Asia’s shipbuilding renaissance: Record orders and rising prices

Asia has been the centre of shipbuilding for decades thanks to its geographical and strategic location and the capital and labour-intensive nature of the industry. Currently, the sector is experiencing a significant upturn, spurred by new environmental regulations and demand for ship replacements

Asia builds the world’s ships

In recent decades, Asia has emerged as the epicentre of the shipbuilding industry, thanks to its strategic location and the capital- and labour-intensive nature of the trade. While Europe was the birthplace of shipbuilding, the construction of large deep-sea vessels has largely shifted to Asia. This industry, known for its cyclical nature, has weathered numerous phases of boom and bust, followed by periods of restructuring. Currently, it is riding a new wave of growth, driven by stringent environmental regulations and the pressing need for ship replacements. This upward trend is expected to continue steadily for several years, with Asia firmly at the helm. This note will primarily focus on South Korea’s shipbuilding industry while also considering regional perspectives.

Shipbuilding had gone through a prolonged downturn after a supercycle in early 2000s

Supercycle – 2002 to 2008

Between 2002 and 2008, the shipbuilding industry experienced an unprecedented boom, fuelled by China's rapid economic growth and the surge in global trade, particularly in container volumes. This remarkable expansion followed China's entry into the WTO in 2001 and the subsequent globalisation of supply chains. Although Japan and South Korea initially led the industry, China swiftly captured a significant market share to satisfy its own burgeoning demand for exports and imports.

During this period, new ship prices surged by approximately 120%, prompting shipping lines to embark on mass speculative shipbuilding from 2006 onwards. To meet the soaring demand, shipbuilders invested heavily in large-scale dock expansions. In addition, financial intermediaries introduced new ship funding schemes, injecting more liquidity into the industry.

However, the 2008 financial crisis dealt a severe blow to the global economy, causing a sharp decline in trade volumes. The overheated shipbuilding market was hit hard, plunging into a prolonged downturn that lasted well into the next decade. On the demand side, a severe oversupply of vessels led to falling freight rates and a significant drop in new orders from shippers. On the supply side, the industry faced structural issues, including excess capacity built up during the boom, high fixed costs such as labour and dockage, and deteriorating profitability. As the downturn dragged on, China embarked on a major restructuring of its shipyards, while South Korea shuttered most of its small and medium-sized shipyards.

Upcycle since 2020

Since 2021, the global demand for ships has been on the rise, spurred by the surge in goods trading induced by Covid-19. More importantly, the landscape of environmental regulations has evolved significantly. The International Maritime Organization (IMO) has introduced new regulations, such as the Energy Efficiency Existing Ship Index (EEXI) and the Carbon Intensity Indicator (CII), aimed at reducing carbon emissions and fostering a more environmentally friendly shipping industry. The IMO has also adopted a Greenhouse Gas (GHG) strategy to cut the carbon intensity of shipping by 40% by 2030 and ensure that at least 5% of fuels used in shipping are low carbon by then. This challenge can be met by blending biofuels or using alternatives like synthetic or bio-LNG and methanol. The IMO is also laying the groundwork for a future global carbon levy, which is already being implemented for vessels sailing in Europe and calling at European ports.

While retrofitting ships to meet new environmental regulations can be costly and often uneconomical, these changes present opportunities for shipbuilders to innovate and advance technically. However, shipping companies and shipowners have been hesitant to place new orders due to uncertainties surrounding future fuel options. Although the order books for ships capable of running on alternative fuels are growing, this shift still raises questions and doubts among investors in new vessels. Fleet owners are also reluctant to scrap old tonnage under these conditions. Nevertheless, we can anticipate increased traction for next-generation vessels, even as global trade evolves and grows more slowly. This trend will be a key driver for future shipping demand.

As the life cycle of ships, particularly bulk carriers built during the super-cycle comes to an end, we can expect large-scale decommissioning. Typically, most carriers reach the end of their operational life after 20-30 years, though this can vary depending on market conditions. Shipowners might find it more advantageous to expand their fleets and keep older vessels in service, especially with the recent surge in secondhand ship prices. Scrapping values also play a significant role in these decisions. In addition, geopolitical tensions have led to shifts in trade patterns and rerouting, which, combined with slow steaming practices to save fuel, consumes more capacity and necessitates more vessels.

Another boom-and-bust cycle or steady growth ahead?

Several shipyards, particularly those specialising in LNG carriers, have order books extending several years into the future. Despite the cyclical nature of the industry and the typical three-to-five-year lead time for ship deliveries, we believe that current market dynamics will foster a more stable order flow in shipbuilding moving forward. The shipyards that weathered the previous boom-and-bust cycle have not yet expanded their docks, creating a seller's market that is likely to persist for some time.

