Bank Outlook 2023: Bank fundamentals under pressure going into 2023

Banks are facing a number of challenges. We expect the higher risks in energy and energy-intensive lending alongside the impact of higher rates and a slowing economy to have a negative impact on bank loan quality. The extent of the impact will be based on the state of the economy, government measures and ECB policy tightening

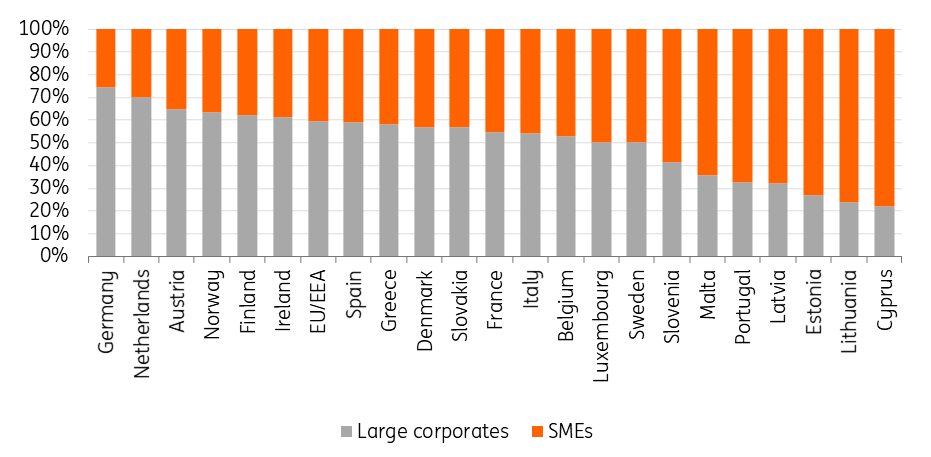

Higher rates and high inflation weaken the capacity of debtors to service their loans. Corporate books are likely to drive provisions. We expect that larger corporates are better positioned than small and medium-sized enterprises (SMEs) when the economy deteriorates. SMEs are likely to have less pricing power and access to more limited funding channels (and levels) when needed.

Loans to households and non-financial corporations

We believe that mortgages remain generally robust despite the slowing of housing markets, but consider that tail risks in these books are edging higher.

Banks with a larger share of floating rate loans in their books stand to benefit from higher rates in their revenues, but they are also likely to see more pressure in loan quality. Banks that have a higher share of fixed-rate mortgages will instead see only a slow movement higher in their average lending rates. These banks, however, are likely to see their mortgage credit costs remain stickier while their clients continue to enjoy more stable lending rates despite changes in market rates.

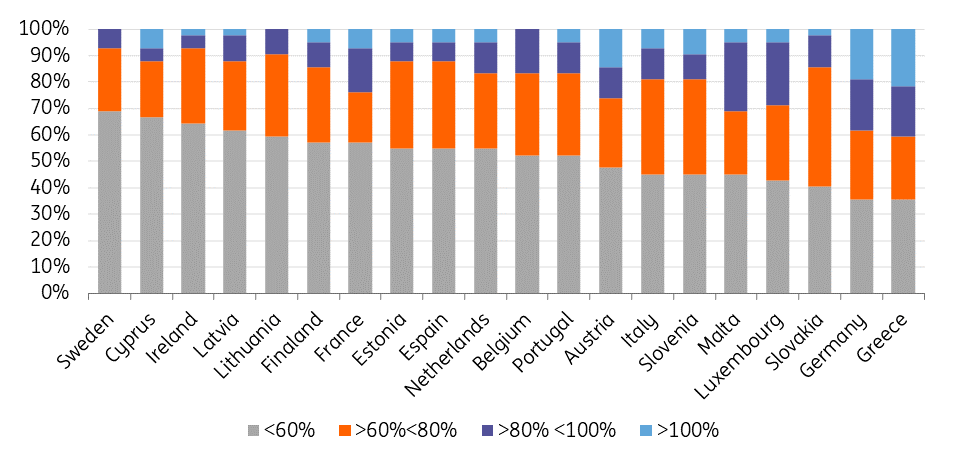

A mortgage with a high loan-to-value ratio (LTV) can be considered of higher risk than one with a low loan-to-value. The loan-to-value ratios of mortgages have improved with 55% of mortgages in the EBA sample exhibiting an LTV ratio of less than 60%, up from 50% at the end of 2020, which has also been supported by higher house prices.

