Gold to rebound as Fed easing starts

US dollar strength and central bank tightening have weighed heavily on the gold market in 2022. In the near term, there is room for more downside with further tightening expected. The medium-term outlook looks more constructive

US strength hits gold prices

Spot gold is trading at its lowest levels in more than two years and has fallen more than 20% from its peak of above $2,000/oz in March as the US Federal Reserve and other central banks have raised rates to tackle inflation.

The strengthening of the US dollar has hit sentiment across the commodities complex, including gold. The USD index has surged to a 20-year high. This strength is largely a result of the aggressive stance the Fed has taken in terms of monetary tightening to fight inflation.

Real yields have also been climbing. Ten-year real US yields have reached their highest levels in more than a decade and are back in positive territory. Given the strong negative correlation between gold prices and real yields, gold has struggled in this rising yield environment. Higher yields increase the opportunity cost of holding gold, which appears to be turning investors off the precious metal.

Record gold buying from central banks lifts global demand

So far this year central banks have continued to increase gold reserves. During times of economic and geopolitical uncertainty and high inflation, banks appear to be turning to gold as a store of value.

The latest data from the World Gold Council (WGC) shows that central banks increased their buying of gold significantly over the third quarter. Central banks bought 399 tonnes in 3Q22, which is up 341% year-on-year and also a record quarterly amount. The data shows that Turkey, Uzbekistan, India and Qatar were the largest buyers of gold over the quarter, but a substantial amount of gold was also bought by central banks that did not publicly report their purchases. The WGC did not give any details on which countries these could be, although banks that do not regularly publish information about their gold stockpiles include China and Russia.

The pace at which central banks have accumulated gold reserves this year has not been seen since 1967.

Given the current environment is likely to persist, central banks are likely to continue to add to their gold holdings in the months ahead.

The gold purchases made by central banks around the world constitute only a portion of the total demand for bullion, which also includes the consumption of jewellery, investments in gold bars, coins, exchange-traded funds (ETFs), and technology.

Chinese gold demand picks up, but Covid risks remain

Chinese gold demand suffered earlier in the year due to the Covid-related lockdowns, particularly over the second quarter of the year, which is when strict restrictions were in place across Shanghai and Beijing. According to WGC data, Chinese consumer demand was down 23% YoY over 1H22.

However, more recently, gold in China has been trading at a huge premium to international prices as improved demand exceeds the country’s imports, which are constrained by quotas. Only accredited banks in the country are allowed to import gold, with quantities set by the People’s Bank of China.

The elevated Shanghai-London gold price spread has continued in October with the seven-day National Day holiday, a stable local price, weak renminbi and economic uncertainty supporting gold sales in Beijing and Shanghai, according to data from the WGC. However, fluctuating Covid-19 cases and subsequent lockdowns could weigh on gold sales in certain areas going forward.

For another key gold consumer, India, demand remained strong in October amid the onset of festivals and weddings season with both jewellery and bar and coin purchases boosted.

Despite stronger consumer demand, gold’s price direction will continue to be driven by investment flows, for which the outlook is less constructive in the short term.

Global gold ETF holdings saw their sixth consecutive monthly decline in October, standing at 3,490t (US$184bn) at the end of the month. North American funds led global outflows.

In the third quarter, investment demand was down 47% year-on-year, as ETF investors responded to a challenging combination of markedly higher interest rates and a strong US dollar.

Speculative positioning in COMEX gold further highlights the lack of investor interest – the latest COMEX exchange numbers showed that speculators in US gold futures were betting on lower prices, however, the number of the bets had declined.

China's gold imports surge

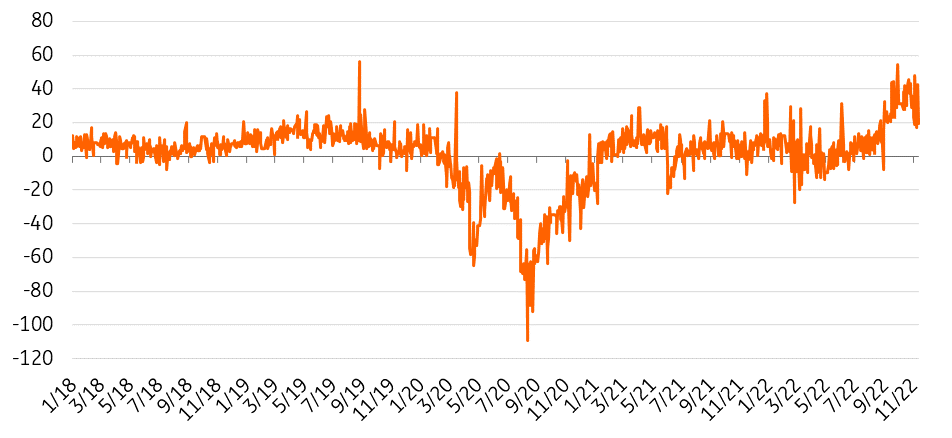

China premium/ discount to international gold ($/oz)

China's gold imports surge

China non-monetary gold imports (tonnes)

Gold to rebound slightly next year as Fed easing starts

We expect gold to remain on a downward trend during the Fed’s ongoing tightening cycle. But while in the short term we see more downside for gold prices amid monetary tightening, any hints from the Fed of an easing in its aggressive hiking cycle should start to provide support to prices. For this to happen, we would likely need to see signs of a significant decline in inflation.

We should see inflation coming off quite drastically over 2023 and this will then open the door for the Fed to start cutting rates over 2H23, according to our US economist.

Under the assumption that we see easing over 2H23, we expect gold prices to move higher over the course of 2023 with prices reaching $1,850/oz in 4Q23.

ING forecasts

Download

Download article

30 November 2022

2023 Commodities Outlook: Stormy seas ahead This bundle contains 13 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more