Bank lending in 2021: Weak, weaker, weakest?

With weak economic growth, demand for bank loans will be muted in 2021. Banks in southern Europe tend to provide relatively more loans to small and medium-sized enterprises and consumer credit, and that's where we expect demand to be especially weak

Overall weakness in business demand for bank loans

Bank lending to businesses surged in spring this year, as businesses scrambled for liquidity. Demand eased over the summer in most countries, though at different paces depending, among other things, on the availability and use of government guarantee schemes and the breadth of alternative government liquidity supply, for example in the form of tax deferrals and wage payments.

Bank lending demand by businesses in the quarters ahead will be chiefly driven by the following factors:

The recessionary environment weighs on bank loan demand

Our October baseline economic scenario assumes local lockdowns during the winter months and the rolling out of a vaccine in the first half of 2021. This would imply a continuation of the economic recovery in 2021. Given that the economic ground lost will not be recouped until 2023, and unemployment is set to increase, many businesses will struggle with lower demand, compared to pre-Covid-19 levels. This will also lead to investment plans being postponed or slimmed down. Therefore, bank lending demand will be only weakly supported by the economic recovery. Recent developments show that the probability of a more negative scenario, with more broad lockdowns and a much lengthier process for the rollout of a vaccine, is increasing. In such a scenario, GDP would not recover to pre-Covid-19 levels until 2024.

Borrowing rates are supportive, but cannot fall much further

Borrowing rates for non-financial businesses dipped slightly in March and April, but have mostly moved back towards where they were at the start of 2020. While the European Central Bank may introduce additional easing measures before the end of the year, and despite the supporting effect of the ECB’s long-term TLTRO loan operations, the effective lower bound on deposit funding will make it hard for banks to lower lending rates much further (see our companion piece "Negative rates to continue clouding the banking outlook in 2021"). This is especially true for banks in the South that on average are more reliant on deposit funding. We expect lower rates therefore to contribute only marginally to bank lending demand.

Borrowing costs for businesses (%, seasonally adjusted)

That said, bank lending rates are trending down in France and Italy. As a result, while most Eurozone BBB-rated corporates with access to bond markets are able to get better rates there than at their bank, Italian and French corporates now get cheaper bank funding. This may stimulate demand for bank loans in the latter countries.

Corporate BBB-rated (3y) spread over bank lending rate (>€1m, 1-5y)

Substitution from government-supplied liquidity towards banks

Otherwise healthy firms may turn toward their banks, if and when government-supplied liquidity is being phased out. This substitution effect will be stronger in countries which relied more on government-supplied liquidity in 2020. Roughly speaking this appears to apply more in Northern eurozone economies, than in Southern ones (we discussed this earlier here).

Bank loan demand by households: moving slowly

For households, the financial effects of the pandemic have remained muted so far. Though temporary workers and self-employed suffered, unemployment has not, yet, increased markedly, and governments have provided income support. That is bound to change however, as government support is already becoming less generous, and unemployment will inevitably start to rise more going into 2021.

