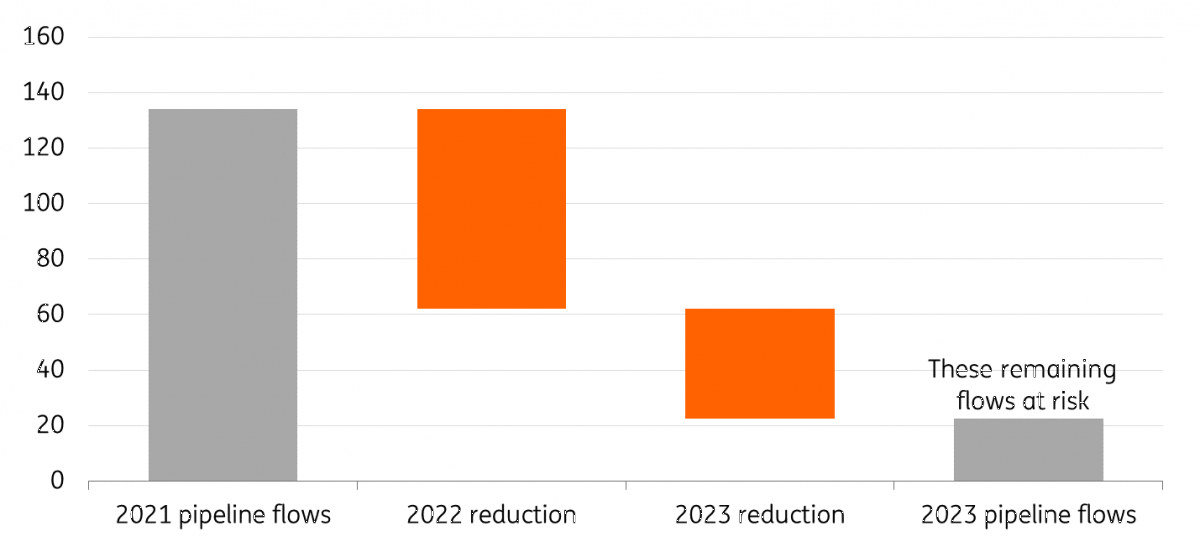

Russian pipeline gas flows have fallen significantly this year. The latest data shows that year-to-date pipeline flows from Russia to Europe have fallen by around 50% year-on-year to roughly 58bcm. And, obviously, these flows have declined progressively as we have moved through the year with reduced flows via Ukraine and Nord Stream. Daily Russian gas flows to the EU are down around 80% YoY at the moment. Therefore, if we assume that Russian gas flows remain at current levels through 2023 (via Ukraine and TurkStream only), annual Russian pipeline gas to the EU could fall by a further 60% YoY to around 23bcm in 2023. And clearly, there is a very real risk that the remaining flows via Ukraine and TurkStream are halted.

In the current environment it is difficult to see a recovery in Russian pipeline flows to Europe. Even if there was the will of both Russia and the EU to restore flows, operationally it would be difficult to see flows return to pre-war levels given the damage to Nord Stream 1. The only route where we could see a return of flows is the 33bcm Yamal-Europe pipeline and increased flows through Ukraine. However, for now, we are assuming no improvement in supply, if anything risks are likely skewed to more supply disruptions.

Russian pipeline flows to the EU (bcm)

Limited LNG supply growth

The liquefied natural gas (LNG) market has helped Europe significantly this year. LNG imports into the EU over October grew by almost 70% YoY, with volumes exceeding 9bcm.

However, there are constraints to how much more LNG Europe can import. There are reports that LNG carriers are queuing for spots at regasification units. This highlights the lack of regas capacity in Europe at the moment. This queue of LNG carriers could also be partly due to market players wanting to take advantage of the significant contango in the front end of the TTF curve.

The EU has seen the start-up of a fair amount of regasification capacity in the form of floating storage regasification units (FSRUs) over the second half of this year. The Netherlands, Germany, Finland/Estonia have or are in the process of starting up operations at these FSRUs with a combined capacity in the region of 23-27bcm. Germany is expected to bring a further 15bcm of regas capacity online early next year. This will help with some of the infrastructure constraints Europe is facing, but the issue is also around global LNG supply and the limited capacity which is expected to start next year.