Lower LTV levels suggest lower loan balances as loans may have been repaid partially. Households with lower loan balances may have a better capacity to absorb a rise in mortgage rates. The highest share of mortgages with an LTV of below 60% were in Sweden, Cyprus and Ireland. In the current environment with a slowing economy and higher rates, high loan-to-value ratio loans warrant attention, in our view. In case of forced sales, loans with higher LTVs are most at risk. The share of mortgages with a higher than 100% LTV was 5% in the first quarter of 2022, which is a stable QoQ change. The ratio was still 8% in the third quarter of 2020. The highest share of LTVs that are above 100% were in banks in Greece, Germany, and Austria.

Loan-to-value ratios by country

Danish and Benelux (Belgium, the Netherlands, and Luxembourg) banks in particular have relatively large mortgage books. Greek and Italian banks have less exposure to mortgages and are more geared toward corporates. French and German banking sectors have a more even split. German and Dutch banks have higher exposure to larger corporate loans, while Cypriot and Baltic lenders are among those with the highest relative exposures to SME lending. Read more on banks' exposure to energy and energy-intensive sectors here.

Corporate lending and SME lending

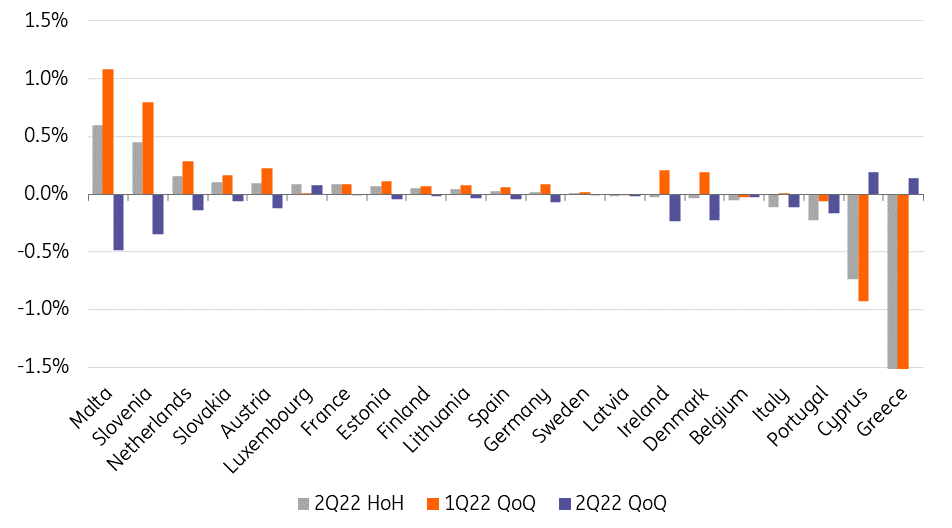

Changes in loan quality limited for now

So far, changes in credit quality have been very limited. In the first quarter of 2021, the banking sector saw a very limited shift higher in the cost of risk. Instead, in the second quarter of this year, the change has already somewhat levelled out with the cost of risk levels edging lower again.

The overall cost of risk has remained very limited at 45bp for EEA banks in 2Q22, down from 51bp in 1Q22 and from 47bp in 4Q21. The cost of risk moved higher in the Netherlands, Austria, Ireland and Denmark in 1Q22. After the dip in 2Q22, the cost of risk remains higher from the year-end in the Netherlands, Austria and France.