Korean and Japanese shipbuilders are likely to make strategic and risk-managed investments in capacity expansion, as they are more selective in taking orders. In contrast, Chinese shipbuilders may adopt a different approach, as the largest fraction of the fleet eligible for replacement consists of bulk carriers, which are predominantly built by Chinese shipyards. This could drive a stronger need for investment expansion in China. Over the past two years, we have seen some previously closed shipyards in China reopen and start picking up orders again. For now, the more specialised shipbuilders from Korea and Japan are poised to enjoy better earnings by focusing on filling their shipyards with profitable and reliable orders. We believe this cautious approach will prolong the seller's market. Moreover, the capacity shortage among the main players may create opportunities for smaller Asian shipbuilders to increase their market share.

"No. of shipyards to make a delivery" down about 60% compared to 2010

Concerns about oversupply in terms of tonnage from 2027 onwards are already emerging, as orders for LNG and LPG ships, as well as containers, have reached record highs over the past two years. However, the momentum is likely to continue, albeit at a slower pace, driven by regulatory changes and an increase in replacement orders for dual-fuel ships.

For instance, ammonia is being used as a fuel in small and medium-sized LPG carriers. However, the development of clean ammonia, which is produced with minimal or zero greenhouse gas emissions, is still in its planning stages. To achieve decarbonisation goals, there will be an increasing need for a transition to green energy. As part of this shift, shipyards should prepare to retrofit existing vessels with fuel-saving features and new engine systems. This will be essential to accelerate the decarbonisation of the extensive existing fleet.

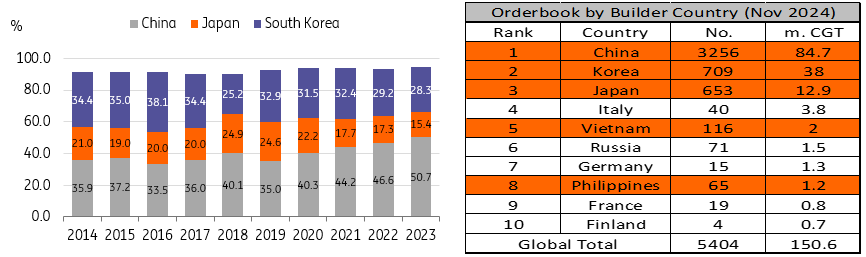

Major three shipbuilders: China, Korea, and Japan

China: Dominating the global shipbuilding industry over the last decade

Since 2012, China's shipbuilding industry has ranked first in the world for new orders. Domestic shipyards fulfil most of the country's shipbuilding needs and possess key competitive advantages. Labour costs, which account for more than 20% of total production costs, are significantly lower in China—about 50% less compared to Korea and Japan. Additionally, China is the world's cheapest steel manufacturer, making its prices more competitive than those of other countries. In terms of financing, the Chinese government provides sovereign refund guarantees for certain classes of vessels, alleviating financial burdens on the shipyards.

Korean shipbuilders' market share on the decline

Korea: Losing market share doesn't mean losing competitiveness

South Korea's market share in the global shipbuilding market has been declining over the past four years, currently accounting for 27.5% of new orders based on Compensated Gross Tonnage (CGT) from 2020 to the third quarter of 2024. However, Korean shipbuilders continue to lead in efficiency. Korea has the highest ratio of shipbuilding per yard.

Korea: most efficient shipbuilder (in terms of utilisation of active yards)

Korea: Unrivalled in LNG and LPG carriers

Most of the orders received by Korean shipbuilders are for high-value vessels such as LNG carriers, LPG carriers, and VLCCs, and they come from reliable shipowners. Korean shipbuilders hold a dominant 93% share of the LPG carrier market, securing 33 out of 37 orders in the first half of 2024. They have also received orders for 44 LNG carriers from Qatar out of a total of 62 orders over the past two years. Meanwhile, China has experienced the strongest growth in exports of motor container ships over the last two years, a segment that is not the primary focus of Korean and Japanese shipbuilders.

Ship exports by country/ China's ship exports by vessel type

Korea: shipbuilding is a key element for exports

When comparing ship exports as a percentage of total exports, Korean shipbuilding plays a more significant role than in China and Japan. Although China holds the largest share of the global shipbuilding market, most orders are placed by Chinese owners, resulting in a lower share of ship exports in total exports compared to Korea and Japan. As of November 2024, Korean ship exports have increased by 40.2% year-over-year, year-to-date, compared to an 8.5% rise in total exports. Alongside semiconductors, which saw a 47.0% increase, ships are driving strong export growth in 2024. With high order backlogs currently at 3.5 years, ship exports are expected to continue growing for at least the next three years.

Korea: ships are a key contributor to exports

Ship exports to rise in the coming years as backlog orders increase

South Korea to invest in smart, clean shipbuilding tech with government support

South Korea has announced a $1.44 billion investment plan over the next 10 years to collaborate with businesses in developing smart and clean energy technologies for the shipbuilding industry. The “K-Shipbuilding Hyper-Gap Vision 2040” strategy aims to develop advanced ship technologies such as full autopilot capabilities and carbon-free engines powered by LNG, ammonia, and hydrogen. The strategy outlines 10 flagship projects, such as developing liquefied carbon dioxide carriers, implementing carbon capture and storage systems for ships, and achieving fully autonomous navigation capabilities. This initiative is designed to counter China's growing dominance in the industry. South Korea is also actively seeking international collaborations. For instance, South Korea and Norway have agreed to enhance cooperation in clean energy, shipbuilding, and the development of eco-friendly and smart vessels.

