Central and Eastern Europe: The worst seems to be behind us

CEE economies are bracing themselves for a slow recovery. But as unemployment is set to rise and high inflation isn't an issue any longer, more monetary easing is on the way. In FX, RUB prospects remain bright while CZK remains our favourite CEE low yielder. Poland central bank's aggressive steps should translate into a further steepening of PLN swap curve

CEE economies: The worst seems to be behind

With the central and eastern Europe region being one of the first movers in Europe to start easing lockdown measures, the economic data should continue improving, with 2H20 growth posting a rebound. But despite the recent rally in markets, we continue to look for a U-shaped rather than V-shaped recovery, as was evident in the rather limited rebound in May CEE PMIs (Figure 1).

As is the case for wider Europe, the CEE recovery will be gradual and will take time to make up for the Covid-19 related output loss.

Figure 1: Rebound in PMIs consistent with U-shaped recovery

More easing on the way

Although the CEE economics should be on the gradual road to the recovery, the expected increase in unemployment (governments’ supportive measures will continue to be rolled back as the economies get out of the worst) and the further decline in inflation across the region towards or in some case below the target both suggest that any meaningful reversal of the recent monetary easing measures seems unlikely. The bias of local central banks is still skewed towards more easing.

We expect the Czech central bank to deliver one last rate cut to bring rates to technical zero, Hungary's central bank to reverse some of its previous FX stabilising hikes and Poland's central bank to fully complete its large scale aggressive QE programme. In Russia, the central bank is poised to cut rates again too.

Poland's central bank cranking up its relative dovishness

While the CEE region does not necessarily stand out trend-wise (vs other emerging market regions or wider Europe) on the growth and inflation fronts, it offers interesting intra-regional stories.

Poland's central bank seems to be challenging National Bank of Hungary's position of the most dovishly perceived central bank in the region

Perhaps most importantly and reflecting the price action in the CEE rates market, Poland's central bank seems to be challenging National Bank of Hungary's position of the most dovishly perceived central bank in the region. The very large quantitative easing and aggressive rate cuts by Poland (all in the context of a large domestic fiscal stimulus) translated into a meaningful steepening of the PLN IRS curve. 5s10s PLN IRS - the part of the curve that is the bell-weather measure of the perceived behind the curve dynamics, have been steepening meaningfully so far this month.

In contrast, the very cautious NBH stance (FX stabilising hikes, limited QE with the NBH cancelling the QE auctions for the second week running) improved the outlook of Hungarian assets vs Poland (both FX and rates).

Steeper CEE curves, driven by core rates

Steeper CEE curve looks to us to be the direction ahead as the local long-end rates will continue being dragged higher by rising core yields (mainly UST yields) while the front-end will remain anchored by either unchanged or lower policy rates (with rate cuts in Czech and Hungary in large part priced in).

But given these dynamics, the PLN IRS curve appears the most prone to steepening within the region.

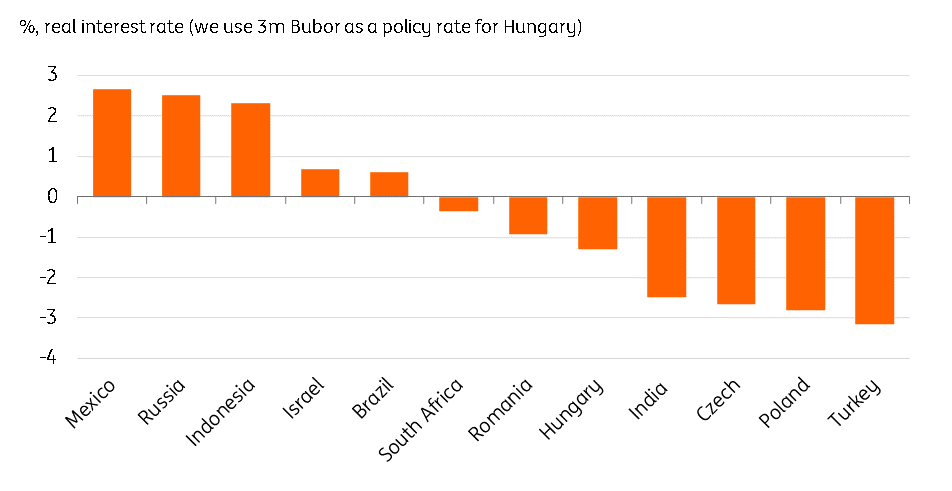

Figure 2: CEE low yielders having fairly negative real rate within the EM spectrum

CEE FX feeling the love of weaker USD environment

CEE currencies benefited greatly from the global reflation trade dynamics which unlocked further broad-based USD weakness.

While all EM currencies gained, one additional idiosyncratic benefit the CEE FX enjoyed stemmed from the rise in EUR/USD (CEE currencies are the only EM FX segment that directly benefits from the rise in EUR/USD).

Hence, and despite the nature of rally which would normally favour higher beta high yielders, the low beta low yielding CEE currencies did fairly well and in many instances competed with EM high yielders in terms of spot gains.

High yielding RUB preferred to low yielding CEE FX

We now think the bulk of the CEE FX rally is behind us and further gains should be more modest. Not only some of CEE currencies still look expensive vs EUR on short term basis (though less so than last week), but given the scale of the spot gains and the limited carry potential and the fairly negative real rate (Figure 2), if risk sentiment remains benign, EM FX high yielders should do better.

Here RUB ticks the box - the respectable carry, one of the highest real rates in the EM space and supported oil prices make the currency well positioned in the EM FX space.

Among low yielding CEE FX, CZK remains our top pick. The relative strong fiscal position, inflation minded central bank and, in our view fairly, low odds of FX interventions to lean against possible currency strength (as CPI is to remain close to the target and deflation risks are not present) all make the koruna attractive.

Download

Download article

11 June 2020

June Economic Update: Hope returns despite the huge challenge ahead This bundle contains 12 articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).