Change in cost of risk

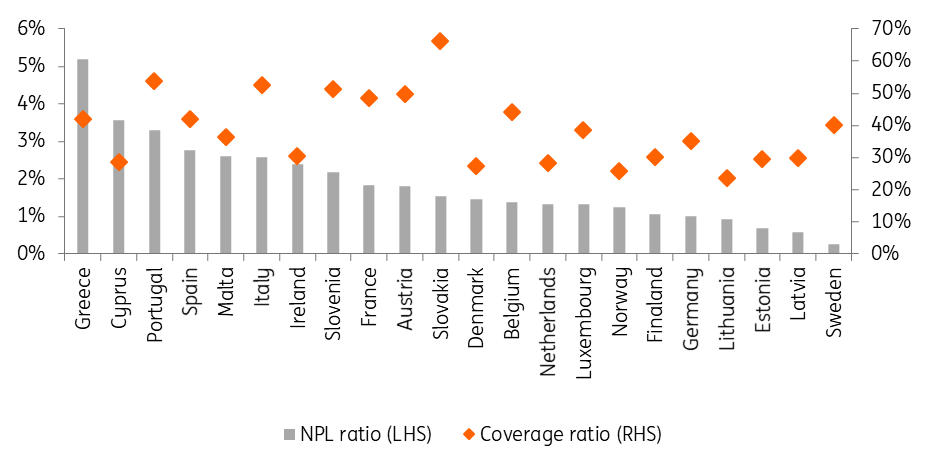

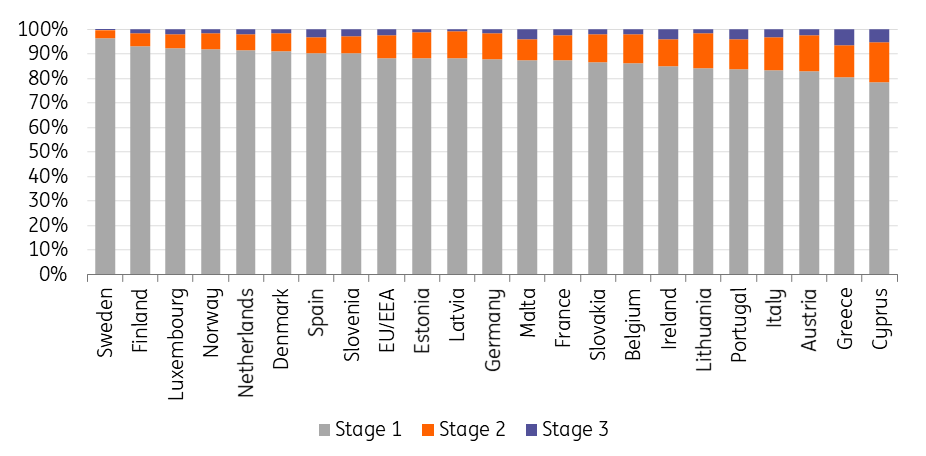

Non-performing loan (NPL) ratios have declined this year across countries. The largest declines have been seen in southern Europe in countries such as Greece and Cyprus, driven by measures to drive down legacy exposures. Southern European banks have relatively higher NPL ratios while the Baltics, Nordics and Germany are among those with the lowest ratios. Higher NPL ratios absorb capital and keep banks engaged in NPL management.

Loan quality of banks in selected countries as of 2Q22

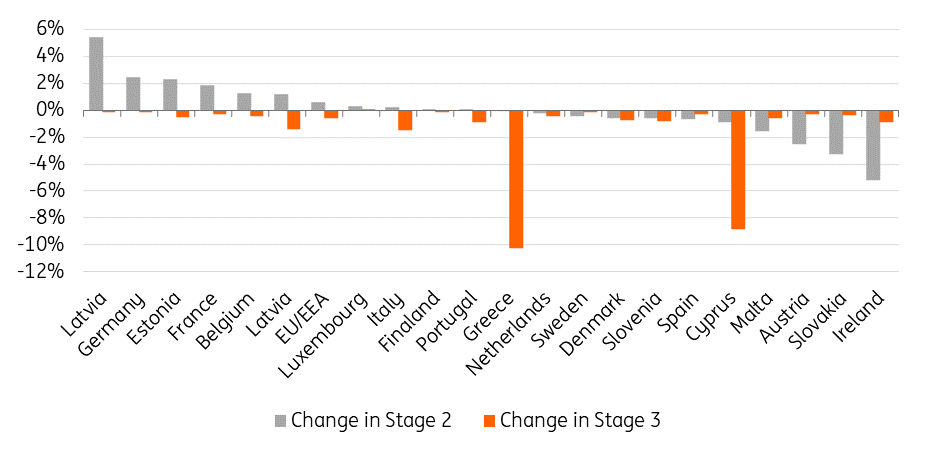

Loan quality is likely to weaken from current levels, however. This year, several banks have categorised a higher share of their loans as Stage 2 loans compared to last year. Banks categorise loans as Stage 2 if they face a significant increase in credit risk but there is no objective evidence of impairment. Thus, a higher share of Stage 2 loans points to a weakening credit quality going forward.

Change in Stage 2 and Stage 3 loans 2Q22 vs the year-end

Banks in Germany, France, Belgium, and Italy are among those that have increased their Stage 2 loans from the year-end. Banks in Ireland and Austria, on the other hand, report smaller shares of Stage 2 loans. It is worth noting that Ireland and Austria are among the countries that had relatively large Stage 2 books to begin with.

Loan book by stages

Bank buffers remain the key

Banks with robust profitability metrics are better positioned to absorb higher credit costs with earnings generation. Furthermore, stronger capital buffers provide more room to be tapped in case credit costs push earnings to a net loss. Low earnings generation capacity means that banks are less well positioned to absorb the impact of a weakening macroeconomic outlook with earnings and instead may need to tap into their capital buffers in case the situation clearly worsens.

