Philippines in 2021: The economy continues to lose steam

Philippine GDP growth contracted 10% in the first three quarters of the year and there's little hope of a big turnaround in 2021

Authorities forecast a quick recovery in 2021 but trends suggest otherwise

The Philippine economy is mired in a recession with year-to-date GDP at -10% as elevated Covid-19 infections force an ongoing 9-month-long partial lockdown in the capital and surrounding provinces.

Authorities have acknowledged that growth will contract sharply on a year-on-year basis in 2020 but continue to bet on a quick recovery in 2021 (6.5 to 7.5%) and 2022 (6.0%) touting the economy’s “solid fundamentals”.

ING maintains that growth will likely enter a lower trajectory as current trends point to a very different scenario heading into 2021 with the Philippine economy missing contributions from every sector of the economy. Worrisome trends for consumption, capital formation and government spending will not likely reverse quickly even as lockdown restrictions are relaxed.

Consumption lacking the remittance punch

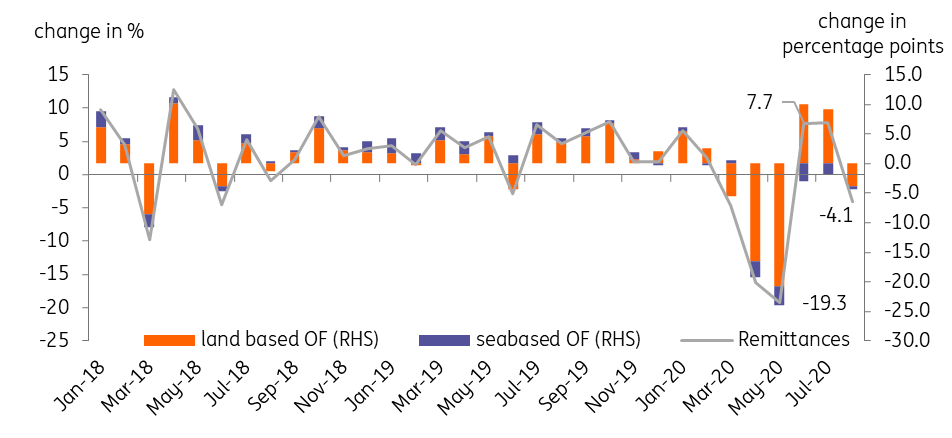

Household consumption delivers the bulk of Philippine economic output and we expect this sector to struggle given elevated unemployment, virus concerns and fading remittance flows. Overseas Filipino (OFs) remittances augment domestic incomes with households receiving Php59,295 annually, roughly 19% of the average income in the Philippines. Land-based remittances will likely slide as global lockdowns are reinstated while a downturn in maritime traffic should impact remittances sent by seafarers. Authorities estimate that up to 300,000 Filipinos will be repatriated due to the pandemic, depleting the stock of 2.2 million Filipino contract workers based abroad.

We forecast a 5-10% drop in remittances this year given renewed lockdowns and negative prospects for maritime traffic. This will translate to a drop of up to $3.1 bn in 2020 and 2021 with consumption missing the integral boost from these inflows.

Philippine remittances per source

Investment momentum stalls, potential output fades

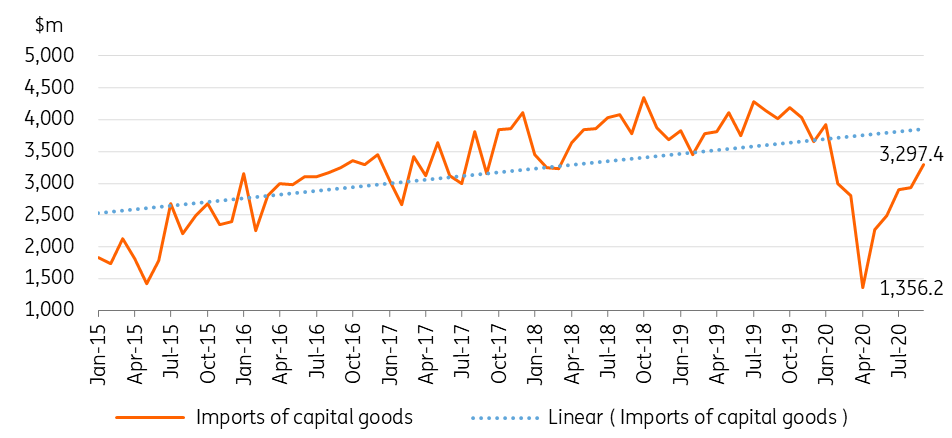

Prior to the pandemic, capital formation was increasing thanks to a construction boom coupled with the administration’s hallmark infrastructure programme but the current trends point to stalling momentum for this sector.

Capital imports fell sharply in April and have recovered somewhat but remain below the 5-year average of $3.5 bn per month. We expect the recent downturn in capital goods to weigh on potential output as corporates are likely to put off large scale investments given the recession to protect cash and weather the downturn. Meanwhile, we also expect households to defer investment plans given the challenging job market, reflected in a steep fall in road vehicle sales, which are down 44.6% for the year.

