China’s economy stabilises but November’s uncertainties loom large

A strong end to the third quarter leaves China within striking distance of this year’s growth target, but uncertainty remains as markets await China’s stimulus plans and as Trump 2.0 looms

2024 growth target is still within striking distance

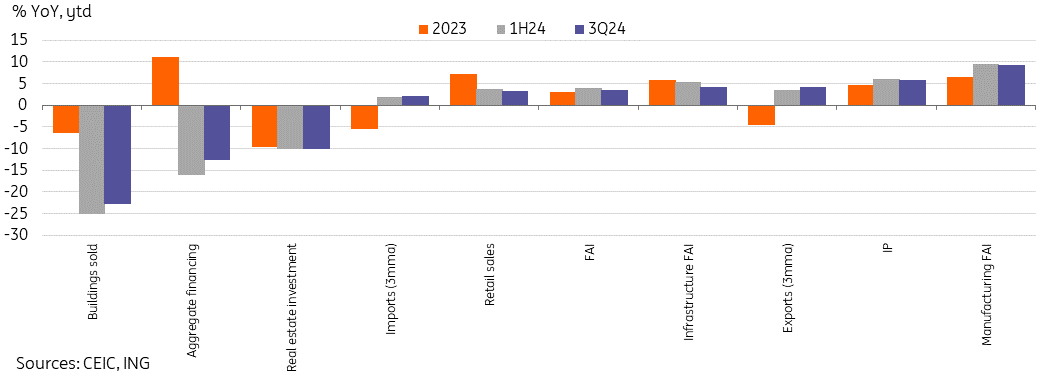

September’s economic data generally outperformed expectations, with a stronger-than-expected third-quarter GDP growth rate of 4.6% YoY, bringing year-to-date growth to 4.8% YoY. September saw a rebound of both industrial production (4.5% to 5.4%) and retail sales (2.1% to 3.2%), which both were a little stronger than forecasts and helped the third quarter number beat expectations. That said, the real number continues to benefit from a negative GDP deflator, which actually means that real growth outpaced nominal growth for the sixth consecutive quarter.

Even if September’s slight improvement continues, it may still be challenging to reach the 5% growth target for the full year. However, it will not take too much to keep growth 'around' 5%, which would just about be good enough for policymakers.

China economic activity monitor

Property sector still awaiting more tangible support

The major exception to last month’s slight improvement in the data was China’s property market. September's new home prices fell by 0.71% MoM and used home prices declined by 0.93% MoM, little changed from the rate of decline in August. Policymakers recently highlighted "halting the real estate decline and spurring a stable recovery" as a priority, but numerous support measures this year have not yet arrested the decline.

From 2021's peak, new home prices have declined 9.0%, and secondary market prices have dropped 15.5%.

Focus remains on fiscal stimulus follow-up

The strong rally of Chinese equities cooled off in October as it soon became apparent that no fiscal policy package was ready to go hot on the heels of the PBOC’s monetary policy easing in September and as markets began to see higher odds of a Trump victory in the US elections.

This week’s National People’s Congress meeting will be watched closely for any possible adjustments to budget deficit targets or specifics relating to new special bond issuance or other quantitative targets for fiscal stimulus.

We expect to see some form of sizeable fiscal stimulus follow-up, as it would be odd for bold moves from the PBoC not to be accompanied by substantive fiscal measures. However, it will take some time as fiscal policy is more complex, even in the best of times, and cash-strapped local governments will make implementation more challenging this time around. Media reports have signalled that the policy package remains flexible and that some RMB10tn over three to five years is being considered. This would fall into our expected range of RMB 2-4tr per year. The bulk of this is expected to be concentrated on addressing local government debt issues and supporting the property market by acquiring unsold homes and idle land. After Trump's election victory in the US, there is also a possibility we could see a larger stimulus push from China in anticipation of incoming tariffs.

We expect a lower multiplier effect of fiscal stimulus this time around, as rather than focusing on infrastructure investment, a lot of money will be used to address current debt and inventory issues. Eventually, we expect to see a growing focus on boosting demand, but this too will take time as there remains a lot of conflicting opinions on 'if' and 'how' to stimulate consumption, making it less obvious how to deploy fiscal resources. We expect fiscal stimulus measures will likely be reflected more in 2025’s data rather than in the remaining months of 2024.

Download

Download article

7 November 2024

ING Monthly: What a second Trump term means for you This bundle contains 13 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more