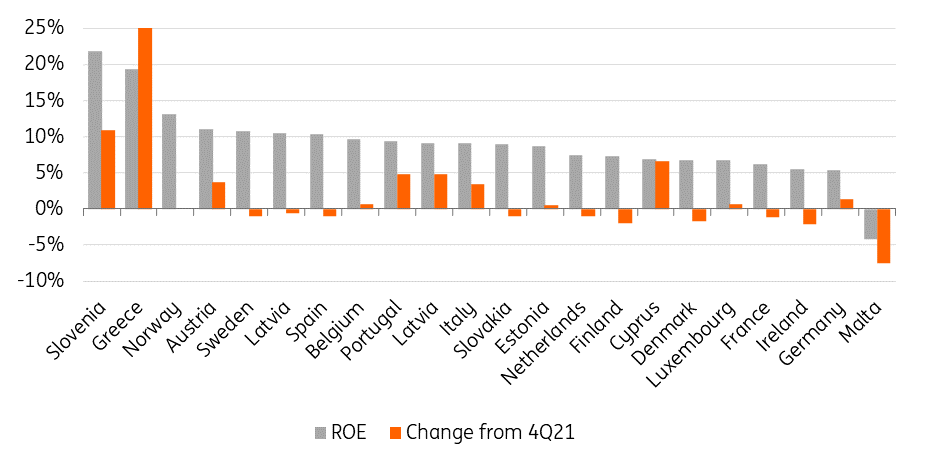

European bank profitability has improved this year. EU banks reported an ROE of 7.9% in 2Q22. Profitability has improved from 2019 (5.7%), 2020 (1.9%) and 2021 (7.3%). ROA metrics show a similar picture with the EU level ratio at 0.49%. Despite improvements, bank profitability, particularly in core countries, remains relatively weak. Banks in Germany and France are positioned at the lower end of the range when it comes to profitability. Banks with stronger profitability metrics include Greek, Norwegian and Austrian banks.

Bank profitability (ROE) as of 2Q22 and change since 4Q21

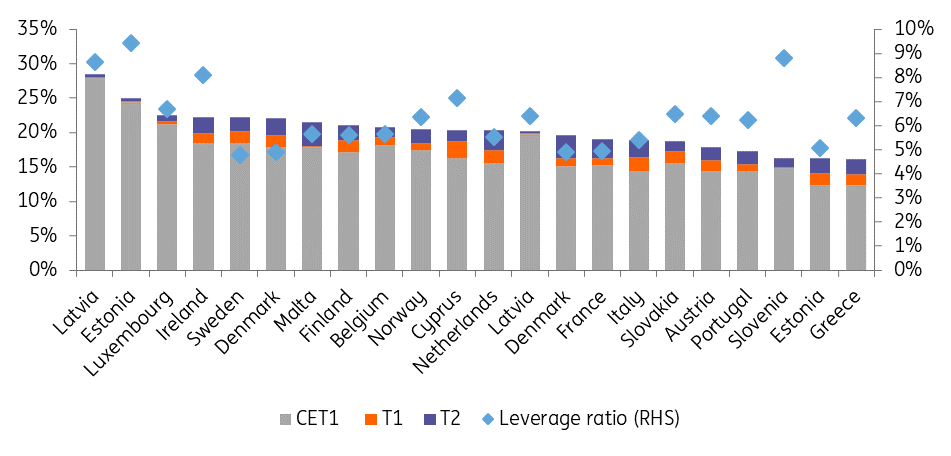

In our opinion, most banks have healthy capital buffers. The chart below shows that banks in Belgium, Finland, Ireland and the Netherlands have strong risk-based and leverage-based capital ratios. By comparison, Banks in Greece and Spain have relatively thinner risk-based capital buffers, leaving less room for absorbing any weakness in times of stress.

Risk-based capital ratios vs leverage ratios

Conclusion

We expect bank loan quality to suffer from the difficult combination of high inflation, a slowing economy and high rates. The resulting higher loan loss provisions are likely to absorb part of the positive revenue impact from higher rates.

While households are negatively impacted by higher mortgage rates and higher energy prices, we believe that the relatively benign quality of most mortgage books limits the impact of the weaker prospects on provisions. We would be more vigilant with banks that have more exposure to lending to corporates and especially to energy, energy-intensive and SME sectors. Substantial government support acts as a limit to risks for banks. That said, due to substantial support measures introduced during the Covid-19 crisis, governments are bound to have less room and willingness for new support measures.

Banks with strong profitability and capital metrics stand to be better positioned. German and French banks ranked behind Spanish, Belgian and Italian peers in a profitability comparison in the second quarter of the year. Spanish banks remain among those with thinner capital buffers. Dutch banks have solid capital buffers, but their profitability has remained sluggish.

Download

Download article

1 November 2022

Banks Outlook: The major challenges and opportunities for 2023 This bundle contains 8 articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more