China: Incipient recovery?

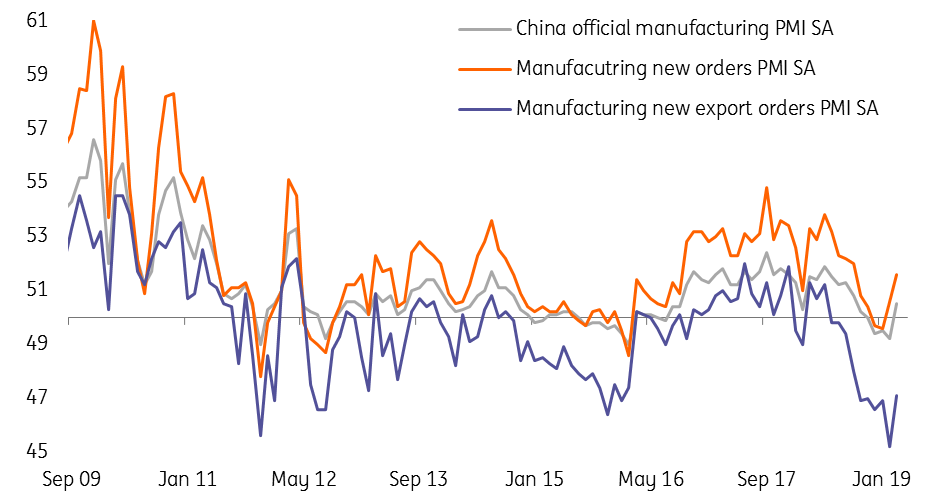

China’s fiscal stimulus has begun to work. Manufacturing PMI showed activity expanded in March. We believe this is in large part because of the fiscal measures taken over recent months. Continued support from fiscal policy will likely be required to maintain activity even if a trade agreement with the US is reached

China’s fiscal stimulus has begun to work. The official manufacturing PMI showed activity expanded in March, with the survey measure rising to 50.5 in January from 49.2 in February.

Without the fiscal loosening, we think even this slight recovery in the manufacturing sector would have been unlikely. The authorities are likely to maintain fiscal stimulus even if a trade deal is signed with the US to continue to support the economy.

With the fiscal stimulus, manufacturing PMI is rising

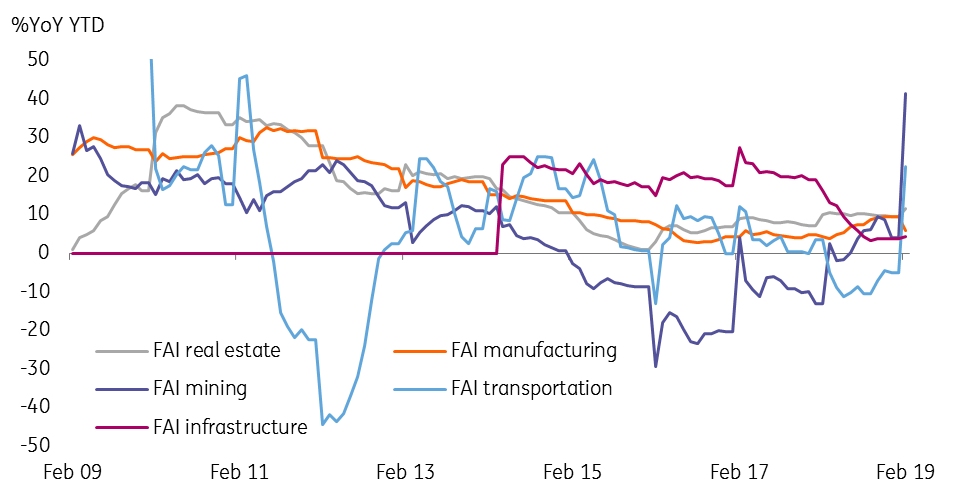

We believe that manufacturers’ profit should improve with the current fiscal support. Upstream manufacturers, such as miners, will benefit first, and then it will gradually move downstream to manufacturers of final goods.

However, we expect that fiscal stimulus will mainly boost infrastructure investments and related production, e.g. investments in mining and transportation. It cannot change the external environment, especially the uncertainties surrounding the US-China trade war. Export-related manufacturers will continue to suffer from US tariffs, and they will consequently be more reluctant to expand their factories.

The recovery was only in the sectors of transportation and mining from infrastructure projects

Trade negotiations between China and the US continue, but still, appear some way from a final resolution. Both sides face difficult choices, with China’s currency policy and approach to cybersecurity two key outstanding issues where it appears the two sides have yet to reach an agreement.

On monetary policy, the central bank (PBoC) governor has said that room for further required reserve ratio (RRR) cuts is limited. As such, we still expect four cuts this year but have revised each RRR cut to 0.5 from one percentage point. Small private firms in China still need targeted monetary easing as they do not benefit from the fiscal stimulus.

The risk from trade tension remains material, and a deal is by no means guaranteed

On the yuan, we keep our forecast for USD/CNY and USD/CNH at 6.75. A major appreciation seems unlikely, as the US has pressed China to commit to refrain from using currency depreciation as a policy tool in the future. That means the Chinese authorities will not want to see an appreciation now, given they may not be able to reverse it later if needed.

In short, the Chinese economy is currently supported by fiscal stimulus. The risk from the trade tension remains material, and a deal is by no means guaranteed. And even there is an agreement; questions will remain about how long it will last.

Download

Download article8 April 2019

What’s going on in Australia? This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).