Global LNG export capacity was set to grow by around 19bcm in 2023, driven by the US, Russia and Mauritania. However, following Russia’s invasion of Ukraine and the sanctions which have followed, it is likely that the start-up of Russian capacity is likely to be delayed. Russian capacity makes up for 46% of the total new capacity expected next year. Therefore, we could see just 10.5bcm of new supply capacity.

The other issue for the EU is competition for LNG. This year, weak Chinese LNG demand has been a blessing for Europe. LNG imports from the world’s largest buyer were down 22% YoY over the first 10 months of the year. This would have been due to the higher price environment as well as the demand impact from Covid-related lockdowns throughout the year. However, if we see a recovery in Chinese demand next year, Europe will have to compete more aggressively for supply.

2023 will be tight for Europe

The pace of inventory builds during the 2023 injection season will be much more modest compared to what we have seen this year, given the reductions in Russian supply. The ability of the EU to completely turn to other sources is just not possible. Therefore, Europe is likely to go into the 2023/24 winter with tight storage, which will leave the region vulnerable next winter.

In order to get through the 2023/24 winter comfortably, we will have to see continued demand destruction once again. This will have to be either a result of market forces (prices needing to trade higher to reduce demand) or EU-mandated demand cuts (the 15% voluntary demand cut at the moment ends in March 2023). While Europe should be able to scrape through the 2023/24 winter if current Russian gas flows continue, it is much more challenging if remaining Russian gas flows come to a full stop.

Therefore, we believe that there is an upside to current 2023 forward values, particularly those towards the end of 2023. Although much will depend on how much storage the EU draws down this winter, which obviously will depend on heating demand through the peak of winter.

EU intervention will not solve the underlying issues

EU member countries have been working on policies to try to soften the hit from higher natural gas prices. These include joint gas purchases, temporarily capping the TTF natural gas benchmark, and the setting up of a new LNG benchmark, which the Commission believes will be a better reflection of actual prices.

However, how effective these measures will be is still questionable. Capping the TTF benchmark increases the risk that we see more of the trade moving to the over-the-counter market, which will be excluded from the cap. This in turn would reduce liquidity on European natural gas exchanges and also reduce transparency in these markets. It appears as though the Commission will set this cap well above the market, which suggests that they only want to cap prices in an extreme situation, where high prices (similar to levels seen in August) are sustained. Furthermore, the longer-term goal of setting up a new benchmark is not going to solve the issue of bottlenecks in European gas infrastructure. TTF is trading at a premium to LNG prices because of the bottlenecks in LNG regasification capacity and pipeline infrastructure. At the end of the day, the only viable long-term solution for Europe is increasing supply and removing some of the bottlenecks facing the industry.

US natural gas market more comfortable

The US natural gas market this year has also seen significant strength, trading to multi-year highs. Strong global LNG prices, stronger demand from the power sector and below-average inventories have all proved bullish for Henry Hub. However, the outlook for US gas prices is more bearish. US dry gas production is expected to hit record levels next year, growing by a little more than 1.6bcf/d to average almost 99.7bcf/day over 2023, whilst finishing 2023 with output in excess of 100bcf/day. In addition, this year saw stronger demand from the power sector over the summer, which pushed overall gas demand higher this year. Expectations are that domestic demand will fall back towards more normal levels. Meanwhile, on the export side, whilst there is more LNG capacity set to start up over the course of the year, this is fairly limited. LNG exports are expected to average a little over 12.3bcf/day in 2023, up from an estimated 10.8bcf/day in 2022.

As a result, over the course of 2023, we should see US natural gas inventories moving from below their five-year average to above it ahead of the next heating season. In fact, the US could go into the 2023/24 winter with storage at its highest levels since 2020. Therefore, we expect Henry Hub to trade lower in 2023 relative to 2022.

ING natural gas price forecasts

Download

Download article

30 November 2022

2023 Commodities Outlook: Stormy seas ahead This bundle contains 13 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more