Trump opportunity

Given the expected tariff hikes and stricter trade rules promised by President-elect Trump during his campaign, Korean exports are likely to take a hit. However, when it comes to shipbuilding, Trump’s foreign and defence policy could be beneficial for Korean shipbuilders. According to industry news, Korean shipbuilders have secured several maintenance, repair, and operation (MRO) contracts with the US Navy, and Trump has expressed rare positive sentiments towards non-US manufacturers in shipbuilding. South Korea is likely to emerge as the Trump administration’s most likely partner for overhauling and constructing US combat ships.

With geopolitical tensions high, the US is likely to increase foreign orders to close the gap with China, as the US shipbuilding industry is virtually defunct. South Korea, with the world’s second-largest combat ship-building capacity after China, is well-positioned to capitalise on this. Under the Jones Act, US ships must be built by local shipyards. In response, Korean shipbuilders are stepping up their efforts. In June, Hanwha Ocean acquired a shipyard in the US and plans to boost its capacity to build ships. Other major shipbuilders are also tapping into the MRO market and plan to expand investments in the US.

Rest of Asia will become major players in the future

China, South Korea, and Japan currently account for more than 85% of the global shipbuilding industry. However, other Asian countries such as Vietnam, the Philippines, and India also have significant potential to grow in the global shipbuilding scene. As previously mentioned, shipbuilding requires substantial capital and labour to remain competitive. With significant up-front investment and skilled workers, and markets already dominated by the top three countries, the barrier to entry in shipbuilding is relatively high and often requires government support.

Moreover, global trade is increasingly driven by intra-Asia trade, and export-driven economies are naturally linked to shipping and shipbuilding, even though vessels can be flagged and managed from anywhere in the world. As Asia is a global hub for the production and consumption of goods, it has a competitive advantage in maintaining a strong shipbuilding industry. At the same time, there is an abundance of affordable yet skilled labour in these countries. Beyond China, South Korea, and Japan, we see growth potential from other Asian countries as well.

India has announced that it will set up a shipping company as part of its national strategy. The idea is to reduce dependence on foreign shipping lines by having a national fleet of ships. This is likely to lead to increased investment in shipbuilding in the mid-term. India has set an ambitious goal, aiming to rank among the top 10 shipbuilders by 2030. The government has taken several key measures, such as the Financial Assistance Policy on Shipbuilding and Grant of Infrastructure Status.

In the case of Korea, there has been a shortage of labour, so shipbuilders have had to recruit technicians from abroad, mostly from East Asian countries. South Korean shipbuilders have also acquired shipyards in Vietnam and the Philippines. This signals that Asia will continue to be the main hub of the global shipbuilding industry.

In the case of Vietnam, shipbuilding has increased tenfold over the past 10 years. According to the Vietnam Shipbuilding Industry Research Report 2023-2032, Vietnamese shipbuilding is expected to grow at a record CAGR of 6% from 2023 to 2032. Vietnam is actively collaborating with international partners to strengthen its capabilities. Japan has agreed to transfer military technology to build military ships. Additionally, a joint venture between Hyundai Mipo (South Korea) and Shipbuilding Industry Corporation (SBIC - Vietnam), established in 1996, has grown to become the largest shipyard in Southeast Asia.

From the cradle to grave (or from cradle to cradle?)

While this article has focused on shipbuilding in Asia, the region also plays a crucial role in ship recycling. Not only does Asia build the majority of the world's ships, but it also recycles or disposes of most ships at the end of their lives. South Asia recycles 80-85% of the world's ships, although new recycling facilities have been established in Brazil, Indonesia, and the Middle East. China has stopped recycling foreign-flagged ships but continues to promote steel scrap to reduce pollution in finished steel products. With the Hong Kong Convention set to enter into force in June 2025, many ship recycling sectors are improving their practices to ensure safe and environmentally sound procedures are followed.

New players from non-Asian countries have entered the market in greater numbers. However, to expand their market share, they will need to consider several factors, including the affordable disposal of hazardous materials, access to affordable skilled labour, transparent ship recycling regulations, and the proximity to markets for recycled and remanufactured products. All these factors suggest that South Asia will remain the leader in ship recycling for a considerable time.

South Asia accounts for 85% of ship recycling

Conclusion: Shipbuilding will remain a major growth driver in Asia

Shipbuilding has evolved into one of Asia's most vital industries, with China, South Korea, and Japan leading the charge as fierce competitors, and new players steadily entering the market. The current upcycle in shipbuilding is poised to offer numerous opportunities for both emerging and established players. Despite its cyclical nature, which inevitably brings future downturns, shipbuilders have demonstrated resilience and adaptability in managing past challenges. It is evident that shipbuilding will continue to be a significant growth driver in Asia.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more