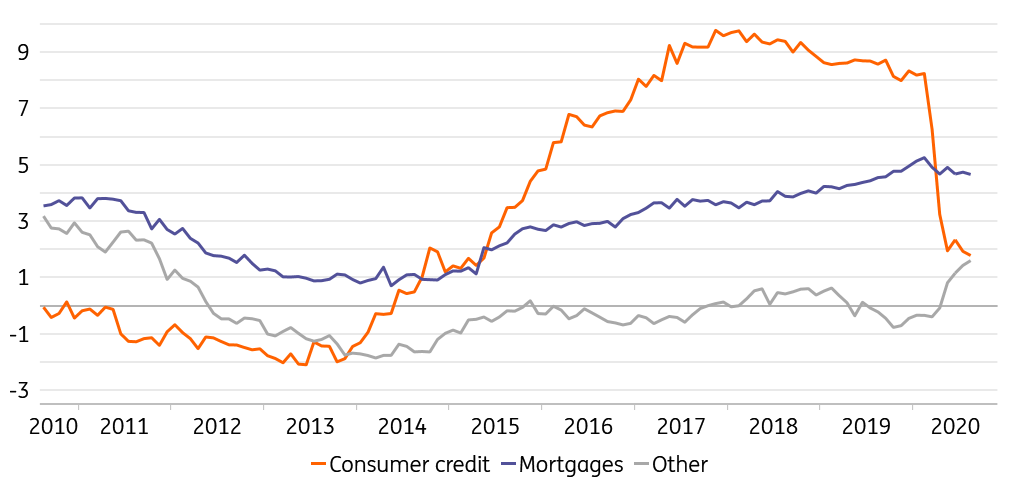

- Looking at types of household loans, growth of consumer credit has collapsed. Both prospective borrowers and lenders have likely become more cautious here. This loss in momentum is partly compensated for by a growth in the residual category of “other” types of household borrowing – the outstanding volume of which is comparable to consumer credit. Mortgage borrowing is keeping up relatively well, for now.

Eurozone bank lending to households, by type, year-on-year growth (%)

- Moving into 2021, the weak economic environment makes it unlikely that consumer credit makes a strong recovery. For mortgage demand, we recall that in the 2012-2013 recession, net mortgage lending remained positive. It did dip briefly below zero in Summer 2009. Today’s economic fallout is steeper and deeper than the one of 2008-9, but there is no financial crisis and our baseline scenario foresees a mild recovery in 2021. We, therefore, expect mortgage borrowing to continue growing, albeit at a slower pace.

- Household borrowing rates remain very low and therefore supportive of demand, but rates have on average not fallen further since March this year. As with business rates, the scope for further rate decreases is limited.

Composite borrowing rates for households

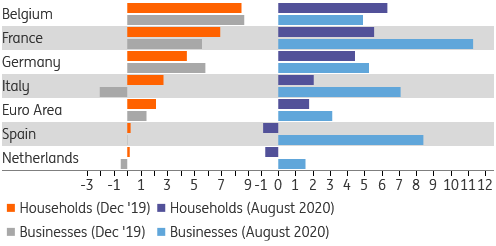

- Pre-corona, bank lending was growing modestly in the eurozone, driven mainly by Belgium, France and Germany. Growth was around zero in Spain and the Netherlands. Italy saw stable household borrowing growth, but net borrowing by businesses turned negative in 2019. While Covid-19 has lifted lending growth everywhere, pre-Covid-19 differences are likely to re-emerge at some point.

Bank lending growth (%YoY)

Bank lending supply: ample funding

- On the supply side, banks do not face a lack of funding. Deposit inflows spiked in spring 2020 as government liquidity flowed in while businesses and households reduced and postponed spending. The ECB’s TLTRO and easing of collateral rules guarantee ample availability of central bank funding. The ECB wanted to make sure that lack of liquidity would not hold banks back, and they succeeded.

- At the same time, the margin pressure on banks remains unrelenting, as low and negative rates look set to stay with us for even longer. Some banks may be tempted to make up margin losses by trying to increase lending volumes. This may require them to increase their risk appetite. While this may help companies to return from the brink, there is a risk that the existence of “zombie firms”, kept afloat initially by government support, is further prolonged. In the longer term, such firms may become a burden both for the economy, occupying resources that could be better deployed elsewhere, and for lending banks.

The outlook for bank lending demand

With economies in Southern Europe on average hit more strongly, a higher share of SME and consumer credit portfolios in those countries, and taking into account pre-corona trends, we expect most weakening of demand in the south, though Italian corporates may be tempted by low bank rates. French bank loan demand may be dampened by the fact that French businesses already borrowed heavily this year. German banks appear slightly better positioned to keep up lending growth, while bank lending growth in the Netherlands was already trending around zero before corona, which makes Dutch banks less well positioned to meet TLTRO benchmarks. This will be less of an issue in many other member states, that saw demand for bank loans surge more during the initial lockdown phase.

Tags

Banks Outlook 2021Download

Download article

30 October 2020

Banks Outlook 2021 This bundle contains 9 articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).