China draws a recovery roadmap

China has decided to relax the lockdown of Wuhan city but maintain strict social distancing in most cities. This is the first step to getting the economic recovery back on track. There are also fiscal and monetary policies in place, but will they work?

First step to recovery

The Chinese government sees unlocking Wuhan as an important first step to economic recovery. But there are still very strict rules on social distancing and distance learning for students. So domestic demand will recover, but only gradually.

Global supply chains are disrupted in Europe and the US, and so is global demand. As we assume in our base case that the global lockdown will only last until early May, the damage should be manageable by Chinese manufacturers and exporters who have been given extensions in fee payments and loan repayments.

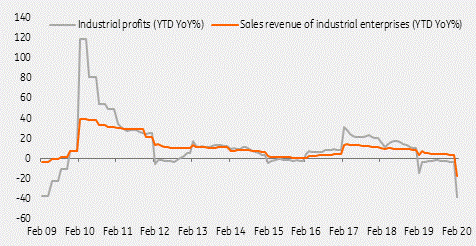

China industrial profits fell to levels similar to the global financial crisis

Roadmap for a full recovery

A roadmap for a full recovery was developed by China when it was hit by Covid-19 in February, and this is becoming clearer now.

The recovery plan involves 'New Infrastructure' projects. Not everything will be done by the government, some will be implemented by the private sector. These new projects lay out the necessary soft and hard infrastructure that China will need to succeed in the future digitalised world.

Stimulus to avoid recession

In terms of government support, fiscal stimulus will range between 6.5% to 8% of nominal GDP in 2020, which will include tax and fee cuts, to prevent the economy falling into recession.

China's sovereign bonds will be bought by the country's corporate treasuries until the end of April, but then some of them will switch from government bonds into investment grade corporate bonds as the market recovers in the second quarter.

PBoC protects the financial system

For now, the central bank has to make sure that a deterioration in credit overseas does not lead to tighter liquidity and more difficult credit conditions in China. More frequent and stronger-than-expected rate cuts should prevent this from happening. But if there is a deterioration in credit, the recovery plan will clearly be delayed.

Downgrade growth forecast

We expect GDP growth at 3.6% year-on-year in the first quarter. Fiscal stimulus should avert a year-on-year recession but cannot prevent a slowdown from falling global demand. Our GDP forecast for 2020 is revised downward to 4% from the previous forecast of 4.2%. The recovery plan may be able to boost GDP growth in the second half of the year but it is still too early to tell.

The yuan's path will follow the dollar. There shouldn't be any delays to outward remittances as capital outflow pressures will not be high. USD/CNY could reach 7.25 by the end of 2Q20 and reach 6.9 by the end of 2020.

Download

Download article

2 April 2020

Covid-19: The scenarios, the lockdown, the reaction, the recovery This bundle contains 18 articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).