Philippine imports of capital goods

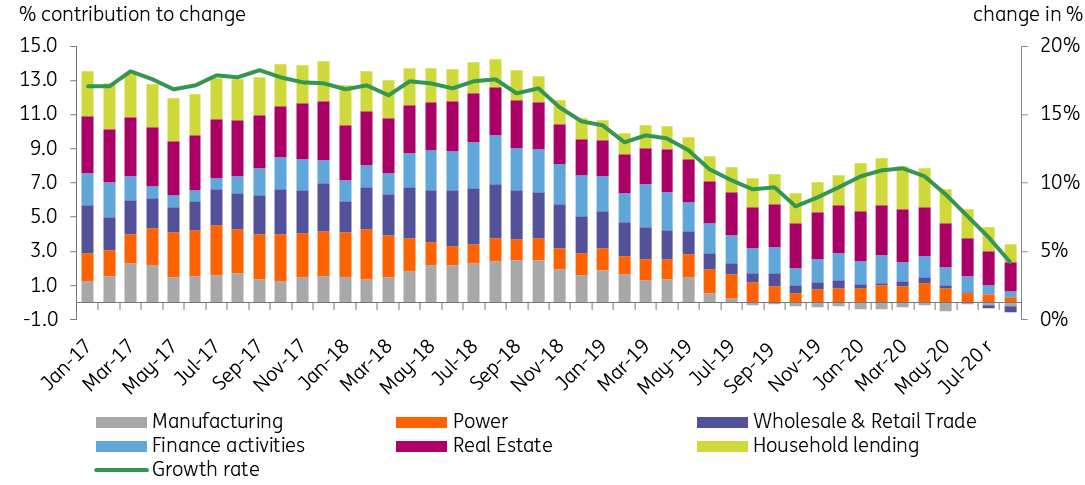

Bank lending grinding lower

Meanwhile, declining investment momentum is mirrored in trends for commercial bank lending, which has now been decelerating for five months through August. Loan disbursements to retail trade and manufacturing have turned negative with manufacturing activity now in contraction (October PMI: 48.5) while retail trade plunged as vacancies in mall space hit 14%, the highest level reported since the Asian financial crisis. Prospects for a pickup in lending to real estate are not particularly upbeat with office space vacancy rising to 8.3% as Chinese offshore gaming operators close shop.

Philippine bank lending per sector

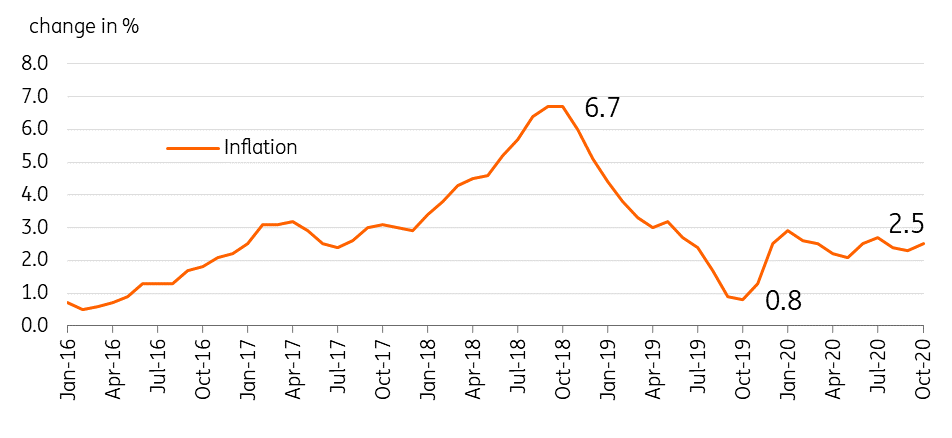

BSP unconventional moves and low inflation

The response of the central bank, the BSP, to the pandemic has been aggressive, resorting to both conventional and unconventional measures, suchas quantitative easing and de facto debt monetisation. The net effect of BSP’s unconventional moves was a surge in excess liquidity, now at Php1.4 trillion, roughly 7.2% of GDP and 8.9% of money supply, resulting in a flatter and lower yield curve. Inflation (2.5%) is not expected to accelerate in the next few months given depressed demand conditions and a stronger currency.

Inflation is expected to be benign through to 2022 and BSP is not expected to exit from unconventional policies soon, so we expect the yield curve to remain flat with rates suppressed unless government borrowing picks up substantially next year.

Philippine inflation

Fiscal response has been modest at best

Trends in government spending also point to a downward trajectory for growth. The fiscal response, however, has been modest with authorities recently passing additional Covid-19 funding worth Php140 bn, to bring the total Covid-19 response spending to roughly Php590 bn or 2.7% of GDP. After seeing an initial surge in spending, we’ve noted a sharp slowdown with September expenditures falling 15.5% as authorities clamped down on efforts to manage the budget deficit. Government officials have repeatedly turned down calls for additional fiscal packages in 2021 and it appears that the economy will not be able to count on government spending to help offset the slowing growth momentum.

Recession to continue into 2021 as trends point to weakness across key sectors

The Philippines is poised to remain in recession for a couple of more quarters with trends pointing to sustained weakness across key sectors. Government officials remain confident of a quick turnaround, but signs of soft consumption, decelerating investment and lacklustre government spending all suggest otherwise. Unless we see a reversal in these trends we believe that the Philippine economy is on pace to enter a lower growth trajectory, failing to return to the pre-pandemic growth average of 6%.

Download

Download article

18 November 2020

Good MornING Asia - 18 November 2020 This bundle contains 5 articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).