Asia week ahead: China and Malaysia in focus

Investors will scrutinise a raft of December data in Asia next week to gauge the impact of the resurging virus. China’s 4Q20 GDP and Malaysian central bank policy are likely to take centre stage

China: GDP growth accelerates

The week kicks off with China's GDP report for the last quarter of 2020 and remaining December activity data – industrial production, retail sales and fixed asset investment, all due on Monday, 18 January.

We believe the export-led recovery gained further traction in the last quarter, keeping GDP growth on a steady upward path. Export growth nearly doubled to 17% year-on-year in 4Q20 from 8.9% in 3Q. This should outweigh any possible softening of domestic demand due to the renewed virus threat. We consider our 5.5% YoY house view of 4Q GDP growth, up from 4.9% in 3Q, subject to an upside surprise.

The People’s Bank of China is also set to review its prime lending rates next week – the monthly rite that is. We see no changes to the benchmark 1-year and 5-year Loan Prime Rate, currently 3.85% and 4.65%, respectively.

Malaysia: Central bank resumes easing

Bank Negara Malaysia’s Monetary Policy Committee meets on Wednesday, 20 January. The significant surge in Covid-19 will push BNM to cut the overnight policy rate by 25 basis points to 1.50%, in our view.

A nearly five-fold jump in infections during the last two months, to over 144k currently, has forced the government to tighten movement restrictions across the country, while it also declared a state of emergency until 1 August. This is poised to derail Malaysia’s economic recovery from a record slump in the last year -- the five most affected states by the pandemic (Melaka, Johor, Penang, Selangor and Sabah) together make up half of Malaysia’s total GDP.

And, unlike most other Asian central banks, which have almost exhausted their rate policies, BNM still has room to cut the policy rate further. Moreover, persistently negative inflation - in November it fell 1.7% YoY (December data is due next week) - has left real interest rates some of the highest in the region. This is detrimental for the recovery.

The earlier the BNM cuts, the better it will be to soften the blow to the economy from the worsening pandemic.

Rest of Asia: Export recovery prevails

Central banks in Indonesia and Japan are also set to review their policy settings next week. Both central banks will retain an accommodative stance in view of the recent rise in Covid-19 cases, though none are likely to change the current policy settings. That said, Bank Indonesia's meeting may well be of interest as low inflation keeps this central bank firmly on an easing path. At 3.75% currently, the BI policy rate is one of the highest in Asia.

December trade data from Japan, Taiwan, Philippines, and Thailand will help to determine the state of global demand, as the spread of Covid-19 has intensified. Released export figures from China, Korea and Taiwan painted a positive picture. We expect the same in the rest of Asia.

Down under, Australia’s labour report for December and New Zealand’s 4Q CPI inflation will provide insights into the impact of the disease on consumer spending.

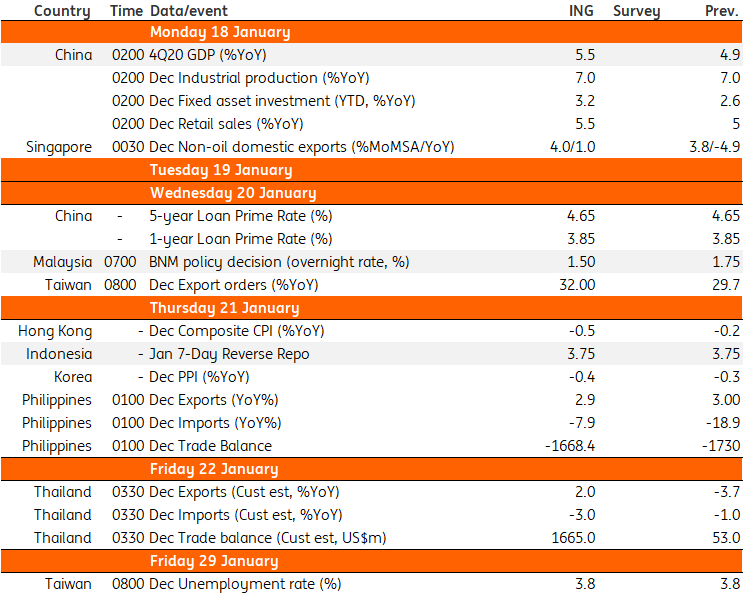

Asia Economic Calendar

Download

Download article

17 January 2021

Good MornING Asia - 18 January, 2021 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).