Canada’s housing market: Is it really all that bad?

The housing market is under pressure in Canada and coupled with household debt problems, you can see why this factors into the central bank's reasoning for prolonging its pause

Higher interest rates and tighter mortgage rules have been feeding their way into the housing market and will continue to do so for a while. This has inevitably taken the steam off things and is arguably one of the main reasons the Bank of Canada (BoC) is happy to prolong its pause.

Three reasons why household finances are undergoing a tricky period

- Homeowners are watching the value of, typically, their largest asset plateau – or even drop. It's also possible that some homeowners would like to sell their homes if they're at the risk of entering negative equity territory.

- Mortgage repayment costs are creeping up as interest rates edge higher, and the fact that a lot of Canadian households are running high levels of debt isn't great news.

- Nevertheless, it isn’t an easy selling environment. Not only is it harder for prospective buyers to get a mortgage, but finding affordable homes is still an issue.

These factors don’t bode well for housing demand.

Home sale figures support view it’s becoming difficult to sell your home

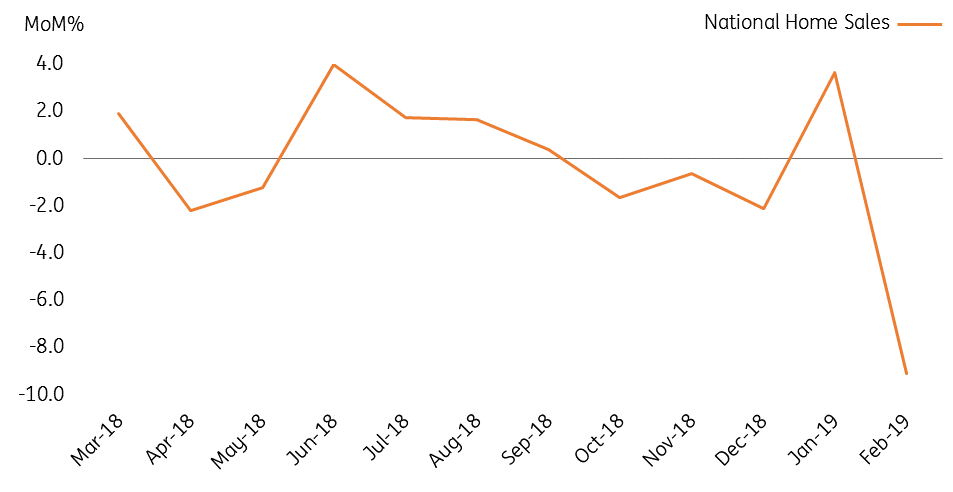

Canada’s real estate association (CREA) recently reported home sales sunk 9.1% month on month in February and hit the lowest level since November 2012. Although the colder climate might have suppressed the figure, it's unclear if the broad-based slowdown is solely a weather story.

Monthly decline was the largest since new mortgage regulations were introduced

New mortgage regulations likely to hurt already vulnerable areas

Canada’s new mortgage regulations were introduced in January 2018. In short, the new rules have made it tougher for those with ‘fragile finances’ to obtain a mortgage and (as a secondary effect) prompted a slowdown in the housing market.

The 2014 oil price shock took a lot of momentum out of Alberta’s housing market and, coupled with the below-par trajectory for the energy sector; you can argue the implementation of a stress test will only make matters worse. Data collected last year confirmed this, where provincial sales reached the lowest level since 2010.

But there are some positives

GDP growth in January not only came as an upside surprise (+0.3% MoM) but also offered some upbeat news for real estate. As reported by Statistics Canada, the construction sector grew for the first time in eight months - with residential construction posting its second consecutive monthly gain. Now, although the sector tends to be quite volatile, as we wrote earlier in our GDP preview, the recovery in building permits provides us with some reassurance when it comes to investment in the housing market going forward.

Moreover, in the recently announced federal 2019 budget, first-time buyers were amongst the winners. The government has created an incentive for individuals to jump onto the property ladder by offering to absorb part of the associated costs, namely an $885 million investment over five years. However, this won’t come into effect until autumn.

As a result, home buyers might be tempted to delay their decisions, meaning, until then, our view on what’s happening in the market will be clouded. This reinforces our previous argument that - if the BoC opts to hike in 2019 - it wouldn’t arrive until the fourth quarter as the housing market is likely to appear weaker-than-expected in the near-term.

To follow, or not to follow (the Federal Reserve)?

A more unwelcome start to 2019 was Canada’s percentage of household debt to income standing at 176.3%, which is the highest it has been since 1990. Given that - when the next downturn in the economy arrives - the persistence and depth of household debt levels will only enhance an already difficult environment, and remains a key vulnerability to the health of the economy.

The persistence and depth of household debt levels remains a key vulnerability to the health of the economy

It seems that, for now, policymakers are happy to sit back to see how the global trade backdrop, oil prices and household activity all evolve. And with the Fed firmly in the dovish territory, it’s possible that this could sway the central bank to follow suit and prolong its pause further.

Tags

CanadaDownload

Download article

18 April 2019

In case you missed it: China to the rescue? This bundle contains 10 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more